Source: PaxForex Premium Analytics Portal, Technical Insight

According to Reuters, the deputy head of the Federal Reserve Bank R. Clarida said during a speech:

- It's not yet time to wind down the support the Fed has provided to the economy;

- We'll be watching wage, compensation, and productivity trends;

- We have not yet made significant progress on our labor market goals;

- The latest jobs report reaffirmed the Fed's data-driven approach;

- We will evaluate the data coming in this year and give the markets advance notice of any decision to roll back QE;

- We will prudently accumulate more data before making a decision;

- The economy is recovering at an uneven pace;

- The Fed's patience with inflation is not infinite; inflation expectations must remain contained.

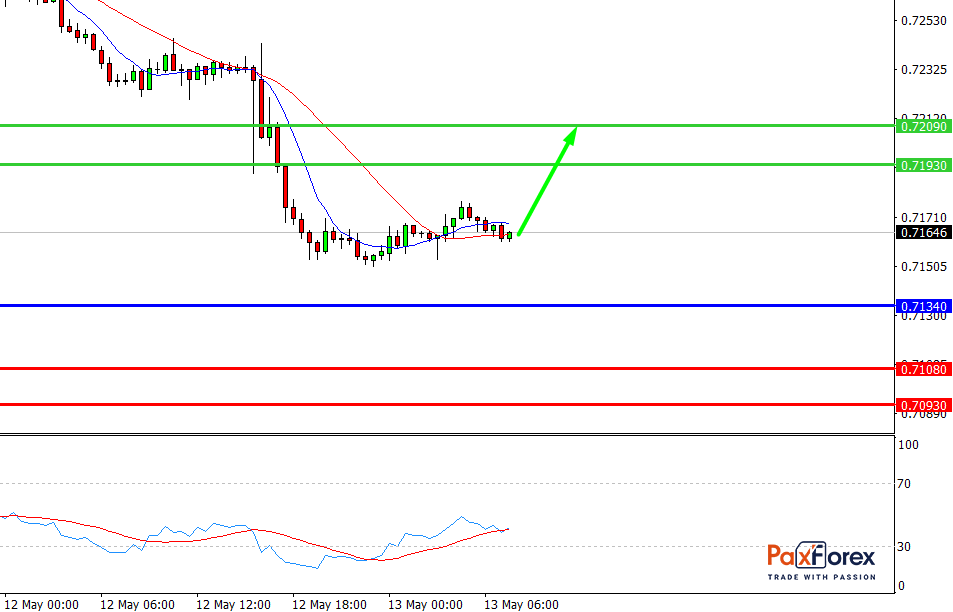

NZD/USD, 30 min

Pivot: 0.7161

Analysis:

Provided that the currency pair is traded above 0.7134, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 0.7161

- Take Profit 1: 0.7193

- Take Profit 2: 0.7209

Alternative scenario:

In case of breakdown of the level 0.7134, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 0.7134

- Take Profit 1: 0.7108

- Take Profit 2: 0.7093

Comment:

RSI shows the possibility of an uptrend during the day.

Key levels:

| Resistance | Support |

| 0.7224 | 0.7134 |

| 0.7209 | 0.7108 |

| 0.7193 | 0.7093 |

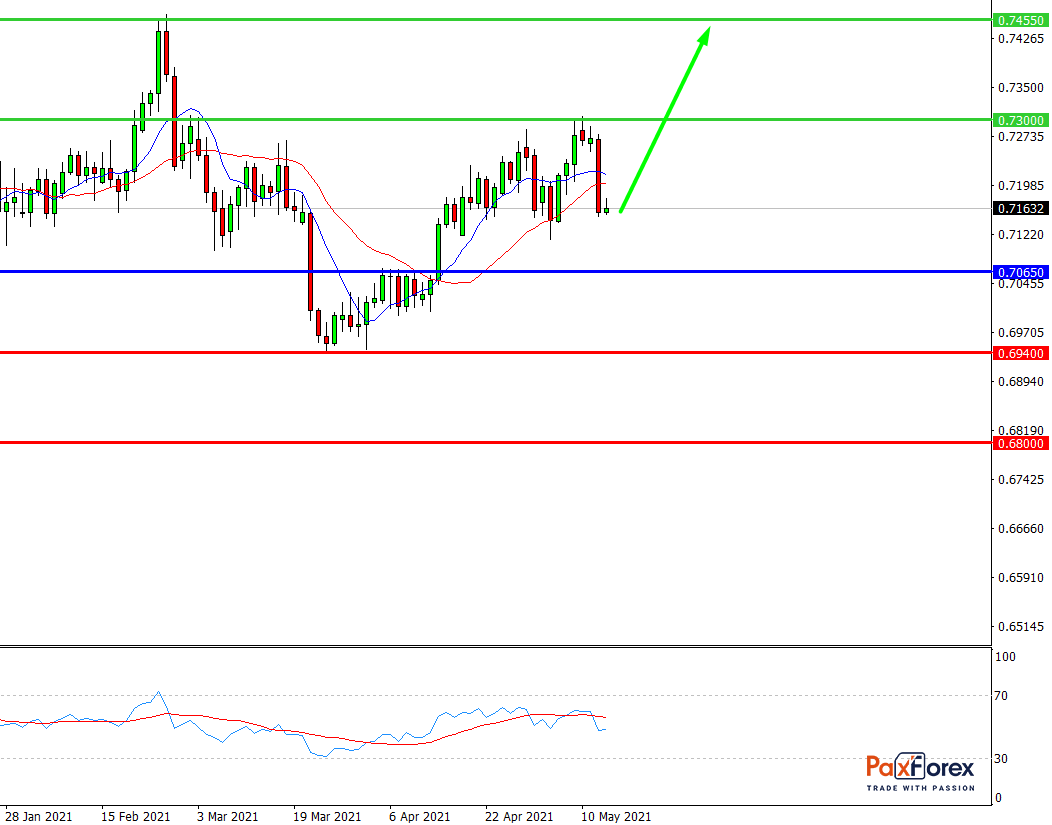

NZD/USD, D1

Pivot: 0.7253

Analysis:

While the price is above 0.7065, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 0.7253

- Take Profit 1: 0.7300

- Take Profit 2: 0.7455

Alternative scenario:

In case of breakdown of the level 0.7065, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 0.7065

- Take Profit 1: 0.6940

- Take Profit 2: 0.6800

Comment:

RSI shows an uptrend in the medium term.

Key levels:

| Resistance | Support |

| 0.7600 | 0.7065 |

| 0.7455 | 0.6940 |

| 0.7300 | 0.6800 |

We also advise you to pay attention to the following currency pairs for intraday trading:

EUR/USD – sell below 1.2100 with 1.2050 and 1.2030 targets as Take Profit. Alternative scenario - if the level 1.2100 is broken-out, buy with the TP 1.2115 and 1.2135.

GBP/USD - short positions below 1.4095 with 1.4015 and 1.3975 targets as Take Profit. Alternative scenario - if the level of 1.4095 is broken-out, buy with the targets 1.4125 and 1.4150 as Take Profit.

AUD/USD – sell below 0.7760 with 0.7670 and 0.7640 as Take Profit targets. Alternative scenario - if the level of 0.7760 is broken-out, you should consider buying with the targets 0.7790 and 0.7815 as Take Profit.