Source: PaxForex Premium Analytics Portal, Technical Insight

The strengthening of the dollar may gain momentum on the eve of Friday's publication of the monthly report on changes in the number of US Non-Farm Payrolls. The number of jobs in June is expected to increase by 690,000 after 559,000 in May and the unemployment rate is expected to fall by 0.1% to 5.7%. The steady improvement in the labor market may provoke a new round of talk that the Fed may move more quickly to a tighter monetary policy than the central bank's leadership has announced so far.

As we know, at the end of the regular meeting, which ended on June 16, the Fed leaders kept the key interest rates in the range of 0.00%-0.25% and the volume of the QE asset purchase program at $120 billion a month. The accompanying statement said that the Fed would continue to maintain the current monetary policy parameters until the inflation and maximum employment targets are achieved, and the interest rate level would not change.

Nevertheless, despite that decision, the dollar strengthened significantly after the Fed meeting, helped by some changes in the sentiment of Fed policymakers regarding the timing of the possible start of the central bank's rollback of extra-soft stimulative policies. Fed policymakers are now forecasting two rate hikes in 2023, while previously, they had promised not to raise rates until the end of 2023. Seven FOMC officials versus four in March expect to begin raising rates as soon as 2022.

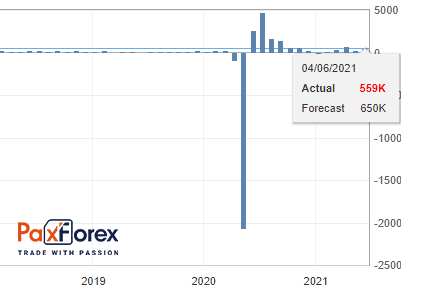

Non-Farm Payrolls Employment

Last data: 559K

Consensus Forecast: 690K

The Non-Farm employment change measures the change in the number of people employed during the last month in the non-farm sector. Total Non-Farm Payrolls represent about 80% of the workers who produce all of the Gross Domestic Product of the United States.

It is the most important piece of data contained in the employment report that offers the best overview of the economy.

Monthly changes and adjustments in the data can be very volatile.

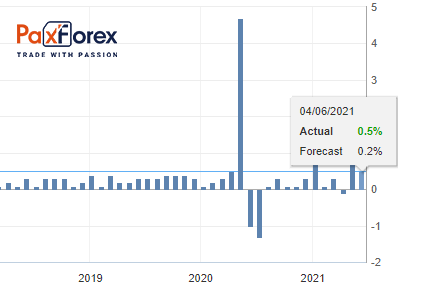

U.S. Average Hourly Earnings YoY

Last data: 0.5%

Consensus forecast: 0.3%

This indicator shows the change in the average hourly wage level for major industries, except agriculture.

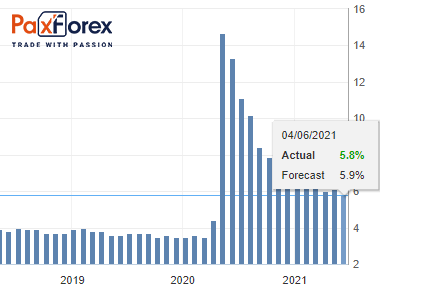

Unemployment Rate

Past data: 5.8%

Consensus forecast: 5.7%

The unemployment rate measures the percentage of the total labor force that is unemployed but actively looking for a job and willing to work in the United States.

A high percentage indicates weakness in the labor market. A low percentage is positive for the U.S. labor market and should be taken as a positive factor for the USD.

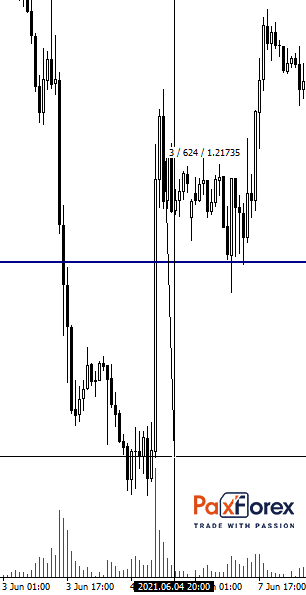

In the previous release of data, the movement on the EUR/USD currency pair at that moment made 62 points:

At the same time, having developed movement at 106 points within a few hours: