Source: PaxForex Premium Analytics Portal, Technical Insight

Commenting on the Fed verdict, Lloyds analysts write:

The monetary policy statement contained no surprises;

The Fed continues to reiterate its willingness to offer additional support to the economy if needed, but is showing increasing confidence that such additional measures may not be necessary;

Nevertheless, any policy tightening is a long way off; markets do not expect a rate hike before 2024;

The start of mass vaccination has increased the Fed's confidence that economic conditions will improve significantly later this year;

Another reason for the Fed to be optimistic is likely to hope for a new fiscal stimulus program from the Biden administration.

USD/CHF, 30 min

Pivot: 0.8896

Analysis:

Provided that the currency pair is traded above 0.8880, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 0.8996

- Take Profit 1: 0.8905

- Take Profit 2: 0.8920

Alternative scenario:

In case of breakdown of the level 0.8880, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 0.8880

- Take Profit 1: 0.8870

- Take Profit 2: 0.8855

Comment:

RSI shows the possibility of ascending momentum.

Key levels:

| Resistance | Support |

| 0.8940 | 0.8880 |

| 0.8920 | 0.8870 |

| 0.8905 | 0.8855 |

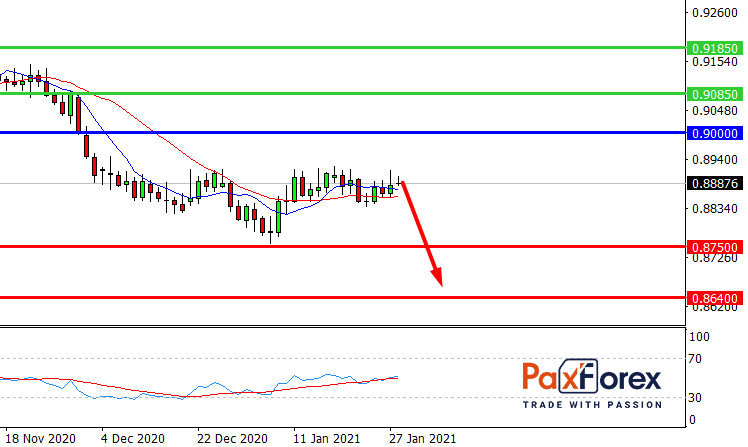

USD/CHF, D1

Pivot: 0.8870

Analysis:

While the price is below 0.9000, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 0.8870

- Take Profit 1: 0.8750

- Take Profit 2: 0.8640

Alternative scenario:

If the level 0.9000 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 0.9000

- Take Profit 1: 0.9085

- Take Profit 2: 0.9185

Comment:

RSI shows the development of a downtrend in the medium-term.

Key levels:

| Resistance | Support |

| 0.9185 | 0.8750 |

| 0.9085 | 0.8640 |

| 0.9000 | 0.8550 |

We also advise you to pay attention to the following currency pairs for intraday trading:

EUR/USD - sell below 1.2120 with 1.2055 and 1.2040 targets as Take Profit. Alternative scenario - if the level 1.2120 is broken-out, buy with the TP 1.2145 and 1.2170.

GBP/USD – sell below 1.3700 with 1.3635 and 1.3610 as Take Profit targets. Alternative scenario - if the level of 1.3700 is broken-out you should consider buying with the targets 1.3725 and 1.3755 as Take Profit.

AUD/USD - short positions below 0.7670 with 0.7600 and 0.7580 targets as Take Profit. Alternative scenario - if the level of 0.7670 is broken-out, buy with the targets 0.7700 and 0.7730 as Take Profit.