Source: PaxForex Premium Analytics Portal, Technical Insight

The U.S. stock market closed yesterday on the upside amid growing shares of technology companies. Investors continue to monitor the situation on the US government bond market. The yield on ten-year US Treasuries on Monday fell to 1.682% compared with 1.729% on Friday. That gave support to tech company securities, which have been winning in the COVID-19 pandemic but have been under pressure in recent days due to rising government bond yields. The Dow Jones Industrial Average index was up 103.23 points (0.32%) at 32731.2 by market close after declining for two straight sessions.

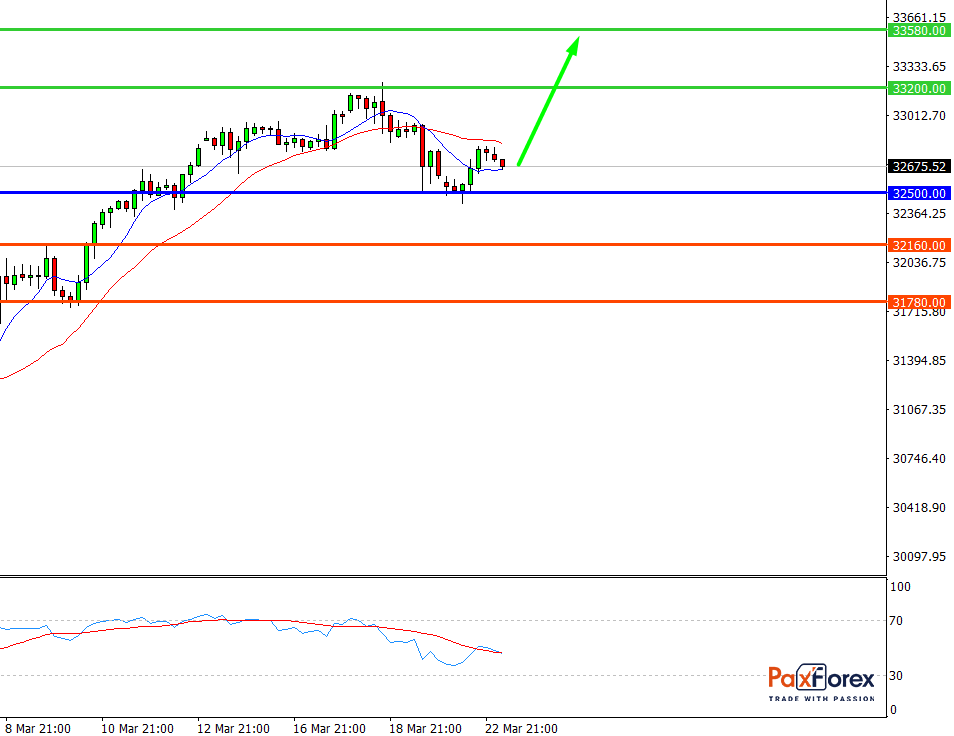

Dow Jones 30, H4

Pivot: 32746.00

Analysis:

Provided that the index is traded above 32500.00 , follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 32746.00

- Take Profit 1: 33200.00

- Take Profit 2: 33580.00

Alternative scenario:

In case of breakdown of the level 32500.00 , follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 32500.00

- Take Profit 1: 32160.00

- Take Profit 2: 31780.00

Comment:

RSI indicates an uptrend during the day.

Key levels:

| Resistance | Support |

| 34000.00 | 32500.00 |

| 33580.00 | 32160.00 |

| 33200.00 | 31780.00 |

Dow Jones 30, D1

Pivot: 32755.00

Analysis:

While the price is above 32000.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 32755.00

- Take Profit 1: 34100.00

- Take Profit 2: 34750.00

Alternative scenario:

If the level 32000.00 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 32000.00

- Take Profit 1: 30880.00

- Take Profit 2: 29850.00

Comment:

RSI is bullish and indicates a mid-term uptrend.

Key levels:

| Resistance | Support |

| 37125.00 | 32000.00 |

| 34750.00 | 30880.00 |

| 34100.00 | 29850.00 |