Source: PaxForex Premium Analytics Portal, Technical Insight

The head of the Dallas Federal Reserve Bank, Kaplan: we'll start talking about a rollback sooner rather than later:

- The unemployment rate will fall this year;

- U.S. GDP will grow 6.5% this year, upside risks prevail;

- Some factors contribute to inflation in the short term, but their impact will fade within 12 months;

- PCE will grow 2.25% this year, we will monitor the situation;

- Since December we have seen the results of vaccinations and a new aid program has been enacted;

- Wouldn't want to start winding down prematurely, but wouldn't want to be too late either;

- Buying Fed bonds could lead to imbalances;

- The economy will be healthier when we start winding down QE;

- We are announcing the winding down of purchases in advance and will do so gradually;

- It is still difficult to say whether we will complete the rollback before the Fed raises rates;

- The conditions necessary for a rate hike will be met in 2022.

USD/CHF, 30 min

Pivot: 0.9074

Analysis:

Provided that the currency pair is traded below 0.9100, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 0.9074

- Take Profit 1: 0.9045

- Take Profit 2: 0.9030

Alternative scenario:

In case of breakout of the level 0.9100, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 0.9100

- Take Profit 1: 0.9120

- Take Profit 2: 0.9145

Comment:

RSI shows the possibility of descending momentum.

Key levels:

| Resistance | Support |

| 0.9145 | 0.9045 |

| 0.9120 | 0.9030 |

| 0.9100 | 0.9000 |

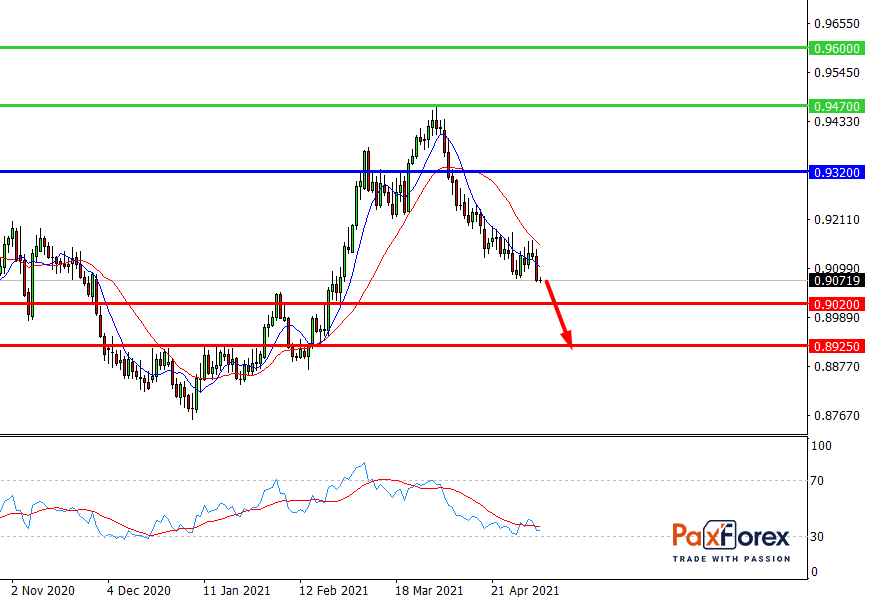

USD/CHF, D1

Pivot: 0.9161

Analysis:

While the price is below 0.9320, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 0.9161

- Take Profit 1: 0.9020

- Take Profit 2: 0.8925

Alternative scenario:

If the level 0.9320 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 0.9320

- Take Profit 1: 0.9470

- Take Profit 2: 0.9600

Comment:

RSI shows the development of a downtrend in the medium-term.

Key levels:

| Resistance | Support |

| 0.9600 | 0.9020 |

| 0.9470 | 0.8925 |

| 0.9320 | 0.8830 |

We also advise you to pay attention to the following currency pairs for intraday trading:

EUR/USD - buy above 1.2045 with 1.2095 and 1.2120 targets as Take Profit. Alternative scenario - if the level 1.2045 is broken-down, sell with the TP 1.2030 and 1.2015.

GBP/USD – buy above 1.3885 with 1.3930 and 1.3950 as Take Profit targets. Alternative scenario - if the level of 1.3885 is broken-down, you should consider selling with the targets 1.3870 and 1.3855 as Take Profit.

AUD/USD - buy above 0.7755 with 0.7815 and 0.7830 targets as Take Profit. Alternative scenario - if the level of 0.7755 is broken-down, sell with the targets 0.7735 and 0.7715 as Take Profit.