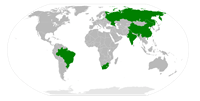

Earlier this week it was reported that BRICS, which stands for Brazil, Russia, India, China and South Africa, has agreed on a $100 Billion fund in order to combat fiscal malpractice by the developed world and counter associated negative impacts on currency markets (BRICS Collaboration and Currency Markets). BRICS has over $4.4 Trillion in currency reserves, but not the attributable financial influence in the global arena which caused BRICS to stand by and accept the negative impacts of developed world mistakes. The creation of this $100 Billion fund is another step in the right direction to change that.

Earlier this week it was reported that BRICS, which stands for Brazil, Russia, India, China and South Africa, has agreed on a $100 Billion fund in order to combat fiscal malpractice by the developed world and counter associated negative impacts on currency markets (BRICS Collaboration and Currency Markets). BRICS has over $4.4 Trillion in currency reserves, but not the attributable financial influence in the global arena which caused BRICS to stand by and accept the negative impacts of developed world mistakes. The creation of this $100 Billion fund is another step in the right direction to change that.

Tensions on the Korean peninsula increase and the tone of North Korea as well as the U.S. gets more aggressive which is why we tried to answer a question on the mind of plenty forex traders (Can North Korea derail forex markets?). For now, most currency traders ignore this boiling hotspot, but they will take notice should the tensions rise even further. Only regional currency pairs are currently under the impact of political as well as military pressures which are on the rise in Korea.

Overview of profits for the week which ended March 29th

- EURUSD: 42 pips

- USDCAD: 35 pips

- EURAUD: 150 pips

- GBPCAD: 97 pips

Total: 324 pips

Monday, March 25th

AUDUSD Short Recommendation

We recommended a short position at 1.0465 which was an addition to our existing short position we took on March 5th at 1.0225 (AUDUSD Rising Wedge Formation). We set our take profit level at 1.0330. We also have one long hedge open. This trade currently carries a floating trading loss of 226 pips. This represents a decrease of 44 pips compared to last week.

Tuesday, March 26th

NZDUSD Short Recommendation

We recommended a short position at 0.8380 with a take profit target of 0.8340 (NZDUSD Spinning Top). This pair has moved a few pips lower and currently carries a floating trading profit of 5 pips. We should be able to close this trade next week.

Wednesday, March 27th

USDCAD Long Recommendation

We recommended a long position at 1.0150 which would be an addition to our existing long position we took on March 3rd at 1.0322 (USDCAD Falling Wedge Formation). This trade currently carries a floating trading loss of 126 pips. This represents a decrease of 91 pips compared to last week. We have adjusted our take profit level to 1.0250.

Thursday, March 28th

EURUSD Long Recommendation

We recommended a long position at 1.2760 with a take profit level of 1.2810 (EURUSD Bearish Price Channel). We closed this trade on March 28th for a profit of 39 pips.

Exit from trades of previous weeks

EURUSD Hedge

We closed our EURUSD hedge on March 25th for a profit of 3 pips. We opened the hedge on March 19th at 1.2850.

USDCAD Hedge

We closed both our USDCAD hedges on March 27th for a profit of 35 pips. We opened the hedges on February 18th and March 5th at 1.0076 and 1.0268 respectively.

EURAUD Hedge

We closed our EURAUD hedge on March 28th for a profit of 150 pips. We opened the hedge on March 21st at 1.2385.

GBPCAD Hedge

We closed our GBPCAD hedge on March 28th for a profit of 97 pips. We opened the hedge on March 18th at 1.5475.

We had a total of four trading recommendations this week. One was closed for a profit of 39 pips, while two were additions to existing trades which remain open and one new position which remains open as well. We also closed four positions from previous weeks for a profit of 285 pips which bring sour total profits for the week to 324 pips. The two add-on positions as well as the new position carry a floating trading loss of 347 pips. This represents a decrease of 140 pips compared to last week.

Besides our open positions from this week we have nine positions from previous weeks. We have three open USDJPY positions, two short positions and one long hedge, which currently carry a floating trading loss of 161 pips. This represents a decrease of 21 pips compared to last week. We maintain our take profit target of 92.50.

We have two open USDCHF short positions which carry a floating trading loss of 366 pips. This represents an increase of 174 pips compared to last week. We maintain our take profit level of 0.9325.

We have three open GBPUSD positions, two long positions and one short hedge, which currently carry a floating trading loss of 2,461 pips. This represents an increase of 62 pips compared to last week. We will continue to monitor this trade and seek to exit our hedge this week.

We have three open GBPCHF positions, two long positions and one short hedge, which currently carry a floating trading loss of 1,363 pips. This represents a decrease of 103 pips compared to last week. We maintain our take profit level of 1.4700 for our long positions.

We have one open GBPCAD long position which currently carries a floating trading loss of 150 pips. This represents a decrease of 5 pips compared to last week. We seek for add a second long position to this trade in the next few days.

We have four open EURGBP positions, three short positions and one hedge, which currently carry a floating trading loss of 1,067 pips. This represents a decrease of 286 pips compared to last week. We will maintain our take profit target of 0.8250.

We have three open EURAUD long positions which currently carry a floating trading loss of 1,130 pips. This represents an increase of 345 pips compared to last week. We will maintain our take profit level of 1.2735.

We have two open AUDNZD short positions which currently carry a floating trading loss of 98 pips. This represents a decrease of 114 pips compared to last week. We will maintain our take profit target of 1.2382.

We have two open AUDCHF short positions which currently carry a floating trading loss of 609 pips. This represents an increase of 140 pips compared to last week. We will maintain our take profit target of 0.9580.

Our total floating trading loss at the end of the week stood at 7,752 pips. This represents a decrease of 89 pips or 1.14% compared to last week. This was our third weekly decrease in floating trading losses while our monthly profits increase on a double digit percentage scale. GBP related trading losses accounted for 5,221 pips or 67.35% of all losses and are down 152 pips or 2.83% compared to last week.

Our total profits for March equal 1,531 pips and are higher than our forecast of 1,200 pips. Our floating trading losses minus hedge equal 6,423 pips and in-line with our expectations while our hedged account for floating trading losses of 1,329 pips. Our profit target for April is set at 1,200 pips while we plan to reduce our floating trading losses to 6,500 pips.

We hope you enjoyed your weekend and that we will see you back on Monday. Happy Easter to all clients who celebrate this holiday.