Source: PaxForex Premium Analytics Portal, Technical Insight

Bank of England, Tenreyro: we are still discussing the appropriateness of negative rates:

Additional stimulus may be needed;

In that case, it will be important to have negative rates in the toolkit;

There is no clear evidence that negative rates will reduce bank profitability;

All other things being equal, loose monetary policy can help the economy recover faster;

Experiences in other countries point to the effectiveness of negative rates;

A new wave of disease could lead to significant job losses;

If vaccination in Britain goes quickly, slower vaccination of trading partners could adversely affect the economy;

QE does more to prevent a downturn than to stimulate growth.

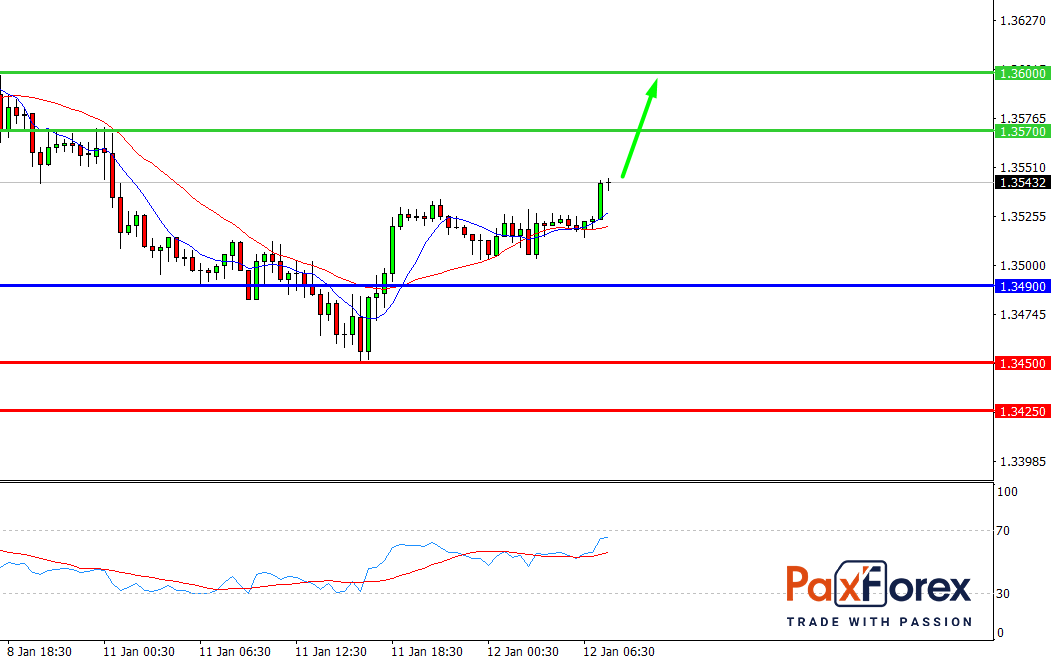

GBP/USD, 30 min

Pivot: 1.3542

Analysis:

Provided that the currency pair is traded above 1.3490, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 1.3542

- Take Profit 1: 1.3570

- Take Profit 2: 1.3600

Alternative scenario:

In case of breakdown of the level 1.3490, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 1.3490

- Take Profit 1: 1.3450

- Take Profit 2: 1.3425

Comment:

RSI shows ascending momentum during the day.

Key levels:

| Resistance | Support |

| 1.3635 | 1.3490 |

| 1.3600 | 1.3450 |

| 1.3570 | 1.3425 |

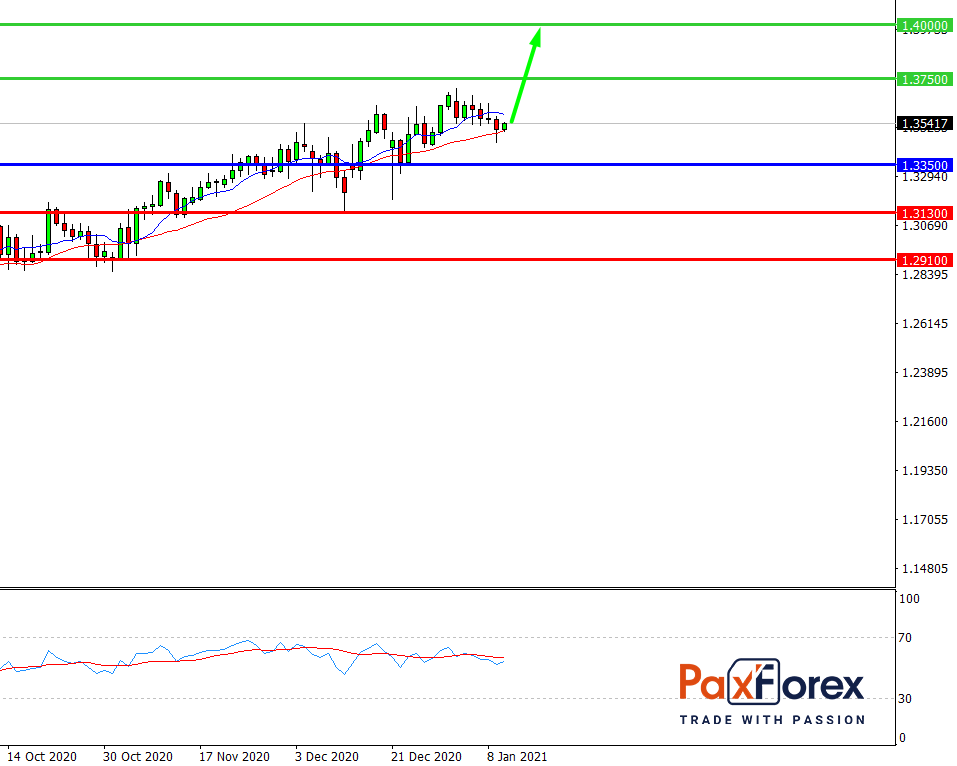

GBP/USD, D1

Pivot: 1.3536

Analysis:

While the price is above 1.3350, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 1.3536

- Take Profit 1: 1.3750

- Take Profit 2: 1.4000

Alternative scenario:

If the level 1.3350 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 1.3350

- Take Profit 1: 1.3130

- Take Profit 2: 1.2910

Comment:

RSI indicates that an uptrend continues in the medium term.

Key levels:

| Resistance | Support |

| 1.4280 | 1.3350 |

| 1.4000 | 1.3130 |

| 1.3750 | 1.2910 |

We also advise you to pay attention to the following currency pairs for intraday trading:

EUR/USD – sell below 1.2175 with 1.2100 and 1.2080 targets as Take Profit. Alternative scenario - if the level 1.2175 is broken-out, buy with the TP 1.2195 and 1.2225.

USD/CAD - short positions below 1.2795 with 1.2710 and 1.2680 targets as Take Profit. Alternative scenario - if the level of 1.2795 is broken-out, buy with the targets 1.2835 and 1.2860 as Take Profit.

NZD/USD – buy above 0.7141 with 0.7199 and 0.7210 as Take Profit targets. Alternative scenario - if the level of 0.7141 is broken-down, you should consider selling with the targets 0.7121 and 0.7110 as Take Profit.