Source: PaxForex Premium Analytics Portal, Technical Insight

Last weekend the head of the Swiss Central Bank said in an interview for the national publication Neue Zuercher Zeitung:

- The large size of the balance sheet is not a problem in itself;

- It could even be increased further if necessary;

- The Swiss franc remains highly overvalued;

- Inflation is only slightly above zero;

- Production capacity in Switzerland is not fully utilized;

- It would be "completely premature" to make adjustments to the current easing policy of the central bank (start to reduce the size of the balance sheet and tighten monetary policy);

- It would be wrong to send the message to the world that the SNB would be the first central bank in the world to think about policy tightening.

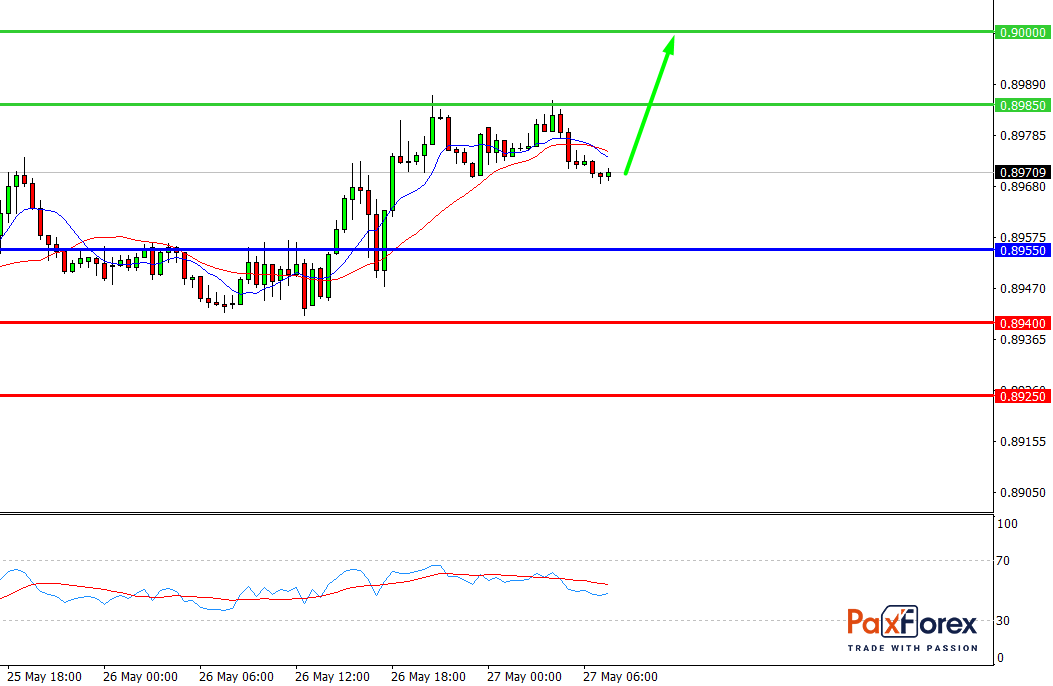

USD/CHF, 30 min

Pivot: 0.8974

Analysis:

Provided that the currency pair is traded above 0.8955, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 0.8974

- Take Profit 1: 0.8985

- Take Profit 2: 0.9000

Alternative scenario:

In case of breakdown of the level 0.8955, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 0.8955

- Take Profit 1: 0.8940

- Take Profit 2: 0.8925

Comment:

RSI shows the possibility of ascending momentum.

