Markets oscillate continuously between trends and ranges always. Trend-following strategies take advantage of moving markets while swing trading strategies work best in flat markets. Swing trading utilizes a single tranche entry most of the time, going long near range support or short near range resistance. An opportune profit is then grabbed at the other end of the range, or when interim barriers slow or stall momentum.

Every so often, activity will slow right down in the forex market and it’s seriously like watching paint dry. Daily trading ranges shrink down, the charts flatten out, and indecision causes brutal price churning. Trading systems will perform poorly without the volatility to cause price movements. This kind of slow environment will also have a negative impact on the psychological level because nothing is happening. To help pick up the pace, you might feel the need to be more aggressive with your trading, just to get some returns happening.

Many traders make the mistake of trading in all market conditions. The truth is that sometimes it’s better to just not trade. Sometimes the markets are too choppy and erratic to trade with any accuracy or effectiveness. It is these times when traders tend to give back all their recent profits and usually even more. Taking time off from the markets is not a bad thing, especially after a winning trade or when the market is chopping sideways and being ‘erratic’. Many traders end up giving back all the money they made when the markets were trending as they move into periods of chop.

Some days a trader should not trade at all simply because the charts do not set up properly for the strategies. Again, we are going for accuracy and not trading simply because we feel that we must trade all the time. This takes great discipline to sit and do nothing. The goal is to be right when you trade and trading manually as opposed to an automated trading gives you this advantage of sitting on sidelines when the odds are not in your favor.

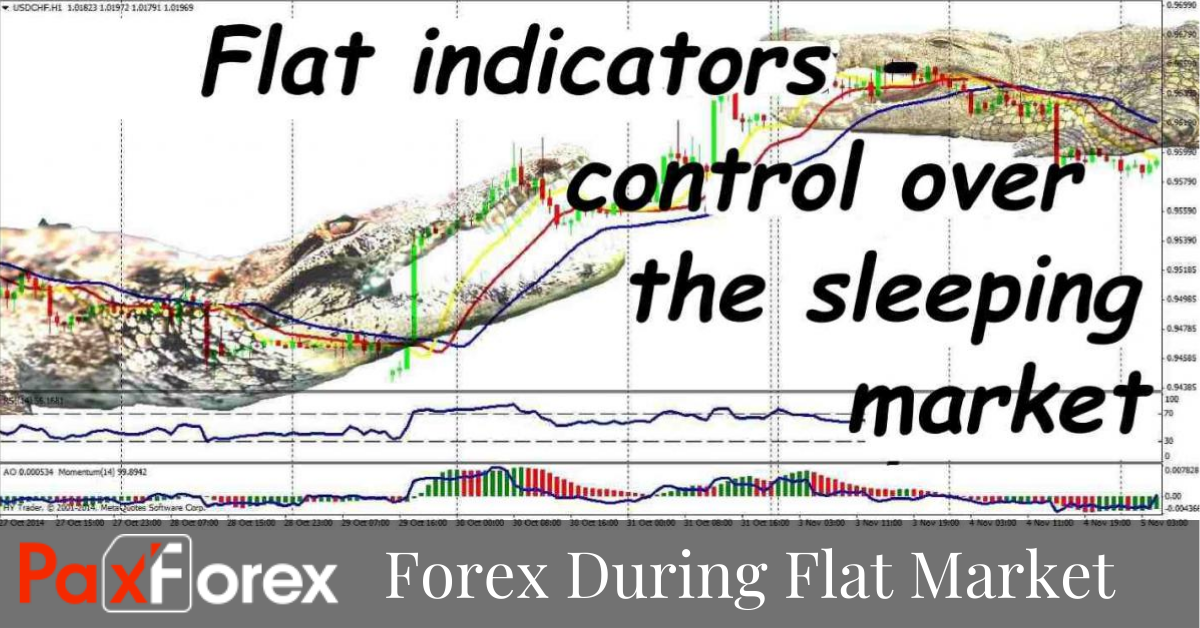

The flat sections must be defined precisely in order to refrain from trading. This will help keep your deposit and nerves. The main problem of the novice or super-active traders is the lack of patience to wait out the dangerous sideways movement and be prepared to work by the trend. Even if you can sometimes earn from the rebound from the channel boundaries, in no case you should build a trading system on this rare luck. With judicious use, the complex flat indicators are a necessary element of any profitable trading strategy.