As every other job, Forex Trading is characterized by some indicators that absolutely need to be known in order to always be on top of things. There are not many at all and therefore it is fundamental to be very comfortable with them.

Lot is a volume of a transaction and it is possible to identify two typologies of lots:

This information should not scare you since it does not mean you need to trade at least 100,000 USD (or any other currency you want to trade), but you can also trade a fraction of a lot. Additionally, we will see how investing a small amount of money is possible to trade with 500 times more than what is invested.

This information should not scare you since it does not mean you need to trade at least 100,000 USD (or any other currency you want to trade), but you can also trade a fraction of a lot. Additionally, we will see how investing a small amount of money is possible to trade with 500 times more than what is invested.

The base currency is the first currency in the currency pair code. For example in GBPUSD the GBP is the base currency and the USD is the quote currency (the concept of base currency will be talked more about in depth in the next article of this guide).

Most of the forex brokers use retail standards which is 100,000 base currency in one standard lot. Following this definition, if you want to buy 1 lot EURUSD you will trade 100,000 EUR.

Forex Traders agreed on defining a pip as the smallest price change that a given exchange rate can move. The majority of exchange rates are priced to four decimal places and therefore a pip refers to a change of +/- 0.0001.

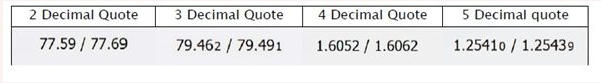

When the price for the GBPUSD changes from 1.5693 to 1.5694 it is means that the price changed 1 pip. In same way, when the price for the USDJPY changes from 79.45 to 79.46 it is also means that the price changed at 1 pip.

The pip always refers to the last number of an exchange rate, independently from the number of decimals (this means a 1 pip change can also happen from 1.23 to 1.24). On the five decimal quote the smallest possible move may be referred to as pipette. One pip is divided into ten pipettes.

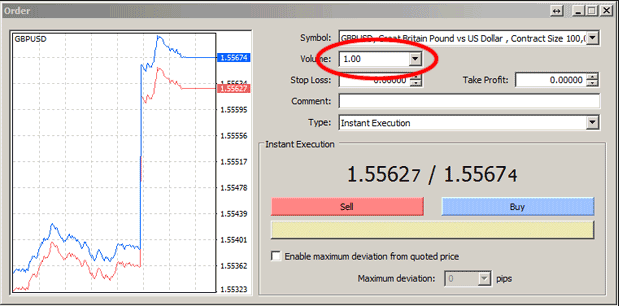

Some brokers offer 5 and 3 decimal prices for the major currency pairs in order to give more flexibility to traders.

In order to determine the cost of a pip you first need to know some important information:

Pip cost = Pip Fluctuation X Volume lot

The formula shows the pip cost on the quote currency. If the quote currency is JPY the cost will be in JPY, if the quote currency CHF or NZD the pip cost is in CHF or NZD accordingly.

Bob wants to know the cost per pip for 1 lot of EURUSD. For a 4 decimal quote: 0.0001 X 100,000 = 10 USD For a 5 decimal quote: 0.00001 X 100,000 = 1 USD

USD is the quote currency.

If Bob has an account in USD everything is clear but if Bob has an account in EUR than he should convert 10 USD in EUR. The current rate of EURUSD is 1.2528 and therefore we just need to use a simple formula:

10 (USD)/ 1.2528 (EURUSD Rate) = 7.98 EUR

This is the simplest example of the calculation. You shouldn’t calculate this all by yourself since you can use our PaxForex Forex Calculator.

Before making any deals Bob should calculate the potential profit and define the potential exit price. The potential exit price is necessary to know in case Bob’s estimations are wrong and he would like to limit losses.

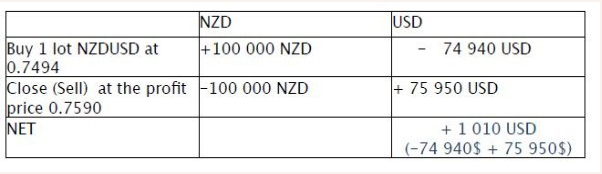

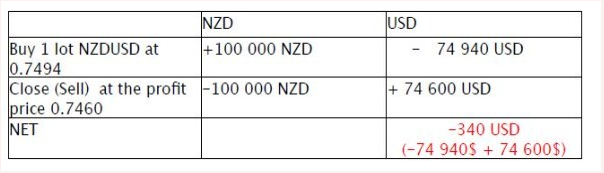

Bob is looking to buy NZDUSD and its current price is 0.7494. The exit point or take profit level is 0.7590 for profits and 0.7460 if the price will go not in the direction desired by him also referred to as the stop loss level. Bob will buy 1 lot of NZDUSD which means he will BUY 100,000 NZD and sell 74 940 USD (we will explain this relation in the following article).

