Source: PaxForex Premium Analytics Portal, Technical Insight

The U.S. stock market closed Monday's trading multidirectional due to strengthening of oil and gas, finance and commodities sectors. The market is demonstrating a negative dynamic on the side of technology, utilities and consumer goods sectors. NASDAQ Composite was down 2.03%.

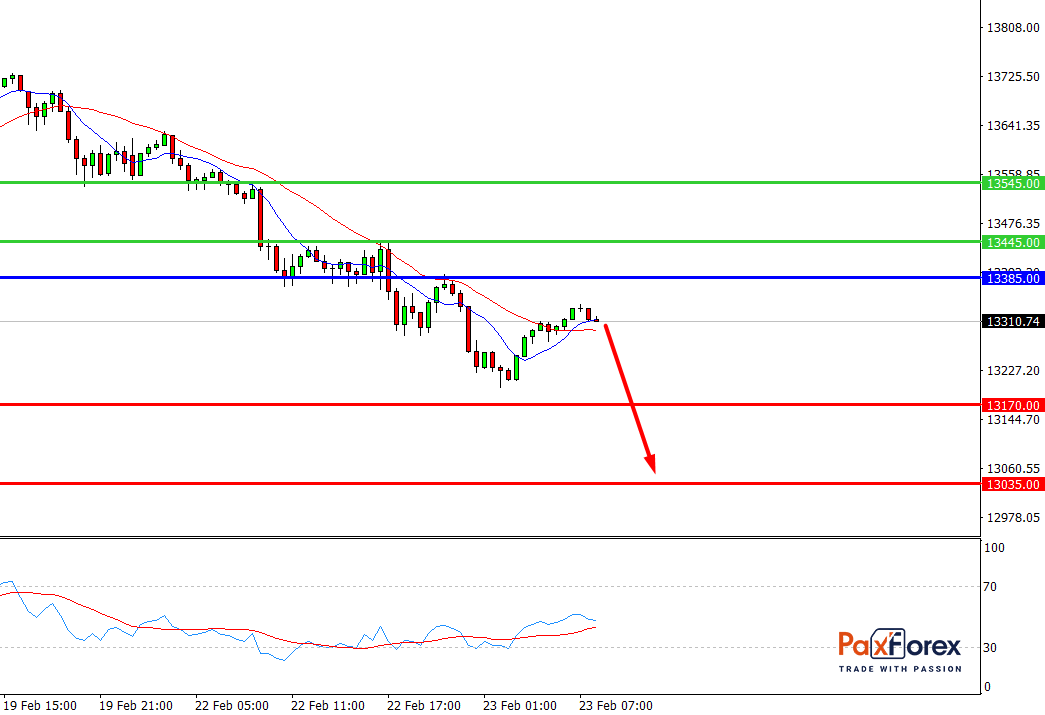

Nasdaq 100, H4

Pivot: 13233.00

Analysis:

Provided that the index is traded below 13385.00 follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 13233.00

- Take Profit 1: 13170.00

- Take Profit 2: 13035.00

Alternative scenario:

In case of breakout of the level 113385.00, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 13385.00

- Take Profit 1: 13445.00

- Take Profit 2: 13545.00

Comment:

RSI indicates a downtrend during the day.

Key levels:

| Resistance | Support |

| 13545.00 | 13170.00 |

| 13445.00 | 13035.00 |

| 13385.00 | 12850.00 |

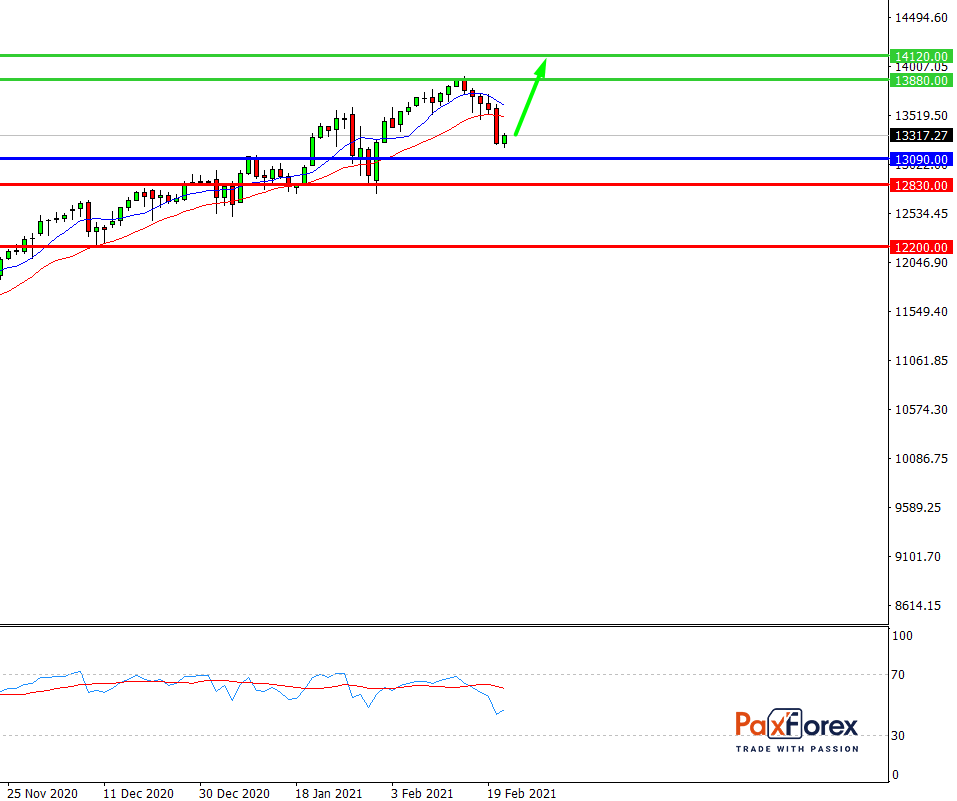

Nasdaq 100, D1

Pivot: 13305.00

Analysis:

While the price is above 13090.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 13305.00

- Take Profit 1: 13880.00

- Take Profit 2: 14120.00

Alternative scenario:

If the level 13090.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 13090.00

- Take Profit 1: 12830.00

- Take Profit 2: 12200.00

Comment:

RSI is bullish and indicates further increase.

Key levels:

| Resistance | Support |

| 14650.00 | 13090.00 |

| 14120.00 | 12830.00 |

| 13880.00 | 12200.00 |