Source: PaxForex Premium Analytics Portal, Technical Insight

Gold prices dropped sharply on Friday amid the strengthening dollar, but the past week was the best of the last five for the precious metal due to expectations of massive fiscal stimulus in the U.S. Gold spot fell 1.27% to $1,846.2 a troy ounce. Nevertheless, gold has gained more than 1% since the beginning of the week. The problem for gold is that it seems to be getting good support at about $1,800, but there is a sense that the dollar has retreated from the lows.

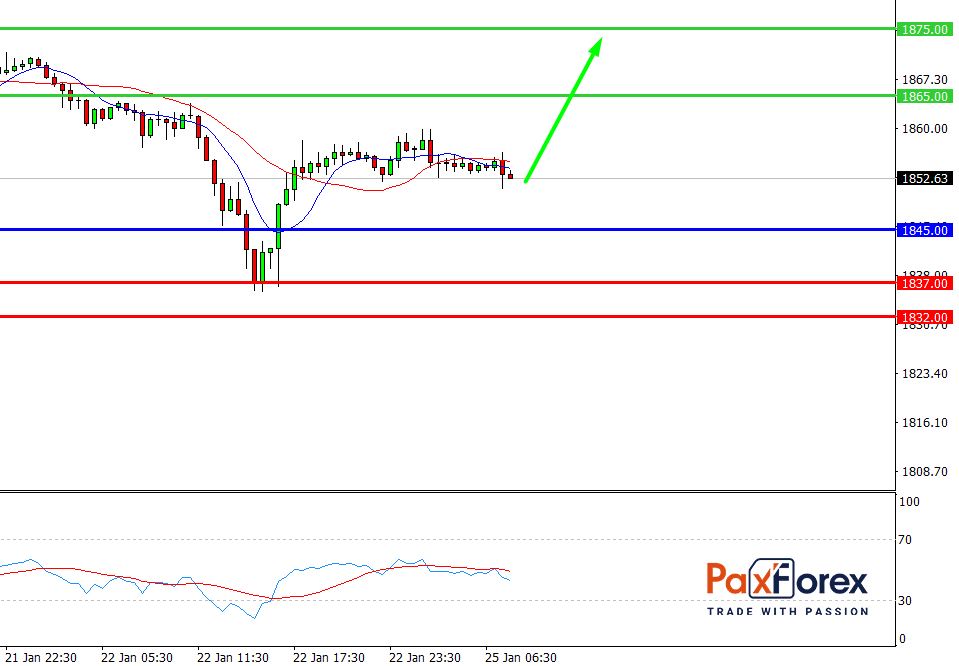

GOLD/USD, 30 min

Pivot: 1852.00

Analysis:

Provided that the price is above 1845.00, follow these recommendations:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 1852.00

- Take Profit 1: 1865.00

- Take Profit 2: 1875.00

Alternative scenario:

In case of breakdown of the level 1845.00, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 1845.00

- Take Profit 1: 1837.00

- Take Profit 2: 1832.00

Comment:

RSI shows an uptrend within a day.

Key levels:

| Resistance | Support |

| 1885.00 | 1845.00 |

| 1875.00 | 1837.00 |

| 1865.00 | 1832.00 |

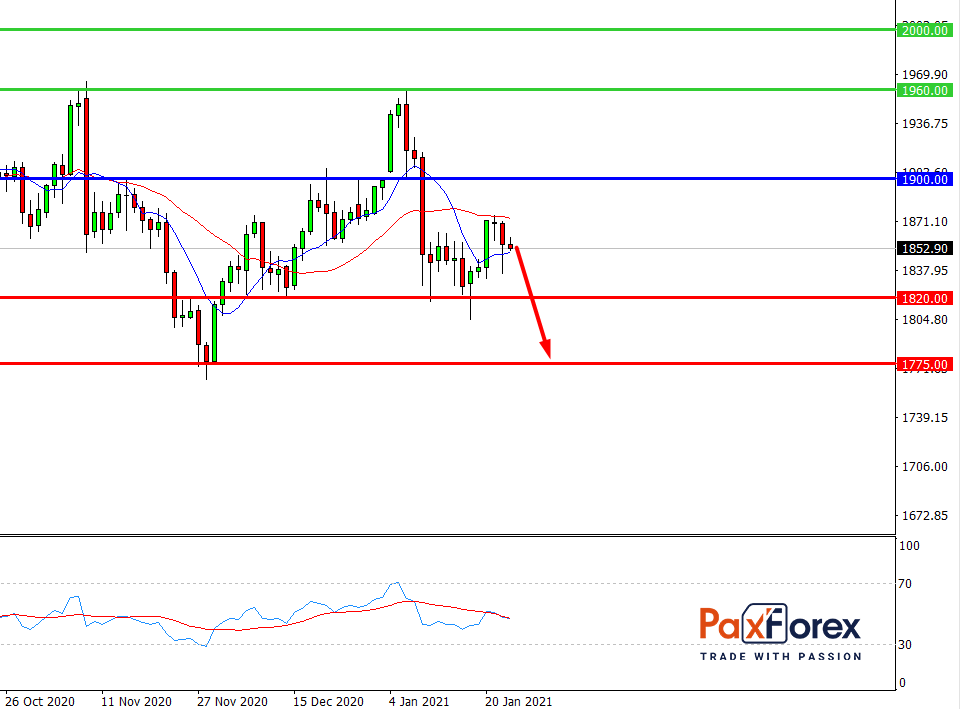

GOLD/USD, D1

Pivot: 1854.00

Analysis:

Provided that the price is below 1900.00, follow these recommendations:

- Time frame: D1

- Recommendation: short position

- Entry point: 1854.00

- Take Profit 1: 1820.00

- Take Profit 2: 1775.00

Alternative scenario:

In case of breakout of the level 1900.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 1900.00

- Take Profit 1: 1960.00

- Take Profit 2: 2000.00

Comment:

RSI shows a downtrend in the medium term.

Key levels:

| Resistance | Support |

| 2000.00 | 1820.00 |

| 1960.00 | 1775.00 |

| 1900.00 | 1720.00 |