Source: PaxForex Premium Analytics Portal, Technical Insight

The dollar dropped to a three-week low on Tuesday, sterling hit a near three-year high, and commodity currencies rose as progress on vaccinations and investors' hopes for a global economic recovery. The dollar index to a basket of major currencies was down 0.2% to 90.299. The euro rose 0.08% to $1.2137. Investors are weighing whether the U.S. will be the sole leader of the recovery, which will support the dollar, or whether it will be broader - and that will be negative for the dollar.

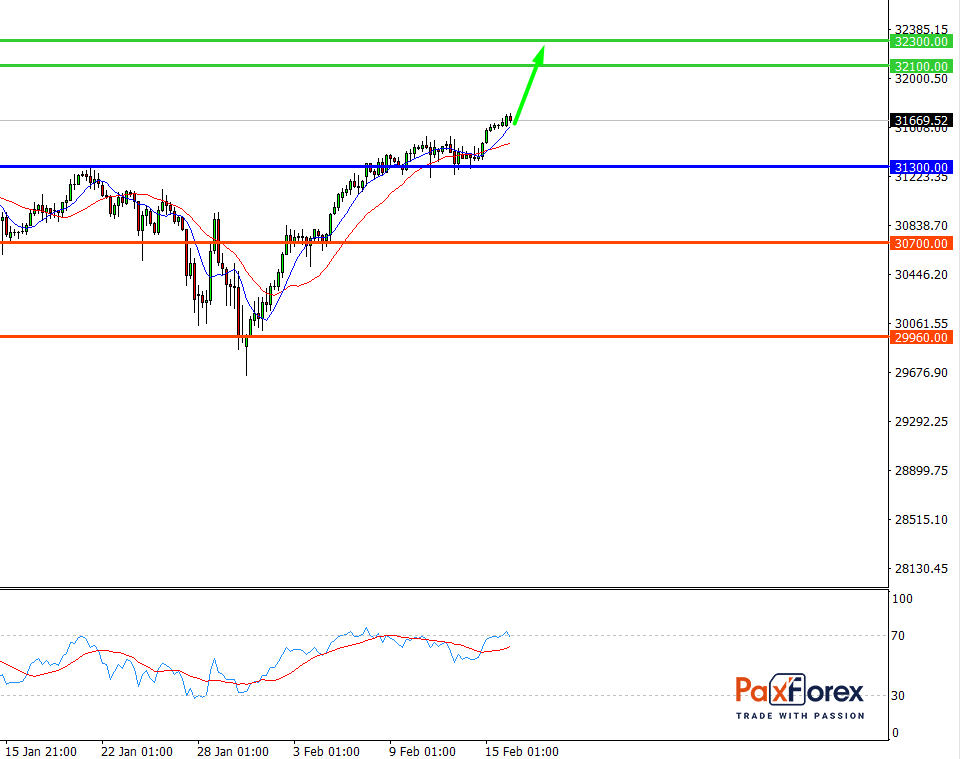

Dow Jones 30, H4

Pivot: 31671.00

Analysis:

Provided that the index is traded above 31300.00, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 31671.00

- Take Profit 1: 32100.00

- Take Profit 2: 32300.00

Alternative scenario:

In case of breakdown of the level 31300.00, follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 31300.00

- Take Profit 1: 30700.00

- Take Profit 2: 29960.00

Comment:

RSI indicates an uptrend during the day.

Key levels:

| Resistance | Support |

| 32500.00 | 31300.00 |

| 32300.00 | 30700.00 |

| 32100.00 | 29960.00 |

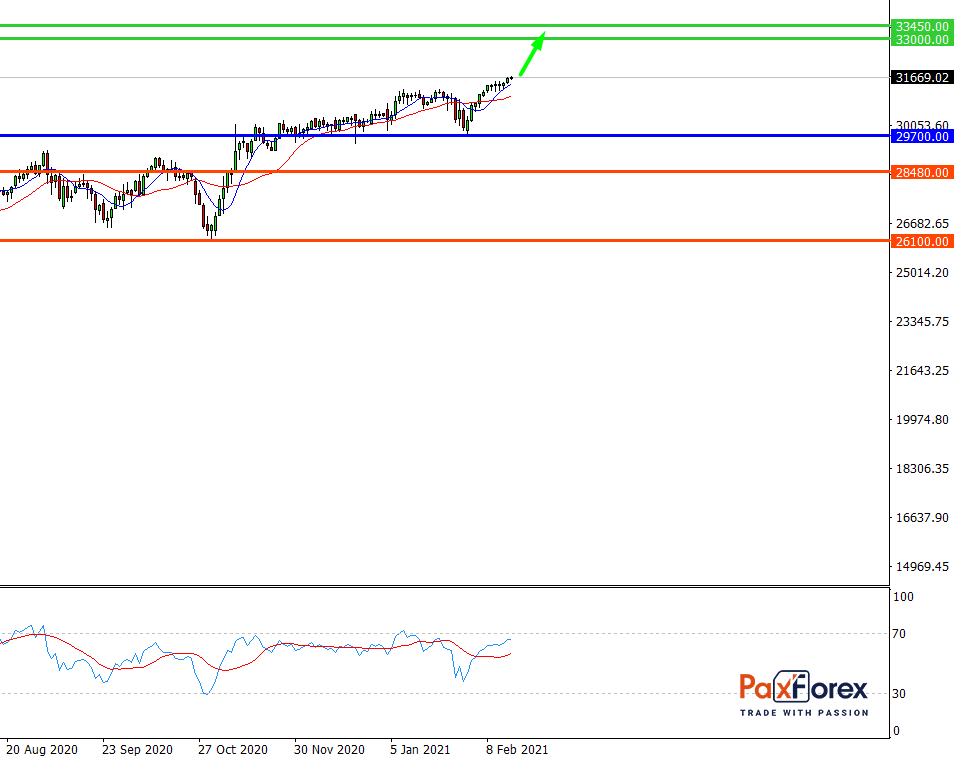

Dow Jones 30, D1

Pivot: 31670.00

Analysis:

While the price is above 29700.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 31670.00

- Take Profit 1: 33000.00

- Take Profit 2: 33450.00

Alternative scenario:

If the level 29700.00 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 29700.00

- Take Profit 1: 28480.00

- Take Profit 2: 26100.00

Comment:

RSI is bullish and indicates a mid-term uptrend.

Key levels:

| Resistance | Support |

| 34000.00 | 29700.00 |

| 33450.00 | 28480.00 |

| 33000.00 | 26100.00 |