Whether trading stocks, futures, options or forex, traders confront the single most important question: to trade trend or range? And they answer this question by assessing the price environment; doing so accurately greatly enhances a trader's chance of success. Trend or range are two distinct price properties requiring almost diametrically opposed mindsets and money-management techniques. Fortunately, the forex market is uniquely suited to accommodate both styles, providing trend and range traders with...

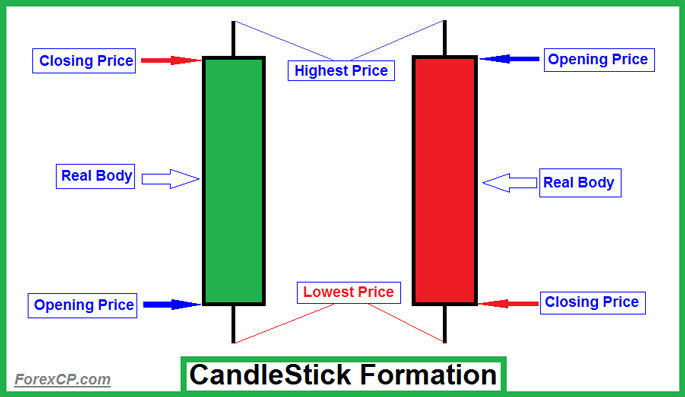

What could possibly be more important to a technical forex trader than their price charts? Your perception of price will ultimately help shape your opinions of trends, determine entries, and more. With this in mind it becomes absolutely critical to understand what you are seeing on your trading monitor. More often than not forex charts are defaulted with candlestick charts which differ greatly from the more traditional bar charts that you may come across in your trading career. Surprisingly after learning to analyze candlesticks, traders often...

If you celebrate Christmas but are also interested in forex trading, or perhaps you are even a professional forex trader who trades currencies for a living, you will probably think about forex trading around Christmas. You might think about whether or not forex trading at Christmas is the right thing to do as a forex trader. A very real trap for the keen forex trader during the Christmas and New Year break, is the lure of spending additional time in front of the screens in the continued quest for trading excellence. In theory, one might...

Markets oscillate continuously between trends and ranges always. Trend-following strategies take advantage of moving markets while swing trading strategies work best in flat markets. Swing trading utilizes a single tranche entry most of the time, going long near range support or short near range resistance. An opportune profit is then grabbed at the other end of the range, or when interim barriers slow or stall momentum. Every so often, activity will slow right down in the forex market and it’s seriously like watching paint dry....

Money management is one of the most important (and least understood) aspects of trading. Many traders, for instance, enter a trade without any kind of exit strategy and are therefore more likely to take premature profits or, worse, run losses. Traders need to understand what exits are available to them and know how to create an exit strategy that will help minimize losses and lock in profits. There are obviously only two ways you can get out of a trade: by taking a loss or by making a gain. During trading discussions traders often talk of...