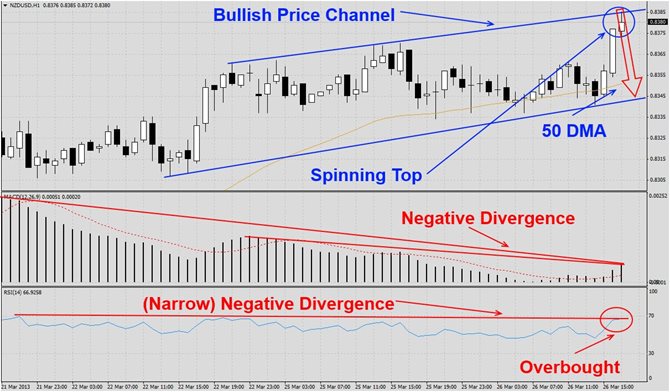

The NZDUSD has rallied over the past few trading sessions and formed a bullish price channel as visible in this H1 chart. Price action has run into its ascending resistance level and the most recent candlestick has formed a spinning top at resistance. We believe this currency pair will correct down to its ascending support level.

MACD has not confirmed the bullish chart patterns and formed a negative divergence. We may witness a bearish centerline crossover over the next few trading days. RSI has formed a very narrow negative divergence and currently trades in overbought territory. A breakdown below overbought conditions should fuel the correction.

We recommend a short position at 0.8380 with a potential second entry level at 0.8450. We also advise trader who wish to hedge to place a buy stop order at 0.8430. Traders who wish to exit this trade at a loss are advice to place their stop loss level at 0.8430. We do not utilize stop loss orders and will execute this trade as recommended. Place your take profit level at0.8340.

Here is why call the NZDUSD forex pair lower

- NZDUSD currency pair trades around resistance levels of current chart formation

- Chart pattern has not been violated

- Last candlestick formed a spinning top at resistance

- MACD formed negative divergence

- RSI formed negative divergence

- RSI trades in overbought territory

- Profit taking

Open your PaxForex Trading Account now and add this trade to your portfolio.