Source: PaxForex Premium Analytics Portal, Technical Insight

Clarida's comments are reported by Reuters:

- Rollback will depend on data;

- The unwinding of the restrictions puts upward pressure on inflation;

- The Fed needs to recognize that there is risk in both rising and falling inflation;

- Current data is consistent with subdued inflation expectations;

- Gives great weight to inflation expectations;

- Important to consider wage and productivity growth along with employment and the share of the active population;

- Does not believe cryptocurrencies can replace the money.

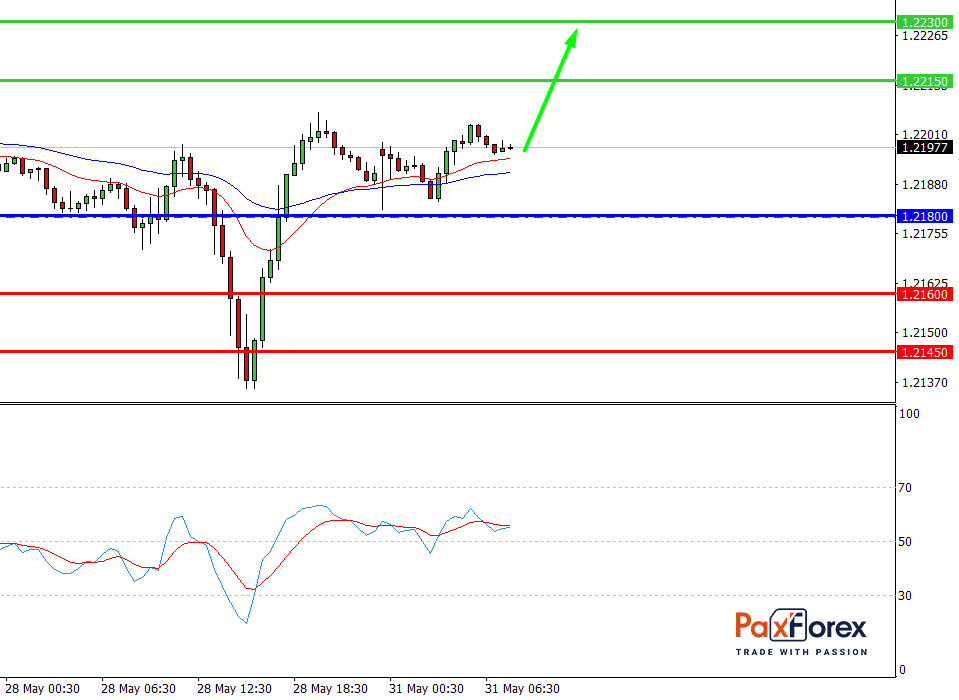

EUR/USD, 30 min

Pivot: 1.2196

Analysis:

Provided that the currency pair is traded above 1.2180, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 1.2196

- Take Profit 1: 1.2215

- Take Profit 2: 1.2230

Alternative scenario:

In case of breakdown of the level 1.2180, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 1.2180

- Take Profit 1: 1.2160

- Take Profit 2: 1.2140

Comment:

RSI is bearish and indicates an uptrend within a day.

Key levels:

