Source: PaxForex Premium Analytics Portal, Technical Insight

In Tuesday's trading session U.S. stock indices did not demonstrate the same dynamics: Dow Jones Industrial Average and S&P 500 indices fell after reaching the all-time highs the day before, while Nasdaq gained slightly. The U.S. Federal Reserve began a two-day meeting on Tuesday. Traders expect the regulator to provide interest rate and inflation forecasts, CNBC notes. Particular attention is attached to Fed Chairman Jerome Powell's press conference on Wednesday. The Dow Jones Industrial Average index was down 127.51 points (0.39%) at 32825.95.

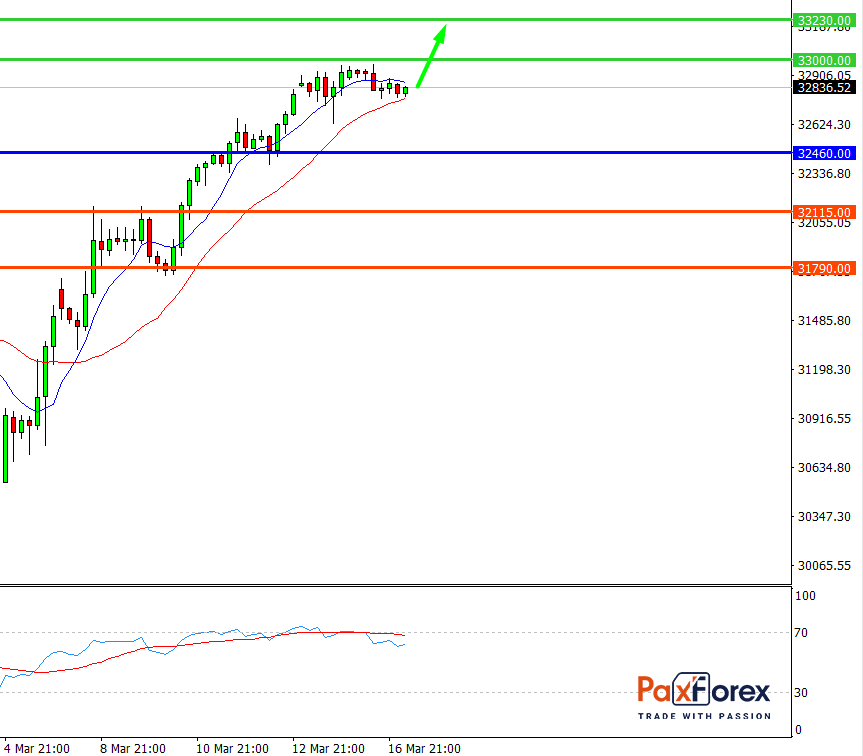

Dow Jones 30, H4

Pivot: 32824.00

Analysis:

Provided that the index is traded above 32460.00, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 32824.00

- Take Profit 1: 33000.00

- Take Profit 2: 33230.00

Alternative scenario:

In case of breakdown of the level 32460.00, follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 32460.00

- Take Profit 1: 32115.00

- Take Profit 2: 31790.00

Comment:

RSI indicates an uptrend during the day.

Key levels:

| Resistance | Support |

| 33700.00 | 32460.00 |

| 33230.00 | 32115.00 |

| 33000.00 | 31790.00 |

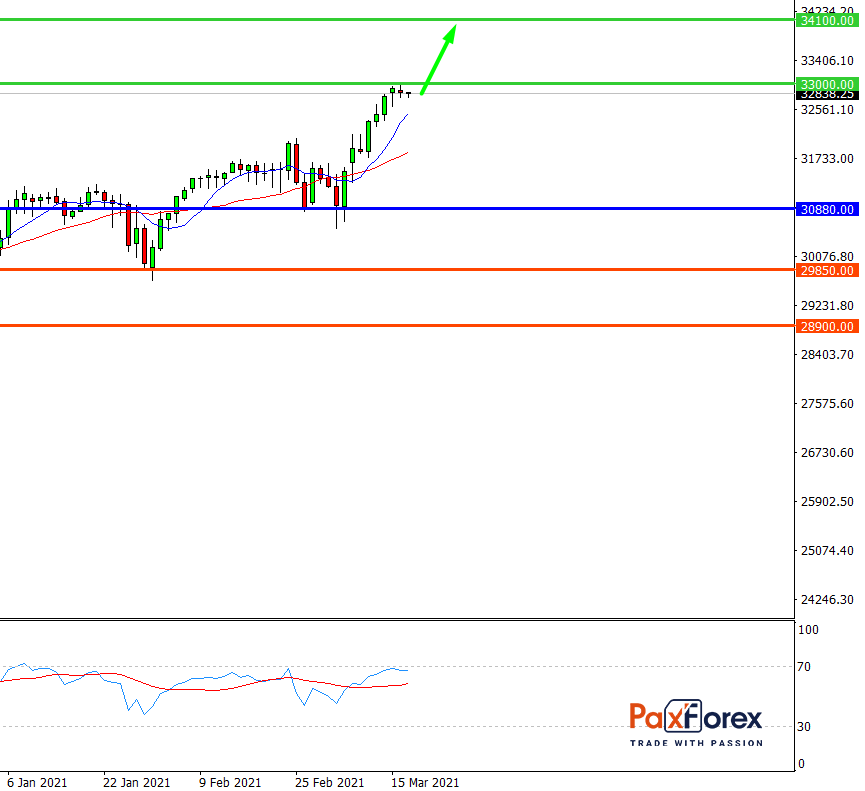

Dow Jones 30, D1

Pivot: 32826.00

Analysis:

While the price is above 30880.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 32826.00

- Take Profit 1: 33000.00

- Take Profit 2: 34100.00

Alternative scenario:

If the level 30880.00 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 30880.00

- Take Profit 1: 29850.00

- Take Profit 2: 28900.00

Comment:

RSI is bullish and indicates a mid-term uptrend.

Key levels:

| Resistance | Support |

| 34500.00 | 30880.00 |

| 34100.00 | 29850.00 |

| 33000.00 | 28900.00 |