Source: PaxForex Premium Analytics Portal, Technical Insight

U.S. indices are showing no unified momentum as concerns about potential tax hikes could limit the market's potential for further growth, analysts said. Meanwhile, Jerome Powell said it was too early to talk about any changes to monetary policy, including reducing the asset buyback program. He noted that the U.S. labor market is far from a full recovery, reports The Wall Street Journal.

Statistical data released Friday pointed to a decline in U.S. retail sales in December. U.S. retail sales declined for the third straight month. Experts hadn't expected any changes compared to November.

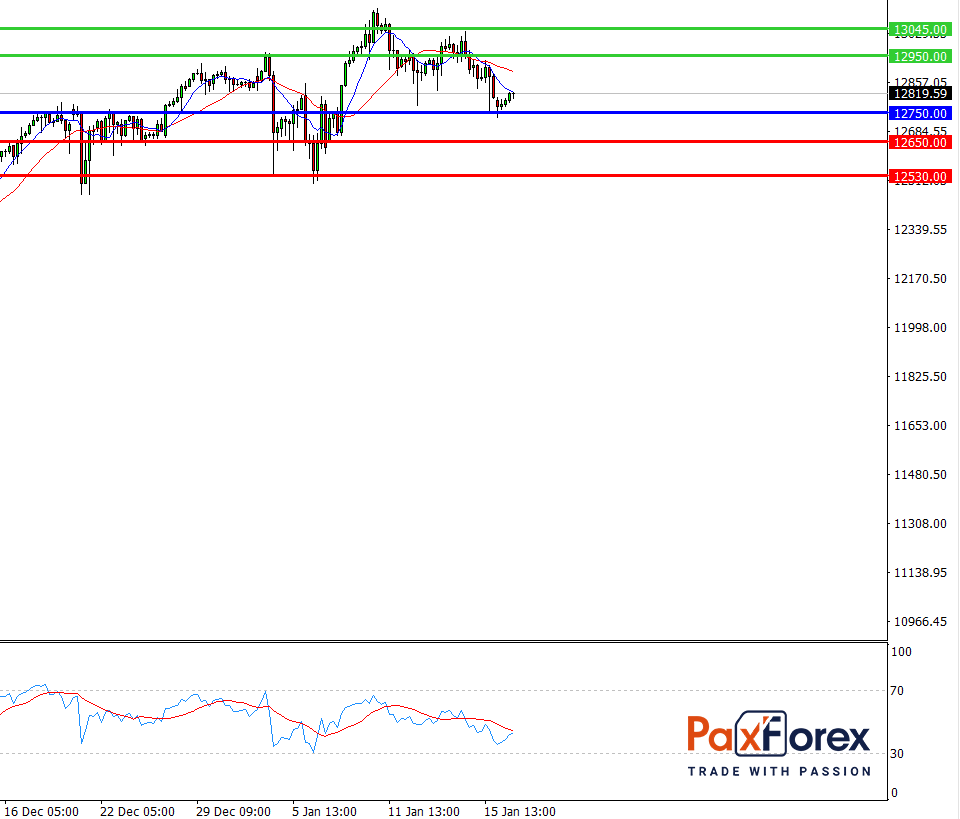

Nasdaq 100, H4

Pivot: 12819.00

Analysis:

Provided that the index is traded above 12750.00, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 12819.00

- Take Profit 1: 12950.00

- Take Profit 2: 13045.00

Alternative scenario:

In case of breakdown of the level 12750.00, follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 12750.00

- Take Profit 1: 12650.00

- Take Profit 2: 12530.00

Comment:

RSI indicates an uptrend during the day.

Key levels:

| Resistance | Support |

| 13100.00 | 12750.00 |

| 13045.00 | 12650.00 |

| 12950.00 | 12530.00 |

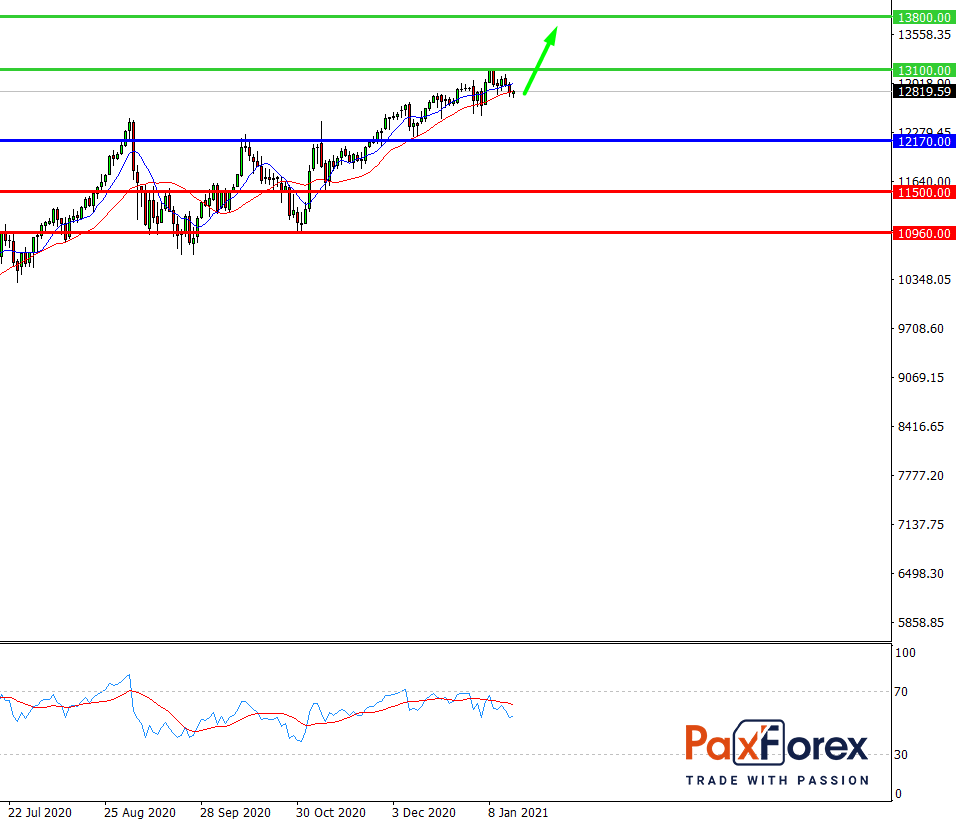

Nasdaq 100, D1

Pivot: 12837.00

Analysis:

While the price is above 12170.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 12837.00

- Take Profit 1: 13100.00

- Take Profit 2: 13800.00

Alternative scenario:

If the level 12170.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 12170.00

- Take Profit 1: 11500.00

- Take Profit 2: 10960.00

Comment:

RSI is bullish and indicates further increase.

Key levels:

| Resistance | Support |

| 14000.00 | 12170.00 |

| 13800.00 | 11500.00 |

| 13100.00 | 10960.00 |