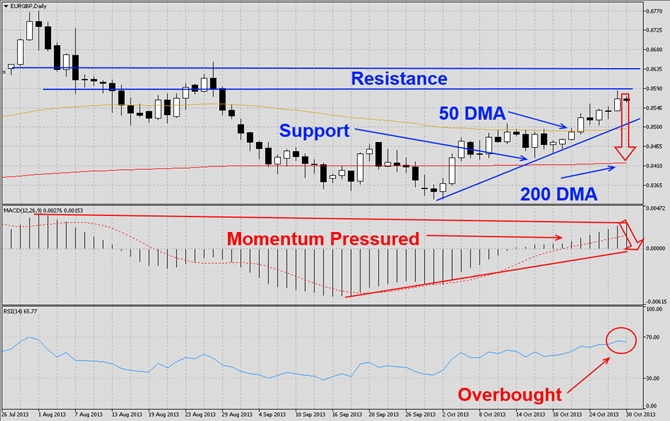

The EURGBP has rallied sharply from its recent low as visible in this D1 chart. This currency pair has now approached its horizontal resistance zone and we expect a reversal which should take it back down to its ascending support line. A breakdown should open the way lower and back down to its 200 DMA.

MACD indicates that momentum is trapped inside a narrow triangle and the histogram trades above its moving average. We expect this to reverse and witness a bearish centerline crossover. RSI is trading in overbought territory and a breakdown should fuel the correction.

We recommend a short position at 0.8575 which would be an addition to our previous short position which we took on January 14th at 0.8300. We currently do not recommend a stop buy order and will remain in this trade without a hedge.

Traders who wish to exit this currency pair at a loss are advised to place their stop loss order at 0.8700. We will not use a stop loss order and execute this trade as recommended. Place your take profit target at 0.8400.

Here are the reasons why we call the EURGBP currency pair lower

- The EURGBP has rallied sharply from its recent low and is now trading at its horizontal resistance zone

- MACD indicates that momentum is trapped and we expect a breakdown to occur and the histogram to trade below its moving average with s subsequent bearish centerline crossover

- RSI is trading in overbought territory and a breakdown should further fuel the correction

- Profit taking after a strong rally in order to realize trading profit

- New short positions by institutional swing traders

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.