Source: PaxForex Premium Analytics Portal, Technical Insight

U.S. stock indices closed Thursday's trading without a single dynamic. The Standard & Poor's 500 index declined by 4.72 points (0.13%) to 3,668.1 points. The market was pressured by a larger-than-expected increase in jobless claims, as well as the lack of tangible progress in the negotiations of lawmakers on a new package of economic support measures. At the same time, hopes for the imminent introduction of COVID-19 vaccines support investor sentiment.

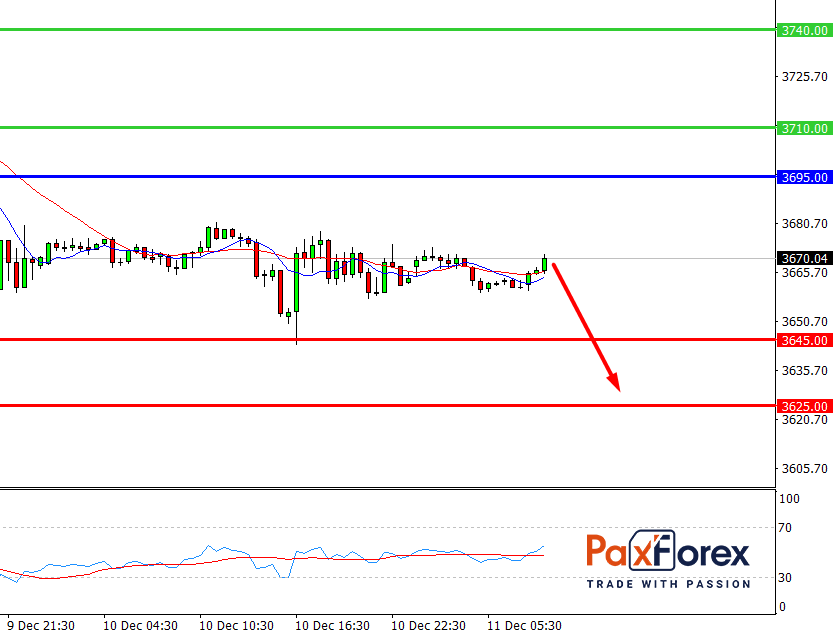

S&P 500, H4

Pivot: 3669.00

Analysis:

Provided that the index is traded below 3695.00, follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 3669.00

- Take Profit 1: 3645.00

- Take Profit 2: 3625.00

Alternative scenario:

In case of breakout of the level 3695.00, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 3695.00

- Take Profit 1: 3710.00

- Take Profit 2: 3740.00

Comment:

RSI indicates a downtrend during the day.

Key levels:

| Resistance | Support |

| 3740.00 | 3645.00 |

| 3710.00 | 3625.00 |

| 3695.00 | 3595.00 |

S&P 500, D1

Pivot: 3688.00

Analysis:

While the price is above 3515.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 3688.00

- Take Profit 1: 3745.00

- Take Profit 2: 3900.00

Alternative scenario:

If the level 3515.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 3515.00

- Take Profit 1: 3390.00

- Take Profit 2: 3210.00

Comment:

RSI is bullish and indicates further increase.

Key levels:

| Resistance | Support |

| 4070.00 | 3515.00 |

| 3900.00 | 3390.00 |

| 3745.00 | 3210.00 |