Source: PaxForex Premium Analytics Portal, Technical Insight

The postponement of general parliamentary elections was announced in New Zealand. The rescheduling of the general parliamentary elections was announced by the Prime Minister of New Zealand, Jacinda Ardern, as reported by The New Zealand Herald on August 17. The Head of Government explained that the decision was taken after discussions with other politicians in connection with new outbreaks of coronavirus infection in the country. The general parliamentary elections were postponed from September 19 to October 17.

NZD/USD, 30 min

Pivot: 0.6535

Analysis:

Provided that the currency pair is traded below0.6555 follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 0.6535

- Take Profit 1: 0.6505

- Take Profit 2: 0.6492

Alternative scenario:

In case of breakout of the level 0.6555 follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 0.6555

- Take Profit 1: 0.6577

- Take Profit 2: 0.6591

Comment:

RSI is below its neutral area at 50. MACD is negative and below its signal line. The configuration is negative. Moreover, the pair is below its 20 and 50 moving averages (by 0.6540 and 0.6541 respectively).

Key levels:

| Resistance | Support |

| 0.6591 | 0.6505 |

| 0.6577 | 0.6492 |

| 0.6555 | 0.6478 |

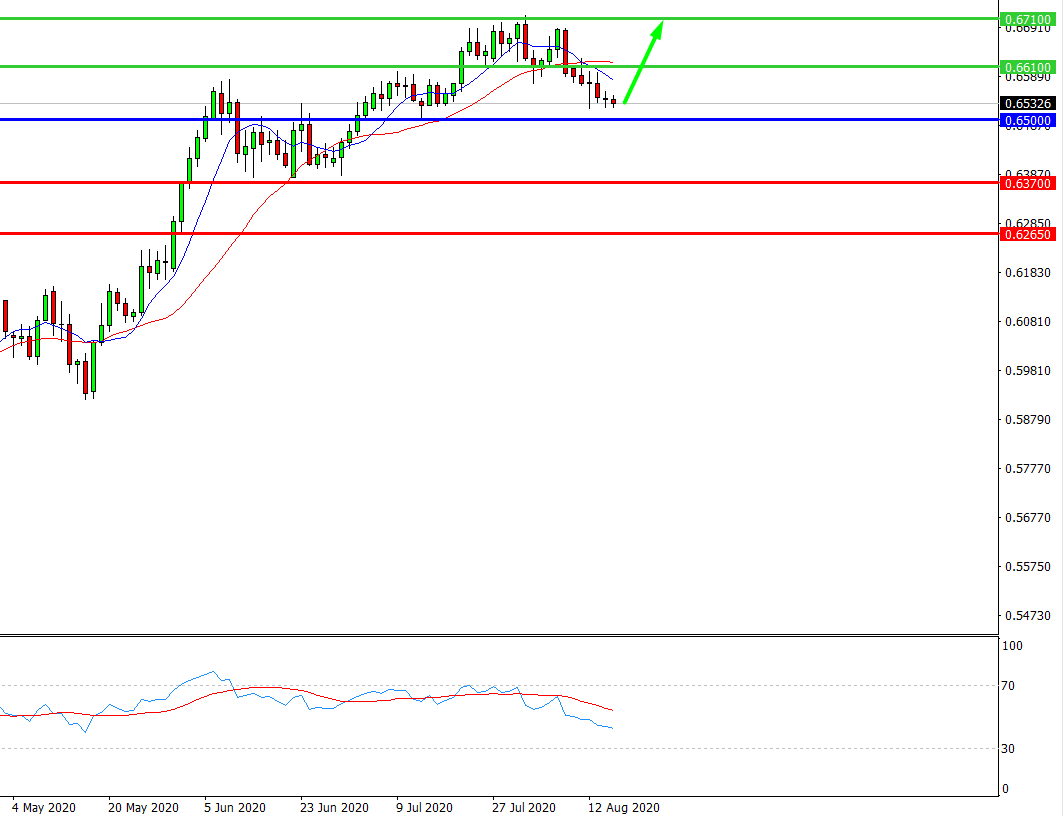

NZD/USD, D1

Pivot: 0.6537

Analysis:

While the price is above 0.6500, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 0.6537

- Take Profit 1: 0.6610

- Take Profit 2: 0.6710

Alternative scenario:

If the level 0.6500 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 0.6500

- Take Profit 1: 0.6370

- Take Profit 2: 0.6265

Comment:

RSI shows further uptrend development.

Key levels:

| Resistance | Support |

| 0.6815 | 0.6500 |

| 0.6710 | 0.6370 |

| 0.6610 | 0.6265 |

We also advise you to pay attention to the following currency pairs for intraday trading:

EUR/USD - buy above 1.1830 with 1.1885 and 1.1900 targets as Take Profit. Alternative scenario - if the level 1.1830 is broken-down, sell with the TP 1.1805 and 1.1780.

GBP/USD - long positions above 1.3075 with 1.3115 and 1.3130 targets as Take Profit. Alternative scenario - if the level of 1.3075 is broken-down, sell with the targets 1.3060 and 1.3045 as Take Profit.

USD /CHF – sell below 0.9110 with 0.9075 and 0.9060 as Take Profit targets. Alternative scenario - if the level of 0.9110 is broken-out, you should consider buying with the targets 0.9125 and 0.9140 as Take Profit.