Source: PaxForex Premium Analytics Portal, Technical Insight

Canada: June, production sales +20.7% MoM vs. the forecast of 16.4% and prev. 11.6%;

Production sales -15.6% YoY

Sales excluding cars +10.3%;

Sales grew in each of the 21 sectors;

New orders +23.6% MoM, -16.4% YoY

Production capacity utilization +10.9% to 73.3% from 81.3% a year ago.

Higher-than-expected production sales in June are the result of the ongoing recovery from the coronavirus crisis. USD/CAD initially declined by about 20 pips in response to the numbers and is now trading at 1.3230

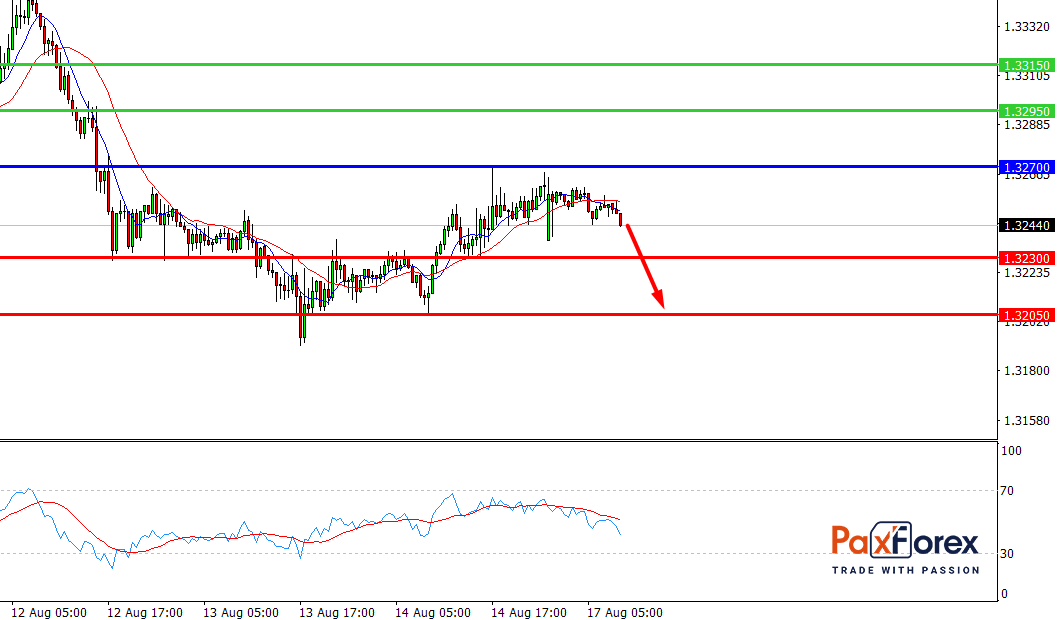

USD/CAD, 30 min

Pivot: 1.3267

Analysis:

Provided that the currency pair is traded below 1.3270, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 1.3267

- Take Profit 1: 1.3230

- Take Profit 2: 1.3205

Alternative scenario:

In case of breakout of the level 1.3270, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 1.3270

- Take Profit 1: 1.3295

- Take Profit 2: 1.3315

Comment:

RSI shows the possibility of a descending momentum during the day.

Key levels:

| Resistance | Support |

| 1.3315 | 1.3230 |

| 1.3295 | 1.3205 |

| 1.3270 | 1.3190 |

USD/CAD, D1

Pivot: 1.3254

Analysis:

While the price is below 1.3500, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 1.3254

- Take Profit 1: 1.3100

- Take Profit 2: 1.2950

Alternative scenario:

If the level 1.3500 is broken-out, follow the recommendations below.

- Time frame: D1

- Recommendation: long position

- Entry point: 1.3500

- Take Profit 1: 1.3720

- Take Profit 2: 1.3870

Comment:

RSI indicates that the downtrend continues in the medium term.

Key levels:

| Resistance | Support |

| 1.3870 | 1.3100 |

| 1.3720 | 1.2950 |

| 1.3500 | 1.2850 |