Source: PaxForex Premium Analytics Portal, Technical Insight

U.S. bank stocks fell markedly after the U.S. Federal Reserve announced that it will not extend the SLR ratio easing, which expires on March 31. The measure, introduced as the pandemic began, allowed banks to exclude Treasuries and deposits with the Fed from the calculation of the leverage ratio. The Standard & Poor's 500 fell 2.36 points (0.06%) to 3,913.1 points.

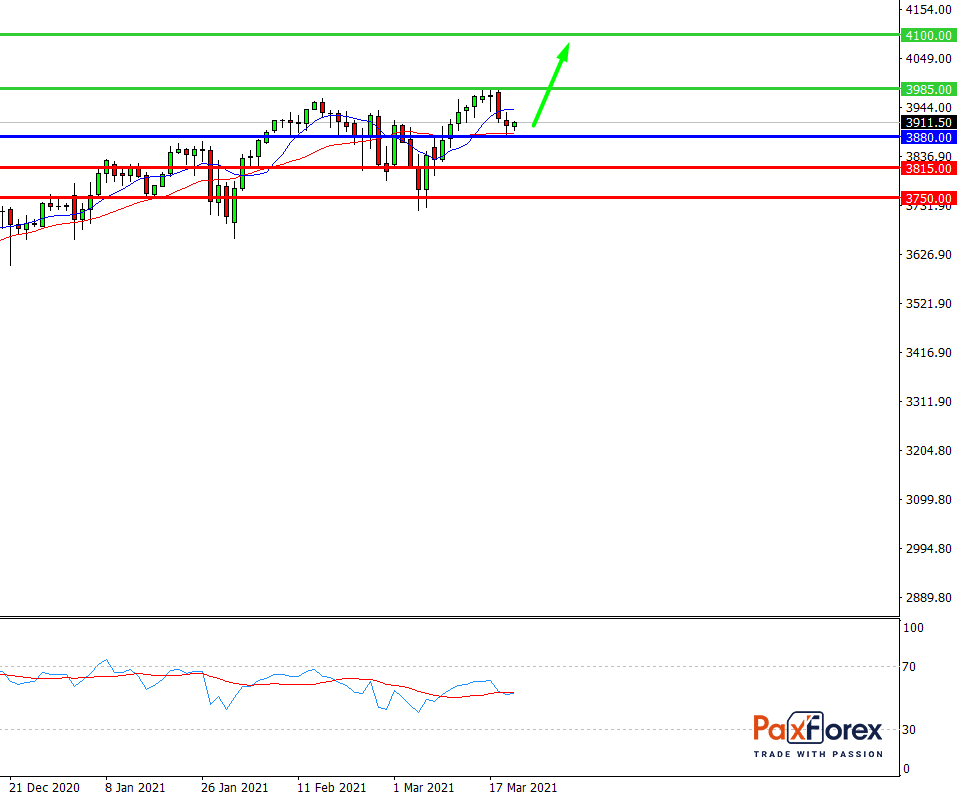

S&P 500, H4

Pivot: 3911.00

Analysis:

Provided that the index is traded above 3880.00, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 3911.00

- Take Profit 1: 3985.00

- Take Profit 2: 4100.00

Alternative scenario:

In case of breakdown of the level 3880.00, follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 3880.00

- Take Profit 1: 38615.00

- Take Profit 2: 3750.00

Comment:

RSI indicates an uptrend during the day.

Key levels:

| Resistance | Support |

| 4150.00 | 3880.00 |

| 4100.00 | 3815.00 |

| 3985.00 | 3750.00 |

S&P 500, D1

Pivot: 3922.00

Analysis:

While the price is above 3820.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 3922.00

- Take Profit 1: 4040.00

- Take Profit 2: 4450.00

Alternative scenario:

If the level 3820.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 3820.00

- Take Profit 1: 3725.00

- Take Profit 2: 3580.00

Comment:

RSI is bullish and indicates further increase.

Key levels:

| Resistance | Support |

| 4500.00 | 3820.00 |

| 4450.00 | 3725.00 |

| 4110.00 | 3580.00 |