| Resistance | Support |

| 1.2260 | 1.2180 |

| 1.2230 | 1.2160 |

| 1.2215 | 1.2145 |

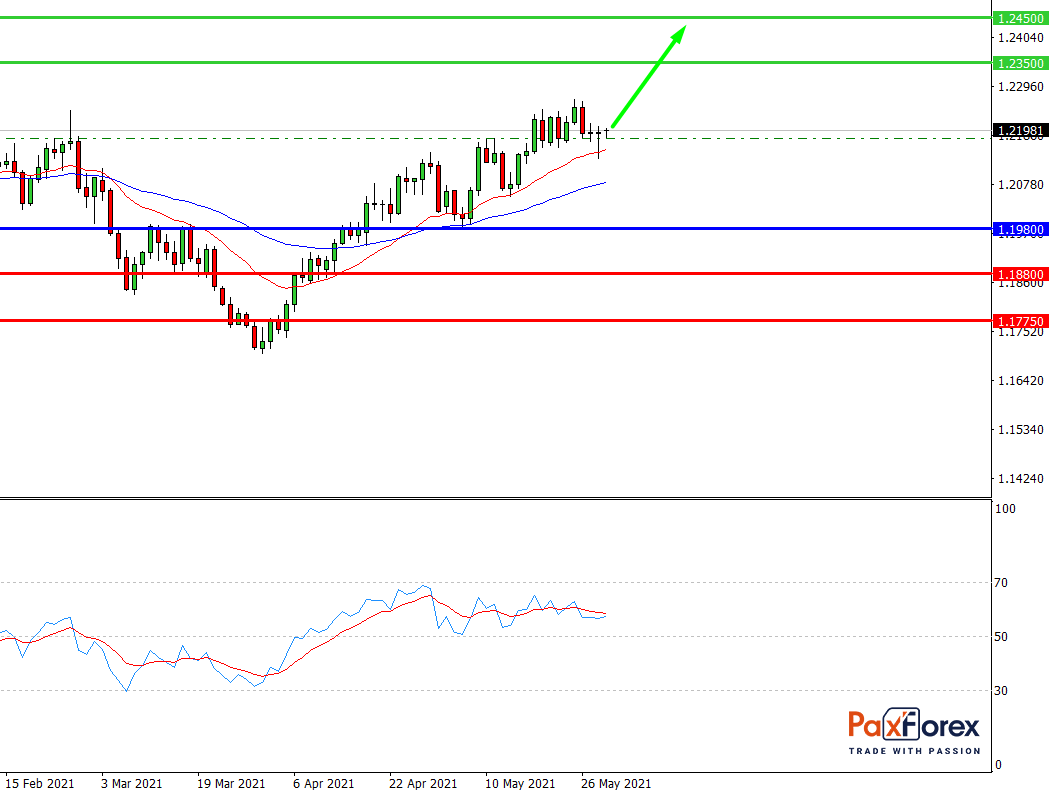

EUR/USD, D1

Pivot: 1.2197

Analysis:

While the price is above 1.1980, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 1.2197

- Take Profit 1: 1.2350

- Take Profit 2: 1.2450

Alternative scenario:

If the level 1.1980 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 1.1980

- Take Profit 1: 1.1880

- Take Profit 2: 1.1775

Comment:

RSI shows the development of an uptrend in a medium term.

Key levels:

| Resistance | Support |

| 1.2555 | 1.1980 |

| 1.2450 | 1.1880 |

| 1.2350 | 1.1775 |

We also advise you to pay attention to the following currency pairs for intraday trading:

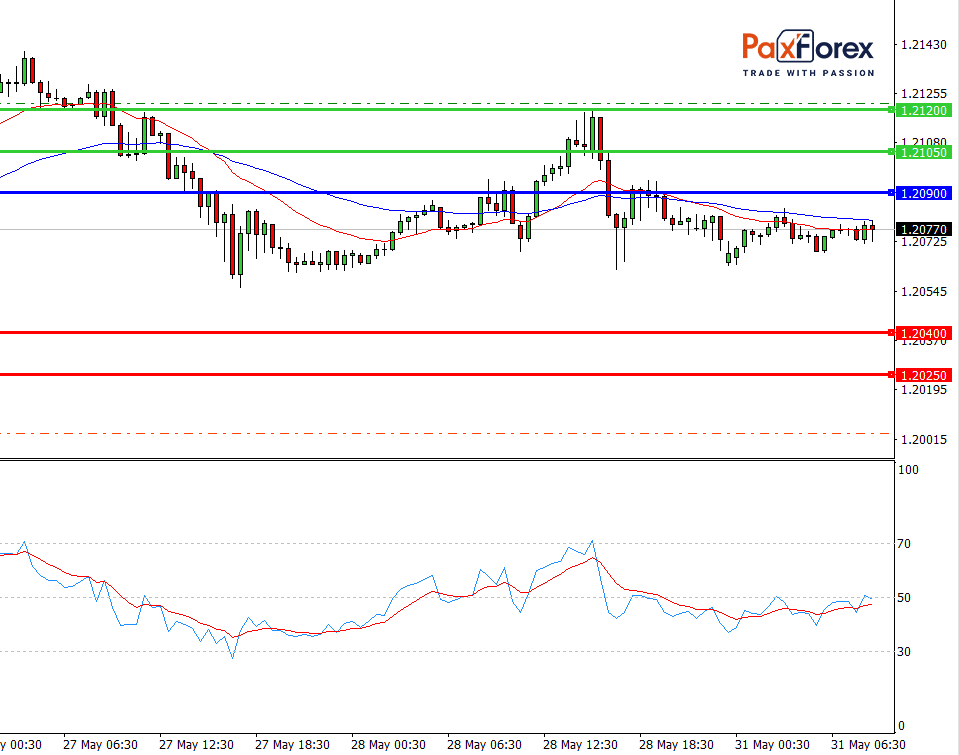

USD/CAD

The U.S. labor market data released the other day showed a bigger-than-expected drop in the number of jobless claims in the country. Last week the number of new jobless claims fell by 39,000 to 406,000, the lowest since the COVID-19 pandemic began. Meanwhile, the Commerce Department's estimate of first-quarter U.S. GDP growth was left at a 6.4% annualized rate.

