Source: PaxForex Premium Analytics Portal, Technical Insight

The US stock market grew at the end of trading on Tuesday, with the S&P 500 and Nasdaq indicators updating their maximum values. Positive news about the coronavirus vaccine has overshadowed investors' concerns about a record number of hospitalizations from COVID-19 in the U.S. and protracted negotiations on new budget incentives. The U.S. Health Protection Administration (FDA) concluded that all relevant data are available for the emergency approval of the U.S. company Pfizer and German BioNTech's COVID-19 vaccine.

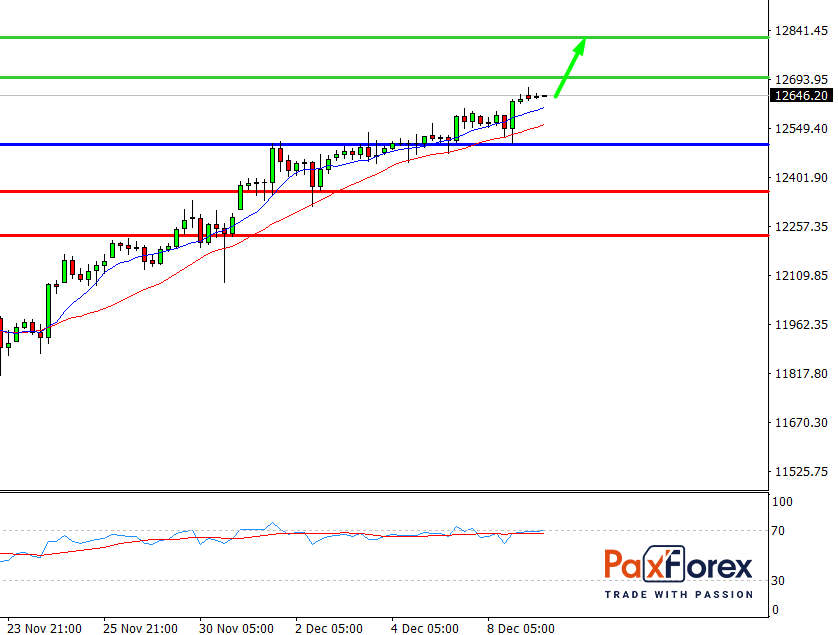

Nasdaq 100, H4

Pivot: 12640.00

Analysis:

Provided that the index is traded above 12500.00, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 12640.00

- Take Profit 1: 12700.00

- Take Profit 2: 12820.00

Alternative scenario:

In case of breakdown of the level 12500.00, follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 12500.00

- Take Profit 1: 12360.00

- Take Profit 2: 12230.00

Comment:

RSI indicates an uptrend during the day.

Key levels:

| Resistance | Support |

| 13020.00 | 12500.00 |

| 12820.00 | 12360.00 |

| 12700.00 | 12230.00 |

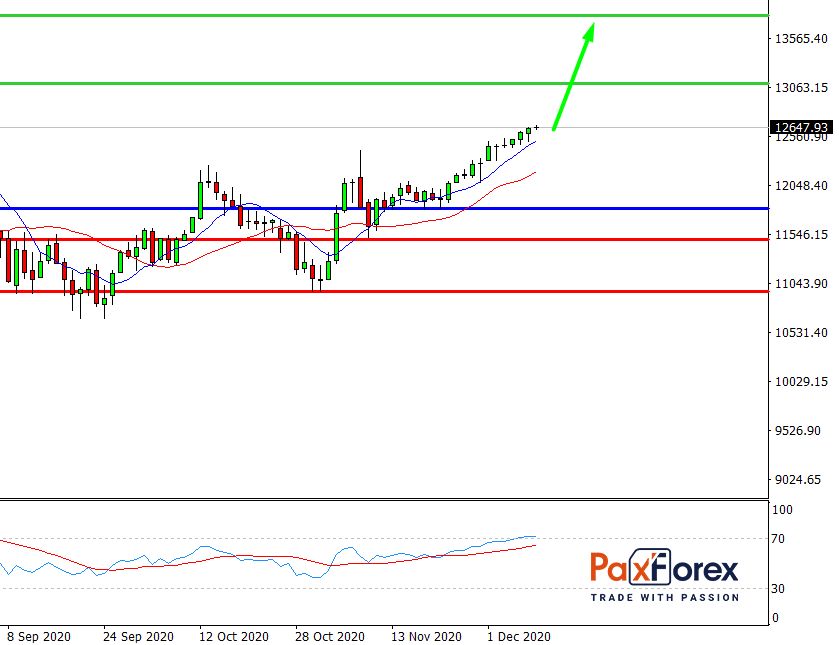

Nasdaq 100, D1

Pivot: 12523.00

Analysis:

While the price is above 11820.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 12523.00

- Take Profit 1: 13100.00

- Take Profit 2: 13800.00

Alternative scenario:

If the level 11820.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 11820.00

- Take Profit 1: 11500.00

- Take Profit 2: 10960.00

Comment:

RSI is bullish and indicates further increase.

Key levels:

| Resistance | Support |

| 14000.00 | 11820.00 |

| 13800.00 | 11500.00 |

| 13100.00 | 10960.00 |