Source: PaxForex Premium Analytics Portal, Technical Insight

The April U.S. jobs report partially justified the Fed's reluctance to adjust the parameters of the QE, as the economy created only 266,000 jobs and the unemployment rate rose to 6.1%. However, commodity markets continue to call out that price pressures have reached levels that pose a real danger to the economy. Frenzied inflation is hard to get under control. Last week's released CPI figure reflected a 0.8% jump in prices, while experts had predicted a 0.2% increase. And while Fed officials are confident that they can handle the pressure with monetary policy tools, there is no guarantee of that. Moreover, it is monetary and fiscal policy that fuels inflationary pressures. Twenty-two U.S. states are eliminating federal unemployment benefits.

Today, U.S. citizens are paid $300 a week in additional unemployment benefits as part of the Biden bailout package. But these payments have resulted in many Americans receiving more in benefits than they would have earned at work. Quite naturally, the desire to look for work disappears.

Such negative effects go a long way toward explaining the very contradictory statistics in the United States:

- On the one hand, business activity indices are off the charts, companies are willing to hire workers and produce more.

- On the other hand, unemployment rose in April compared to the previous month.

Since the beginning of March, the number of people claiming unemployment benefits for the first time has fallen by more than a third. Over the same period, the total number of people receiving benefits has fallen only 12.7%.

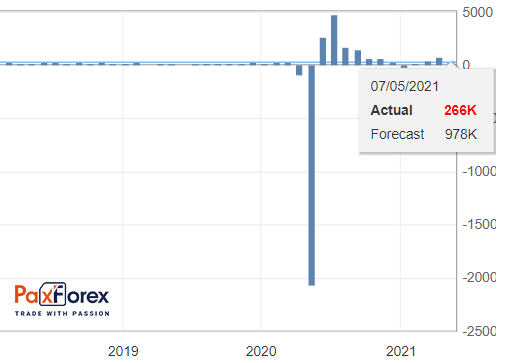

Non-Farm Payrolls Employment

Last data: 266K

Consensus Forecast: 650K

The Non-Farm employment change measures the change in the number of people employed during the last month in the non-farm sector. Total Non-Farm Payrolls represent about 80% of the workers who produce all of the Gross Domestic Product of the United States.

It is the most important piece of data contained in the employment report that offers the best overview of the economy.

Monthly changes and adjustments in the data can be very volatile.

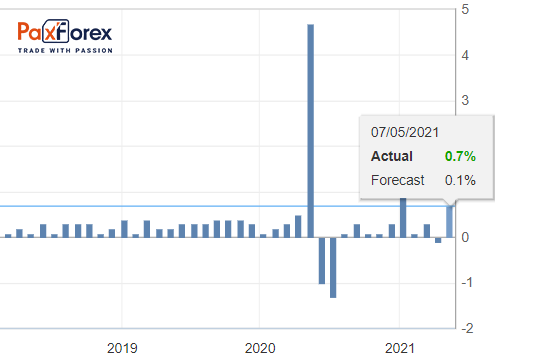

U.S. Average Hourly Earnings YoY

Last data: 0.7%

Consensus forecast: 0.2%

This indicator shows the change in the average hourly wage level for major industries, except agriculture.

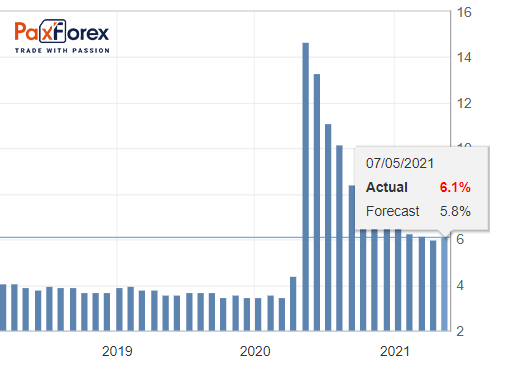

Unemployment Rate

Past data: 6.1%

Consensus forecast: 5.9%

The unemployment rate measures the percentage of the total labor force that is unemployed but actively looking for a job and willing to work in the United States.

A high percentage indicates weakness in the labor market. A low percentage is positive for the U.S. labor market and should be taken as a positive factor for the USD.

