The last time the US intervened in the FX market was in 2011 in the aftermath of the earthquake which rattle Japan and send the Japanese Yen soaring. That intervention was part of a coordinated global effort to strengthen the US Dollar. Analysts are now preparing for a potential intervention as US President Trump is openly attacking the monetary policies of the EU and China. Just days after he announced a truce with Chinese President Xi, Trump took to Twitter and accuse the country of currency manipulation. He also lashed out at the EU which is his next tariff target after he slapped 400% tariffs on imports of Vietnamese steel. The EU and Vietnam just signed a free trade deal and Trump acted fast to show his displeasure with the South-East Asian economy and the trade surplus it has with the US.

Trump tweeted “Europe and China are playing a big currency manipulation game.” He has criticized his own Fed Chair pick and the monetary policy he implemented, arguing publicly that the central bank should help him in his trade wars as other central banks help their leadership. Another tweer read “MATCH, or continue being the dummies who sit back and politely watch as other countries continue to play their games.” Trump’s latest two Fed nominations are the latest sign that he seeks to manipulate the central bank to lower interest rates as one favor a return to the gold standard. He has better luck with the US Treasury which can ultimately step into the forex market and manipulate the exchange rate of the US Dollar.

How will this impact FX trading? The US Treasury didn’t label China a currency manipulator in its latest report published in May, but Trump is obsessed with it and insists he is right on the matter. CIBC’s North American Head of FX Strategy, Bipan Rai added “The obsession with currency manipulation a month after the last Treasury report had different conclusions means we should be prepared for anything. The Treasury hasn’t intervened to weaken the US Dollar for decades, but we wouldn’t be surprised if that changes potentially under Trump.” The US Fed is open to the idea to cut interest rates and market participants expect them to do so as soon as this month, but will it be enough for Trump or does he want the US Treasury to step in and further weaken the currency in order to make exports more competitive?

The US Dollar weakened slightly after Trump’s tweets but remains near the strongest reading since 2002 according to a US Federal Reserve trade-weighted measure. The risk of US FX intervention will rise if the Fed doesn’t cut interest rates this month. Open your PaxForex Trading Account now and start your profitable forex career with the help of our expert analysts who stand by to guide you through the forex market.

Global Cross-Asset Investment Specialist Anthony Doyle at Fidelity International added “Generating inflationary pressures, generating competitiveness through a lower currency is one tool that central banks can use to support their economies and it’s the only game in town at the moment.” The ECB has struck a more dovish tone as economic data continues to point towards weakness. The Head of Asia Pacific Fixed Income at State Street Global Advisors, Ng Kheng Siang, in regards to Trump noted “Clearly if he feels that the US interest is not served, in his eyes, he’ll start to poke and even blast at anyone.” Will the US Intervene in the FX Market? It may all depend on if and when the US Fed will decide to cut interest rates, but Trump's patience with his central bank is running thin. He has started several trade wars and is using tarrifs as a negotiating tool, but feels that monetary policiy should also assist his attempts to force new trade deals. Here are three trades which will boost your forex portfolio, regardless of what Trump tweets.