To calculate profits we need to know:

Assume Bob will close his position with a profit:

Assume Bob will close his position with a loss:

In our case Bob will hold his position within one day; if Bob would hold his position for more than one day we should also count swaps (which will be introduced soon in our guide).

Forex Leverage allows you to buy big amounts of money, funds or assets on small amount of invested capital. The assets could be currencies, stocks, metals and other different instruments. On the Forex market it is currencies.

As PaxForex is among high leverage forex brokers, it offers up to 1:500 leverage which means that you can have 2,000$ in your account and operate with 1,000,000$ (=2 000$ X 500). This is 10 lots (1,000,000/100,000) for any currency pair where the USD is the base currency, like USDCHF, USDJPY etc.

In practice it works like this:

You deposit 2,000$ in your PaxForex account and we provide you with 1:500 leverage. You can operate with 1,000,000 USD (2 000$ X 500), which is equal to 10 lots. Now you can buy or sell any currency in equivalent of 1 million USD. For example you bought EURUSD at 1.25 and after one day you sold it at 1.26. Your earning would be 0.01 USD multiplied by 1,000,000, which is $10,000.

After you deposit 2,000$ in your account and we provide you with 1:500 leverage you can trade with 10 lots total volume of your trades. This means that you can open 1 trade with 10 lots, or 2 trades with 5 lots each or 5 trades with 2 lots each etc.

Margin is an amount that guarantees your obligation in front of the broker. The margin shows you how much capital you need to have in your account in order to buy or sell a certain amount of funds. Margin depends on the leverage and deal size (lots).

With leverage of 1: 100 you can buy 1,000,000 USD for 10,000 USD in your account. In technical terms, to buy 10 lots you have to have 10,000USD in your forex trading account with leverage 1:100.

In this case:

The size of the loan is determined by the leverage and the amount of funds in your account. The Lot calculation is very simple. In order to find out how much you can buy for 100USD in your account with Leverage 1:100 you just need to multiply you balance with the leverage.

Account balance X leverage = available amount of funds for trading or lots.

100USD * 100 = 10,000 USD

This means that you can operate with an amount up to 10,000 USD or 0.1 lots.

If you have leverage of 1:500, the calculation would be the following:

100USD * 500 = 50,000USD.

In this case you can operate with an amount up to 50,000 USD or 0.5 lots.

Bob might be interested to find out how much margin he needs to buy or sell a certain amount of funds. For example Bob decided to buy 100,000USD and his leverage is 1:500.The calculation will be following.

100,000USD divided by his leverage:

100,000USD/500=500USD

In order to buy 100,000USD Bob needs to have 500USD in his account.

Another example: He decided to sell 200,000 USD with leverage of 1:100. The calculation will be following:

200,000USD/100=2,000USD

In order to sell 200,000USD Bob needs to have 2,000USD in his account.

The concept of currency swap is similar to the one of an interest rate since the mechanism is similar and consists in borrowing a currency at a given exchange rate. This is done since it gives the opportunity to trade a currency you do not own and therefore swaps represent a great opportunity to give traders maximum flexibility.

Swaps are technically borrowings, but unlike bank loans they are not ordinarily disclosed on the balance sheet. Differently from common interest rates, swaps give you the opportunity to both earn and pay them.

Basically, there is a daily rollover (swap) interest rate that a trade pays or earns, depending on your established margin and position in the market; if you do not want to get involved with any sort of interest rates, just close your positions (trades) before 5 pm EST and you will not earn / pay interests on your positions.

Swap interest rates exist because you are borrowing a currency to buy another and therefore interest rates are going to be involved. For instance, if you are buying a currency with an interest rate that is higher than the one you are borrowing, you are earning because you receive more than what you have to pay back.

This is a very simple concept that it is good to keep in mind when trading big amounts of money since it can be a great source of earnings.