Key levels:

| Resistance | Support |

| 0.9020 | 0.8955 |

| 0.9000 | 0.8940 |

| 0.8985 | 0.8925 |

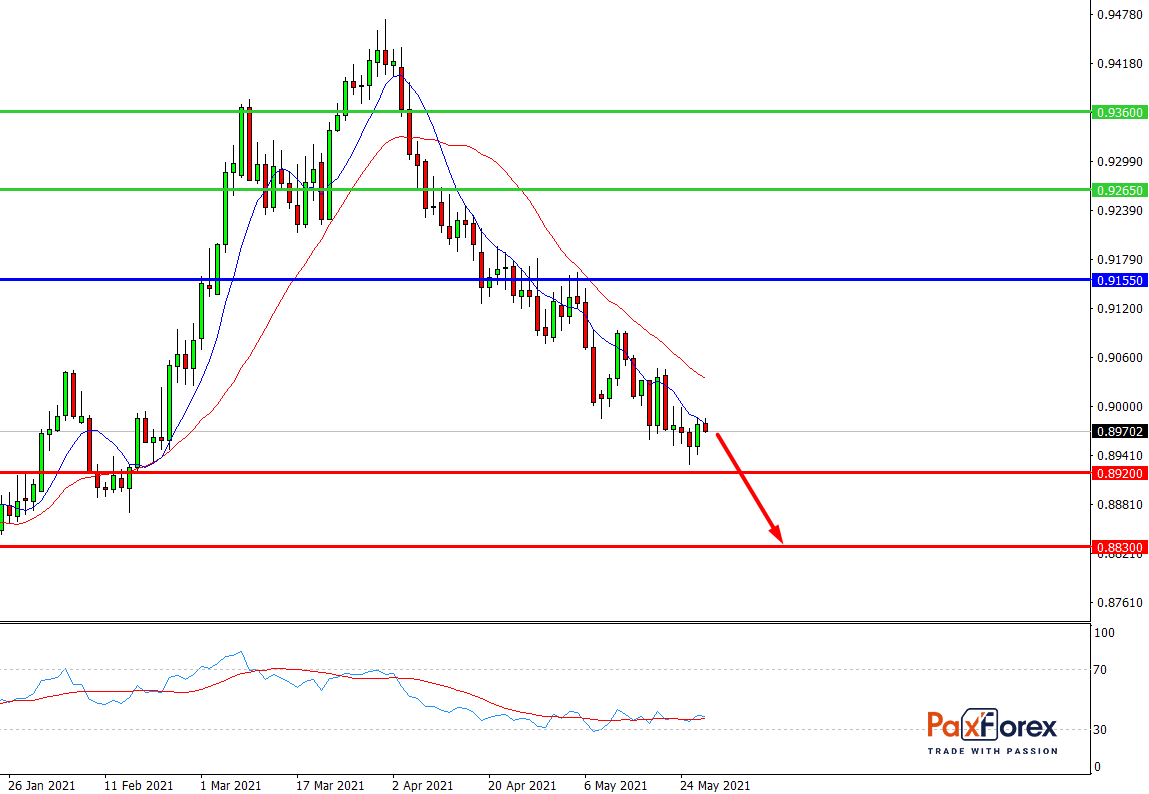

USD/CHF, D1

Pivot: 0.8948

Analysis:

While the price is below 0.9155, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 0.8948

- Take Profit 1: 0.8920

- Take Profit 2: 0.8830

Alternative scenario:

If the level 0.9155 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 0.9155

- Take Profit 1: 0.9265

- Take Profit 2: 0.9360

Comment:

RSI shows the development of a downtrend in the medium-term.

Key levels:

| Resistance | Support |

| 0.9360 | 0.8920 |

| 0.9265 | 0.8830 |

| 0.9155 | 0.8750 |

We also advise you to pay attention to the following currency pairs for intraday trading:

EUR/USD - sell below 1.2205 with 1.2160 and 1.2145 targets as Take Profit. Alternative scenario - if the level 1.2205 is broken-out, buy with the TP 1.2220 and 1.2240.

GBP/USD – sell below 1.4135 with 1.4070 and 1.4050 as Take Profit targets. Alternative scenario - if the level of 1.4135 is broken-out, you should consider buying with the targets 1.4155 and 1.4175 as Take Profit.

AUD/USD - sell below 0.7755 with 0.7705 and 0.7690 targets as Take Profit. Alternative scenario - if the level of 0.7755 is broken-out, buy with the targets 0.7770 and 0.7785 as Take Profit.