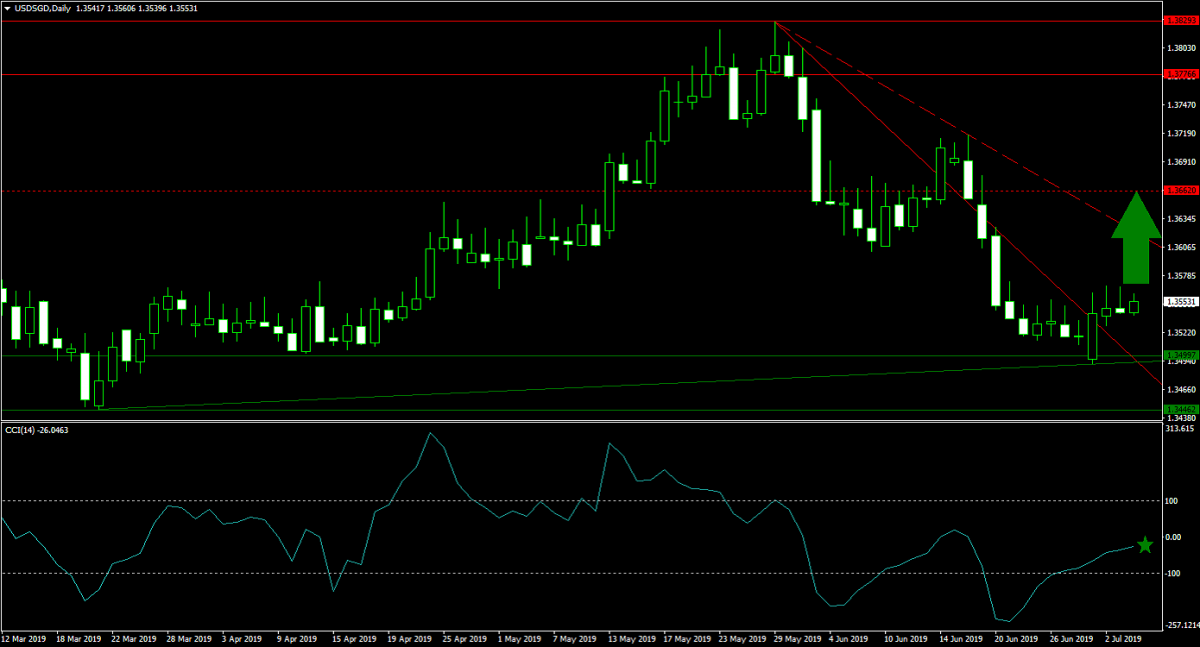

Forex Profit Set-Up #1; Buy USDSGD - D1 Time-Frame

As the US Dollar is slowly coming under pressure from several sources, a corrective phase is the most likely outcome. Die-hard US Dollar bulls can still find attractive upside potential in some currency pairs, such as the USDSGD. Price action has preceded negative news and this currency pair descended into its horizontal support area. Bearish momentum is fading and a reversal ignited by a short-covering rally is the favored outcome which will take price action above it secondary descending resistance level and back into its next horizontal resistance level. Forex traders are advised to buy and dips in the USDSGD down to the lower band of its horizontal support area.

The CCI already completed a breakout above extreme oversold conditions and bullish momentum is likely to extend this trend above the 0mark for a bullish momentum crossover. Download your PaxForex MT4 Trading Platform and start growing your account balance trade-by-trade with the help of our expert analysts!

Forex Profit Set-Up #2; Buy XRPUSD - W1 Time-Frame

Ripple, also known as XRPUSD, is trading at key levels and bullish pressures are mounting for a breakout above its secondary descending resistance level. This would follow the push above its horizontal support area and price action can almost double with limited resistance until this cryptocurrency will challenge its next horizontal resistance level. The downside from current levels is rather limited and the big investments Ripple made in its ecosystem totalling over $500 million will provide a floor under any pull-back. Buying any dips in price action down to the lower band of its horizontal support area remains the favored trading approach.

The CCI corrected after reaching a new high in extreme overbought territory, but remains well above the 0 mark in bullish conditions. A renewed push to the upside is anticipated from this momentum indicator. Follow the PaxForex Daily Fundamental Analysis and earn over 500 pips per month with the guidance of our expert analysts!

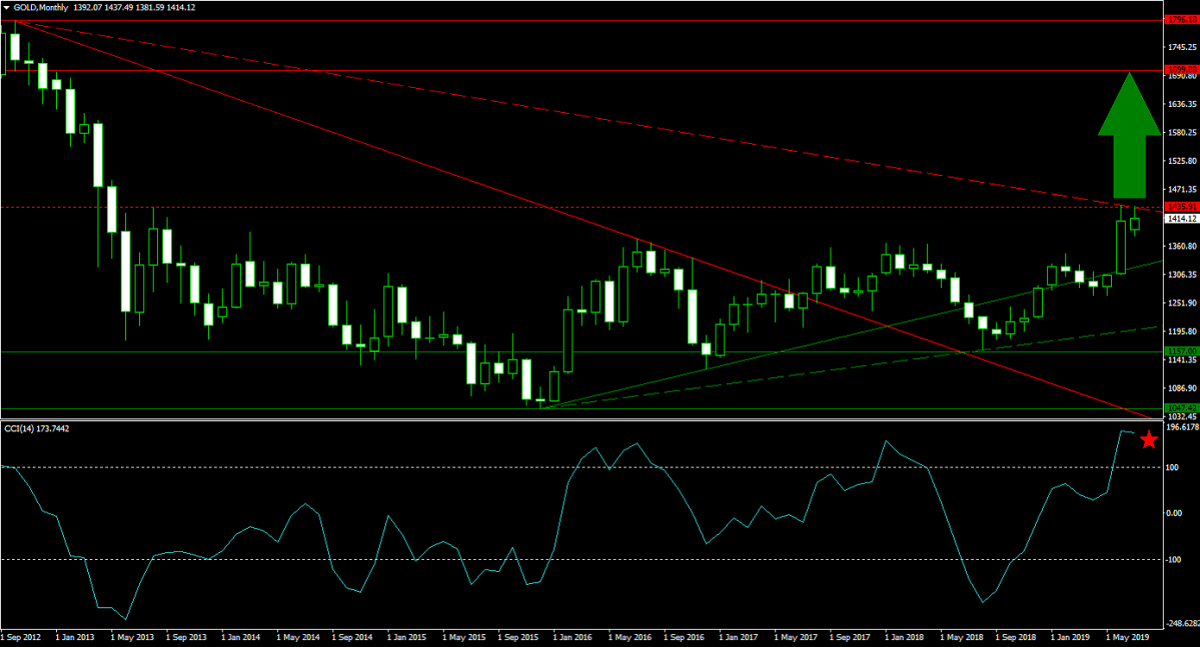

Forex Profit Set-Up #3; Buy Gold - MN Time-Frame

Gold has had a remarkable rally in 2019 as the global economy is slowing and geopolitical risks are on the rise. As this precious metal is testing its horizontal resistance level, a breakout is expected to further extend the current rally. Price action is supported by its primary ascending support level and a double breakout, above its secondary descending resistance level and its horizontal resistance level, will clear the path for Gold to accelerate into its next horizontal support area. Forex traders are recommended to buy any dips down to its secondary ascending support level.

The CCI is trading deep in extreme overbought conditions and setting new highs, but a sideways trend will pull this technical indicator below the 100 level from where a new move higher is expected. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account!