Source: PaxForex Premium Analytics Portal, Technical Insight

Investors still do not know what to do with U.S. government bonds, whose yields are hovering near 1.7%. The index dipped below that mark on Friday, but on Monday it was able to break out again. Last week, Federal Reserve officials conducted an "informational blitz," reassuring investors that inflation was not a threat and that the regulator itself would continue to stimulate markets for the foreseeable future. But demand for seven-year bonds was weak last Thursday, perhaps reflecting investor concerns about price dynamics. Demand for the $62 billion issue was only 2.23 times the supply (below average). Meanwhile, the yield was about 10 basis points higher than the February issue, at 1.3%; double the late 2020 rate. The next report on U.S. Non-Farm payrolls will be released this Friday. Strong data could trigger a selloff in U.S. debt, even though the bond markets closed early on Good Friday. Experts believe the economy added about 630,000 jobs in March, up significantly from 379,000 in February. The high reading will bolster expectations for a quick economic recovery, but it is worth bearing in mind the associated inflation risks.

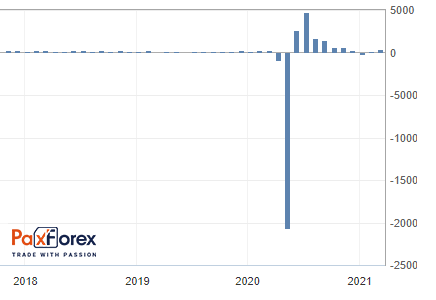

Non-Farm Payrolls Employment

Last data: 379K

Consensus Forecast: 650K

On Friday, the key report on U.S. Non-Farm Payrolls will be released (although many markets, including the U.S., will be closed). And while normally low trading volumes would lead to consolidation, it could be different now as investors prepare for the strongest Payrolls in at least the last 5 months. March has turned out to be a good month for the dollar bulls. Thanks to an aggressive vaccination program, consumer and business sentiment improved and economic activity accelerated. Over the next 3 weeks, 90% of U.S. adults will be able to get vaccinated within 5 miles of where they live, which is encouraging. Investors will also look at Friday's jobs report for hints of an even stronger labor market recovery in the months ahead. However, there is a significant risk worth noting: Biden's infrastructure project could be financed by tax increases. We are talking about $1 trillion to $3 trillion in new taxes, and the larger the real number, the greater the pressure on the stock market. The Administration's most obvious move seems to be to repeal the 2017 law that lowered the corporate tax rate from 35% to 21%, but the personal income tax is also in jeopardy. And given that the stock market is already trading near record highs, profit-taking would not be hard to trigger; high-beta stocks and currencies would suffer as a result. Thus, a stock market correction and strong Payrolls should support the U.S. dollar. However, Biden`s speech, the end of the month and quarter, and the jobs report could be catalysts for increased volatility.

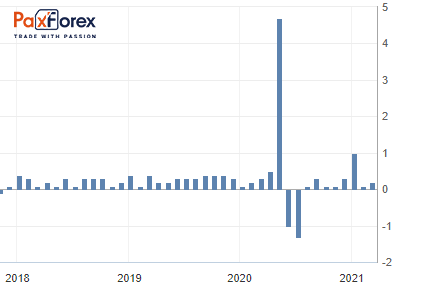

U.S. Average Hourly Earnings YoY

Last data: 0.2%

Consensus forecast: 0.1%

This indicator shows the change in the average hourly wage level for major industries, except agriculture.

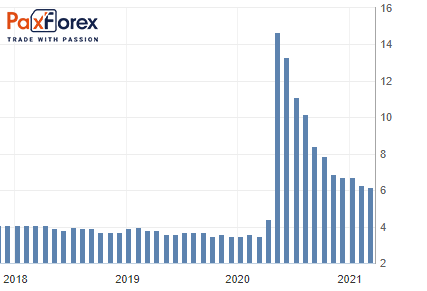

Unemployment Rate

Past data: 6.2%

Consensus forecast: 6.0%

The unemployment rate measures the percentage of the total labor force that is unemployed but actively looking for a job and willing to work in the United States.

A high percentage indicates weakness in the labor market. A low percentage is positive for the U.S. labor market and should be taken as a positive factor for the USD.

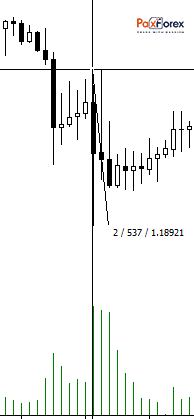

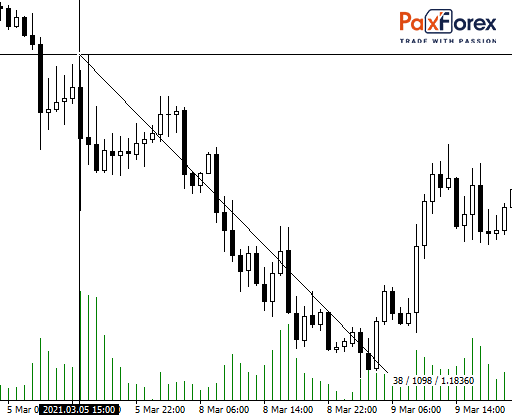

In the previous release of data, the movement on the EUR/USD currency pair at that moment made 53 points:

At the same time, having developed movement at 109 points within a few days:

More interesting course of events took place on the asset, which closely correlates with the currency pair EUR/USD - gold, at the moment of publication gold prices fell by 206 points!

It was followed by a 272-point drop in gold within several hours!