Source: PaxForex Premium Analytics Portal, Technical Insight

In yesterday's trading, the U.S. stock indices fell amid rising U.S. Treasury bond yields. The yield on ten-year US Treasuries rose to 1.49%, CNBC said. Rising government bond yields are raising concerns about stock prices and accelerating inflation. High yields could particularly affect stocks of technology companies that rely more on borrowing. The Dow Jones Industrial Average index was down 121.43 points (0.39%) at 31270.09.

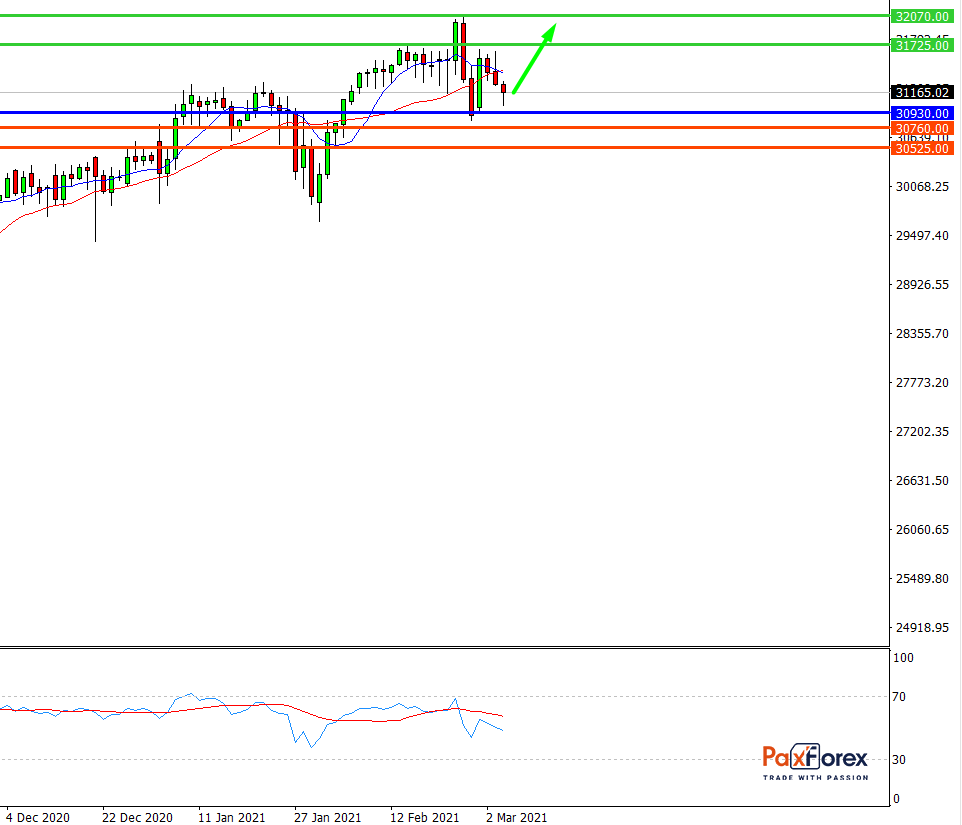

Dow Jones 30, H4

Pivot: 31170.00

Analysis:

Provided that the index is traded above 30930.00, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 31170.00

- Take Profit 1: 31725.00

- Take Profit 2: 32070.00

Alternative scenario:

In case of breakdown of the level 30930.00, follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 30930.00

- Take Profit 1: 30760.00

- Take Profit 2: 30525.00

Comment:

RSI indicates an uptrend during the day.

Key levels:

| Resistance | Support |

| 32300.00 | 30930.00 |

| 32070.00 | 30760.00 |

| 31725.00 | 30525.00 |

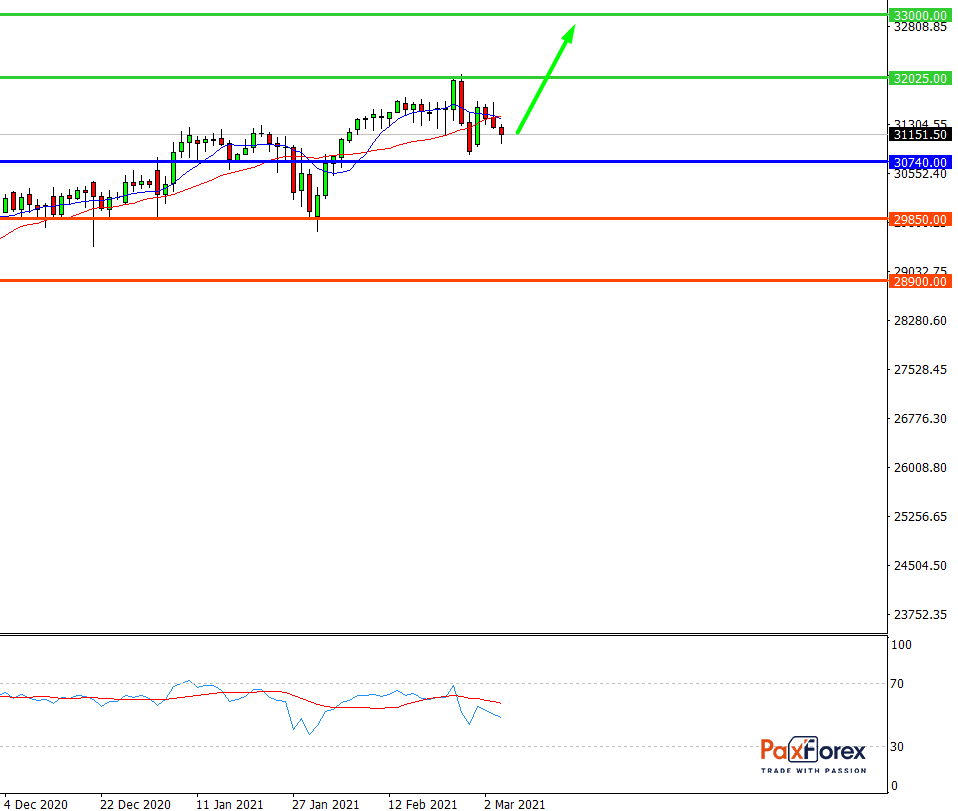

Dow Jones 30, D1

Pivot: 31078.00

Analysis:

While the price is above 30740.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 31078.00

- Take Profit 1: 32205.00

- Take Profit 2: 33000.00

Alternative scenario:

If the level 30740.00 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 30740.00

- Take Profit 1: 29850.00

- Take Profit 2: 28900.00

Comment:

RSI is bullish and indicates a mid-term uptrend.

Key levels:

| Resistance | Support |

| 33450.00 | 30740.00 |

| 33000.00 | 29850.00 |

| 32205.00 | 28900.00 |