Source: PaxForex Premium Analytics Portal, Technical Insight

Reuters released Fed Chairman Powell's response to Senator Rick Scott, who expressed concern about rising inflation and the Fed's buying program:

- Too low inflation hurts both households and companies;

- We don't plan to allow inflation to go substantially above 2% or inflation above that level for an extended time;

- Inflation will rise slightly higher this year, reflecting in part temporary factors amid an economic recovery;

- We don't expect inflation to rise too much, but we do have the tools to deal with 1970s-style inflation;

- The pace of Fed bond purchases is not related to deficits;

- Growth in the U.S. economy appears to be accelerating;

- Unemployment rates are not fully in the labor market, which has not yet returned to pre-pandemic levels;

- Rising COVID-19 incidence is worrisome; Vaccination allows hope for a return to normalcy this year.

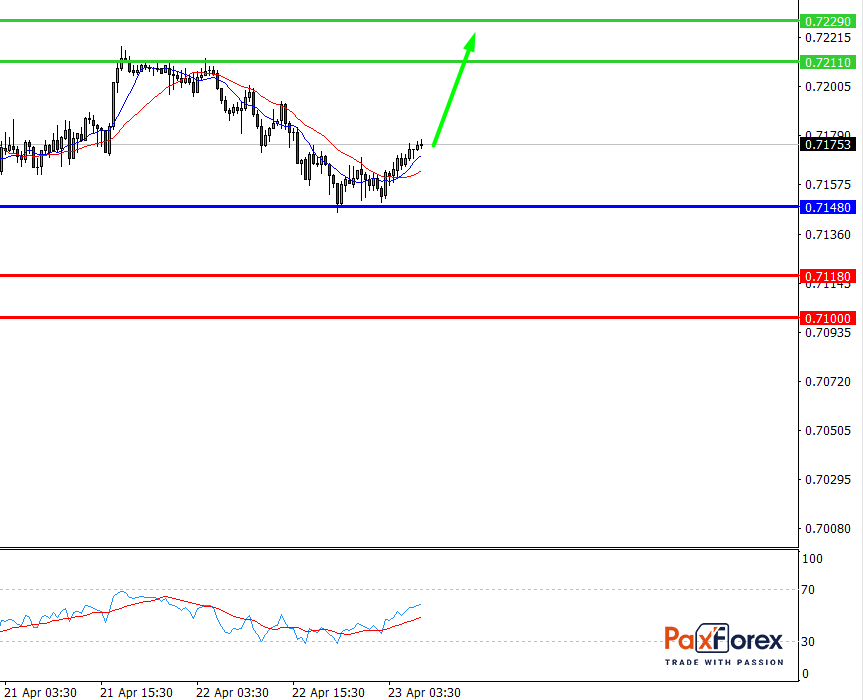

NZD/USD, 30 min

Pivot: 0.7176

Analysis:

Provided that the currency pair is traded above 0.7148, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 0.7176

- Take Profit 1: 0.7211

- Take Profit 2: 0.7229

Alternative scenario:

In case of breakdown of the level 0.7148, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 0.7148

- Take Profit 1: 0.7118

- Take Profit 2: 0.7100

Comment:

RSI shows the possibility of an uptrend during the day.

Key levels:

| Resistance | Support |

| 0.7247 | 0.7148 |

| 0.7229 | 0.7118 |

| 0.7211 | 0.7100 |

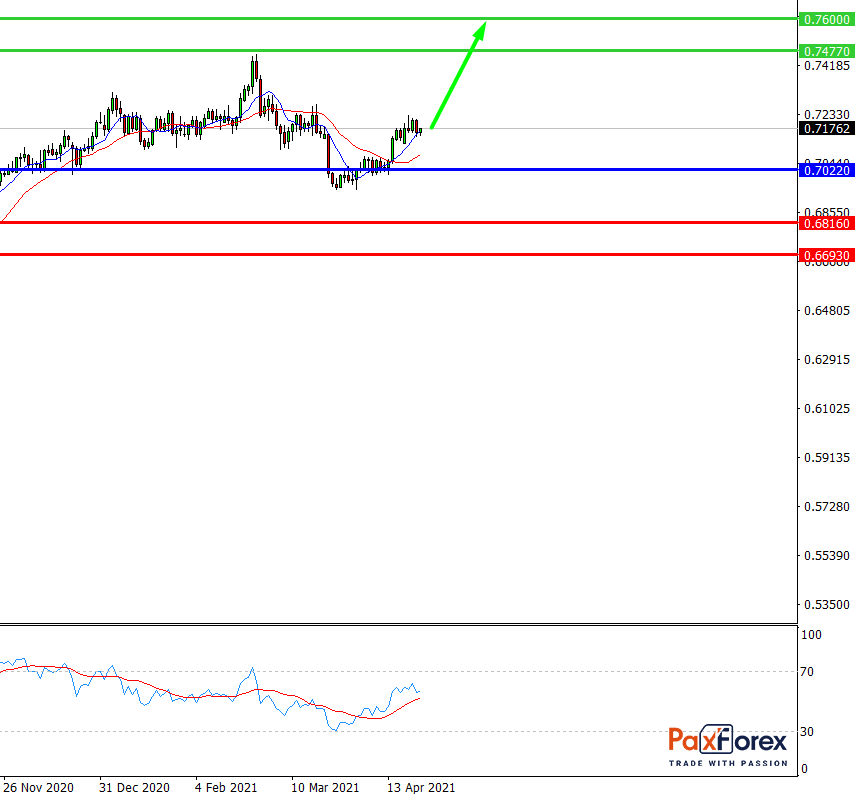

NZD/USD, D1

Pivot: 0.7209

Analysis:

While the price is above 0.7022, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 0.7209

- Take Profit 1: 0.7477

- Take Profit 2: 0.7600

Alternative scenario:

In case of breakdown of the level 0.7022, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 0.7022

- Take Profit 1: 0.6816

- Take Profit 2: 0.6693

Comment:

RSI shows an uptrend in the medium term.

Key levels:

| Resistance | Support |

| 0.7724 | 0.7022 |

| 0.7600 | 0.6816 |

| 0.7477 | 0.6693 |

We also advise you to pay attention to the following currency pairs for intraday trading:

EUR/USD – buy above 1.2010 with 1.2045 and 1.2065 targets as Take Profit. Alternative scenario - if the level 1.2010 is broken-down, sell with the TP 1.1995 and 1.1980.

GBP/USD - long positions above 1.3825 with 1.3915 and 1.3945 targets as Take Profit. Alternative scenario - if the level of 1.3825 is broken-down, sell with the targets 1.3800 and 1.3775 as Take Profit.

AUD/USD – buy above 0.7695 with 0.7760 and 0.7785 as Take Profit targets. Alternative scenario - if the level of 0.7695 is broken-down, you should consider selling with the targets 0.7680 and 0.7660 as Take Profit.