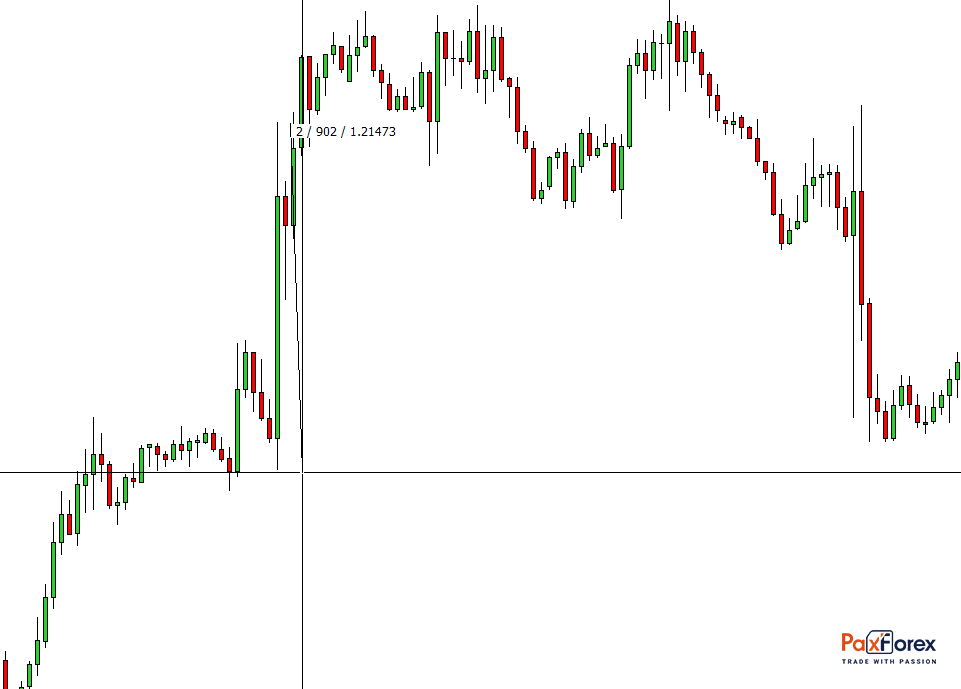

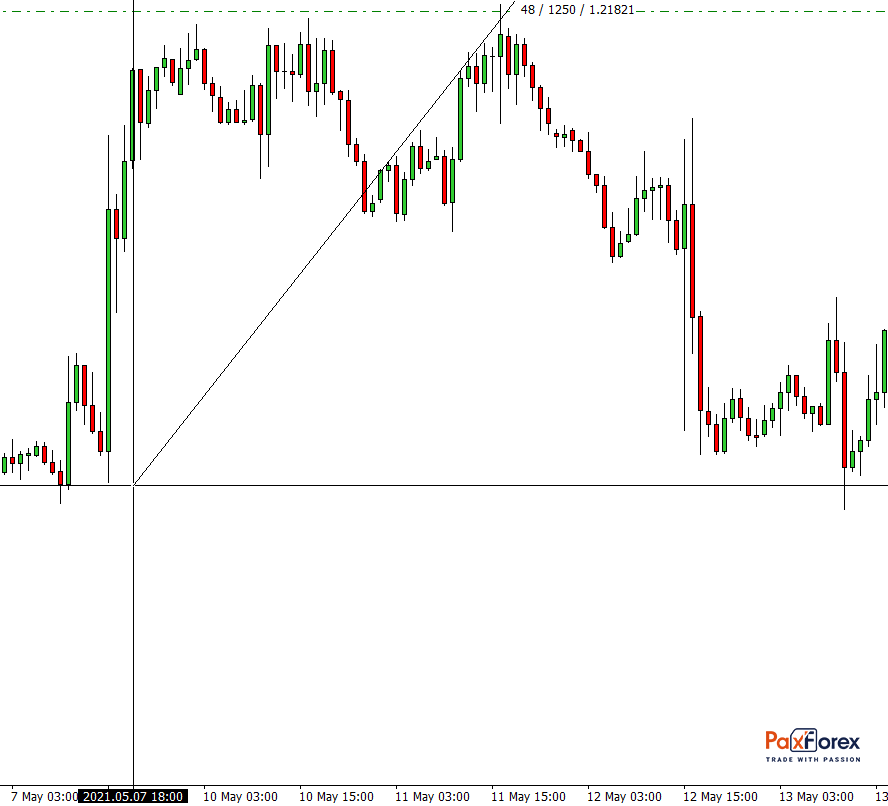

In the previous release of data, the movement on the EUR/USD currency pair at that moment made 90 points:

At the same time, having developed movement at 120 points within a few hours:

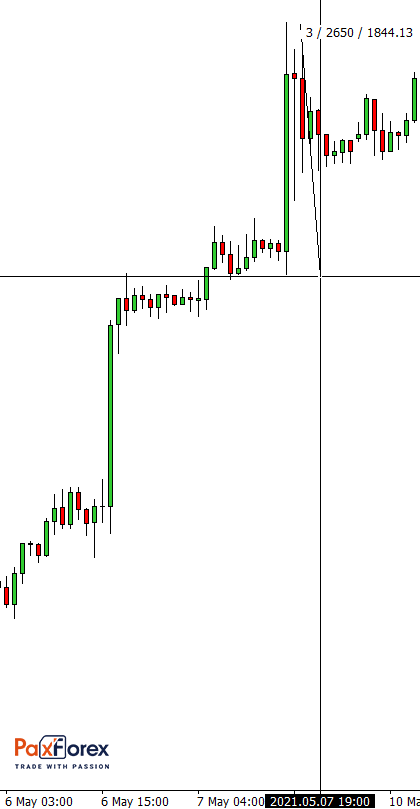

A more interesting development was happening with gold. The price went up 265 points at the moment:

At the same time having developed growth of 704 points in a few days: