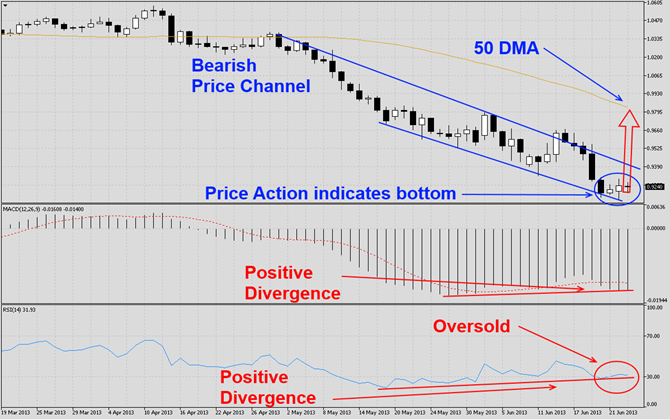

The AUDUSD has been correcting for several weeks as visible in this D1 chart and broke parity which has caused this currency pair to be one of the biggest decliners in the second-quarter. This currency pair has formed a bearish price channel which is a bearish chart formation. The bearish price channel has been very narrow and makes it vulnerable to break-outs. Price action has indicated that this currency pair currently attempts to form a bottom which is supported by the formation of the last three daily candlesticks. We expect a breakout to take place and a retest of its descending 50 DMA.

MACD has confirmed the bearish chart formation, but bearish momentum began to fade and MACD has formed a positive divergence which suggests a directional change. RSI is trading in oversold territory after it broke out from extreme conditions and additionally has formed a positive divergence as well.

We recommend a long position at 0.9230 with no additional entry levels and a stop sell order at 0.9150. This trade is an add-on trade to our two previous long positions we took on May 14th and May 28th at 0.9930 and 0.9630 respectively.

Traders who wish to exit this trade at a loss are advised to place their stop loss order at 0.9150. We will not use a stop loss order and execute this trade as recommended. Place your take profit level at 0.9630.

Here are the reasons why we call the AUDUSD currency pair higher

- AUDUSD is trading at descending support level of current bearish chart formation

- Price action indicates this pair attempts to form a bottom which is supported by the last three daily candlestick formations

- MACD has formed a positive divergence which suggests a directional change as bearish momentum is fading RSI is trading in oversold territory after breaking out from extreme conditions and has formed a negative divergence as well

- Short covering rally before the end of Q2 and H1 in order to lock in profits

- New institutional long positions at strong support levels

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.