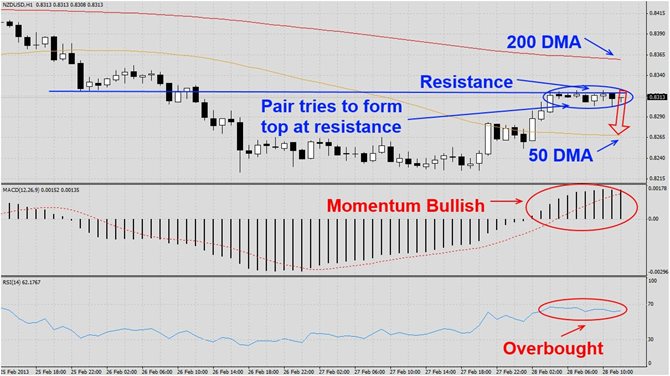

The NZDUSD has rallied from its temporary support level and ran into resistance as visible in this H1 chart. The last half dozen candlestick patterns have tried to form a top at resistance levels which is a bearish sign. We believe this pair will correct down to its 50 DMA before potentially attempting a rally into its 200 DMA.

MACD has turned bullish during the rally which may hint at further upside after a correction. We believe the correction will leave the MACD in bullish territory. RSI has been trading in overbought territory and a breakdown from this level should accelerate the sell-off into its 50 DMA.

We recommend a short position at 0.8310, which will act as a hedge to our remaining long position which was opened on February 15th at 0.8530. We did exit our other long position as well as its corresponding hedge yesterday for a profit. We advise traders to add to their short positions should this pair breach the 0.8450 level.

Traders who wish to exit this trade at a loss are advice to place their stop loss level at 0.8400. We do not use stop loss levels and will execute this trade as recommended. Place your take profit level at 0.8250.