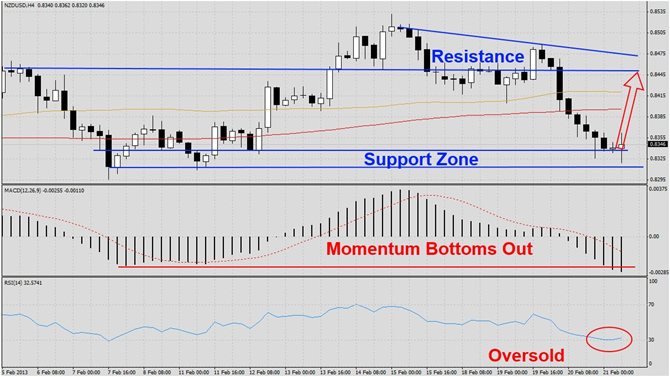

The NZDUSD has corrected sharply as visible in this H4 chart and currently trades around its support zone. The reason for the recent collapse was comments by the New Zealand Central Bank which would like to see a weaker Kiwi. We believe the correction was overdone and due for a bounce back into resistance.

MACD has bottomed out at roughly the same level as its previous decline to this level and formed a double bottom. RSI is trading in oversold territory and a breakout from this level should add to the rally back to resistance.

We recommend a long position at 0.8340. This is in addition to a long position we took on February 15th at 0.8530. We also advise traders to place a sell stop order at 0.8300 using half the volume of both long positions.

Traders who wish to exit this trade at a loss are advised to place their stop loss at 0.8300. We do not use stop loss levels and will execute this trade as recommended. Place your take profit level at 0.8455.