It is now generally accepted that cycles of all kinds occur in nature and that they also occur in financial markets although with less formality than in the natural world. Markets go through cycles both on higher and lower level time frames. The forex market cycles each year as waves of liquidity and trader interest peak, plateau, fall off, bottom out, track sideways and then rise once more. It can be hard to pick any long-term trend and ride it during such periods. Price ranges through much of this time, interspersed with trade...

Predicting the next move in the markets is the key to making money in trading, but putting this simple concept into action is much harder than it sounds. Currencies are moved by many factors - supply and demand, politics, interest rates, economic growth etc. Since economic growth and exports are directly related to a country's domestic industry, it is natural for some currencies to be heavily correlated with commodity prices. A hidden string ties together currencies and crude oil, with price actions...

For economists currency strength expresses the value of currency and it is often calculated as purchasing power, while for financial traders it can be described as an indicator, reflecting many factors related to the currency like fundamental data, overall economic performance or interest rates. It can also be calculated from currency in relation to other currencies, usually using a pre-defined currency basket. When it comes to trading currencies, the only objective we have is to pair a currency that is losing...

Although there are markets that close every day and therefore have real gaps, forex doesn’t do this. The only time it closes is on Friday and it reopens on Sunday. So the only real gaps which exist in forex are these weekly gaps and that is only if the price changes significantly. Gaps are most common in stock trading because, unlike the forex market, stock markets close each day and any events which occur during the time of closure may result in the price opening higher or lower compared to the most recent close. The forex...

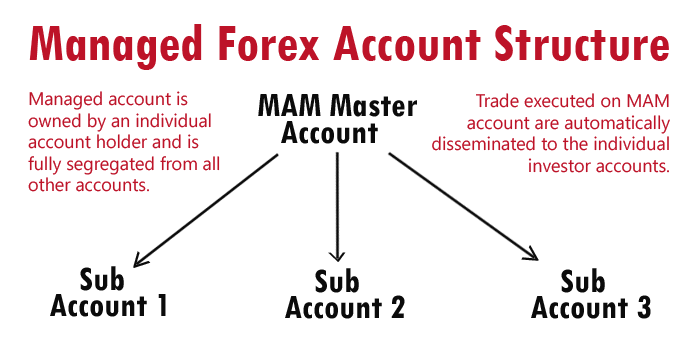

Between understanding technical market fluctuations and determining how politics will affect the currency market to figuring out how to manage leverage and when to enter and exit for maximal profits, the forex markets can be extremely confusing, and there can be just as much potential for loss as there is for gain. For this reason alone, many potential traders prefer to employ the services of an account manager, rather than taking the risk into their own hands. With a good understanding of the market dynamics, the owner of a trading...