Analysis:

Sell below 1.2090 with 1.2040 and 1.2025 targets as Take Profit. Alternative scenario - if the level of 1.2090 is broken-out, buy with the targets 1.2105 and 1.2120 as Take Profit.

| Resistance | Support |

| 1.2120 | 1.2050 |

| 1.2105 | 1.2040 |

| 1.2090 | 1.2025 |

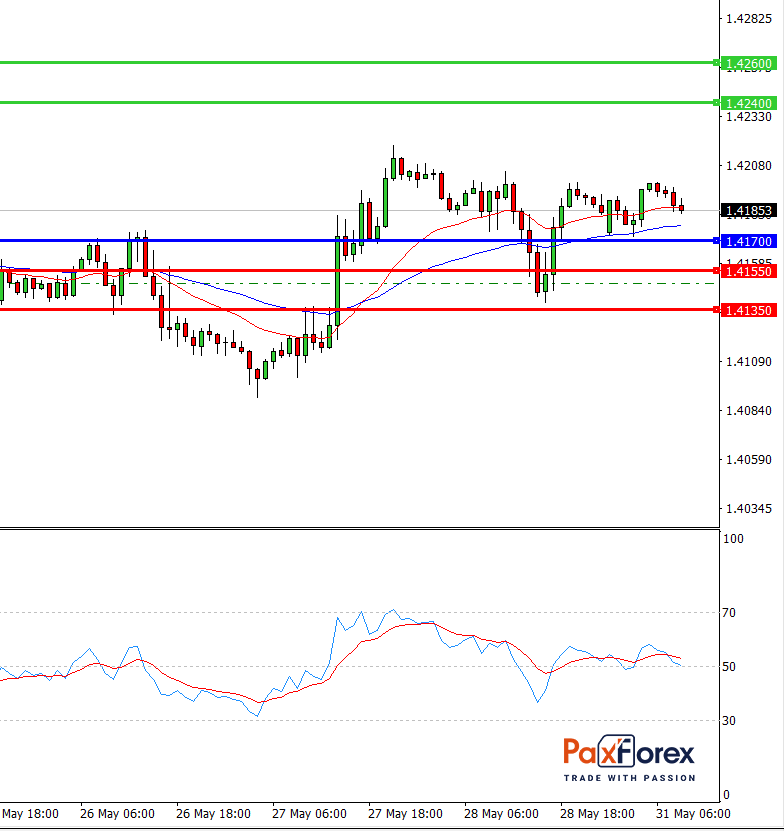

GBP/USD

The pound sterling is holding near a three-month high against the dollar on Friday amid growing expectations of a sooner-than-expected rate hike by the Bank of England.

Analysis:

Long positions above 1.4170 with 1.4240 and 1.4260 targets as Take Profit. Alternative scenario - if the level 1.4170 is broken-down, sell with the TP 1.4155 and 1.4135.

| Resistance | Support |

| 1.4260 | 1.4170 |

| 1.4240 | 1.4155 |

| 1.4220 | 1.4135 |

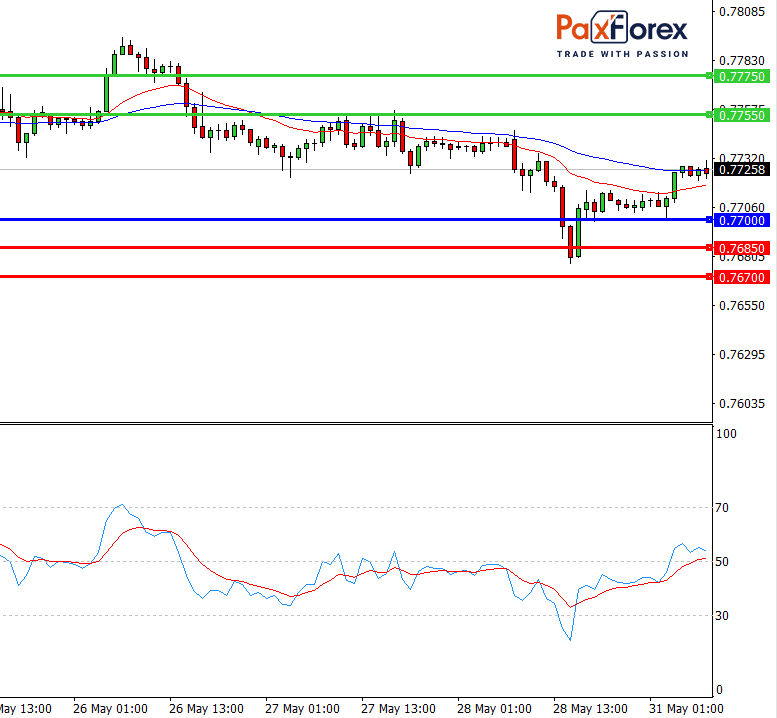

AUD/USD

The US dollar rose in early European trade on Friday, helped by rising U.S. bond yields ahead of the publication of key U.S. inflation data.

Analysis:

Buy above 0.7700 with 0.7755 and 0.7775 targets as Take Profit. Alternative scenario - if the level 0.7700 is broken-down, sell with the TP 0.7685 and 0.7670.

| Resistance | Support |

| 0.7775 | 0.7700 |

| 0.7755 | 0.7685 |

| 0.7735 | 0.7670 |