Italy is one of Europe’s biggest economies and a key anchor for the Eurozone behind Germany and France. It is also the economy which has never fully recovered from the last financial crisis as Italian banks are still loaded with bad loans and the Italian consumer is hesitant to open its wallet. Italy also has the second highest debt-to-GDP ratio with 131.1% as of 2014, trailing only Greece. Bond markets are concerned what a populist government in Italy would do, which puts upward pressure on Italy’s borrowing costs and further complicate its debt issues.

On the positive side of the Italian debt is that the country has the lowest percentage of public debt which is held by non-residents and the national wealth is four times the size of its debt burden. This means there is room for a populist government to apply creative ways to lower debt. Following the Italian election, no clear winner emerged but the Five Star Movement, an anti-establishment party, and the Northern League, an anti-immigration party, are in coalition talks. Both parties initially ruled out a coalition, but as the only other option would have been new election both parties decided to resolve key differences.

Financial markets are still left in the dark as to who will become Italy’s next Prime Minister. Luigi Di Maio from the Five Star Movement or Matteo Salvini of the Northern League. A report published by Corriere della Sera suggested that both candidates may take turns. Italian bond yields are surging as investors digest a report of a potential debt write-down. Claudio Borghi, economic advisor to the Northern League, tried to calm fear and stated that a change in accounting rules is being requested in regards to how ECB purchases are accounted for. This would apply to all Eurozone members and not just Italy.

Will the Euro handle Italy’s populist government? Italy’s heavy debt load is set to swell by another €100 billion which is the estimated cost of the draft government program. Will technical support levels for the Euro hold or is it too much to handle? Access the world of forex trading and open your PaxForex Trading Account today!

The biggest concern to investors and the largest threat to a stronger Euro moving forward may be the pledges made by both populist parties and how the impact it will have on Italy’s public finances. The unpopular pension reform which was introduced by the previous government is set to scrapped, a 15% flat income tax for companies and individuals introduced and a basic income for poor Italians is also on the table. Italian courts as well as the parliament is expected to present major obstacles to the implementation, but Di Maio and Salvini want the public to have a vote on the proposal as well which could pressure opposition. Will the Euro handle Italy’s populist government? Here are three forex trades which will help you collect pips while Italy tries to resolve its current political impasse.

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

This currency pair is currently in the process to validate its horizontal support area. The EURUSD endured a sell-off following an extended period of bullishness and is now trading at key levels which will dictate price action moving forward. As bullish sentiment is returning for this trade at the same time US Dollar bulls are retreating, forex traders should spread their buy orders inside current support in order to capitalize on the expected advance into its descending resistance level.

The CCI is trading in extreme oversold territory, but a positive divergence has formed which is a strong bullish trading signal. A push above -100 is further set to invite buy orders in the EURUSD. Make a deposit into your PaxForex Trading Account now and take advantage of this trade before it will accelerate to the upside.

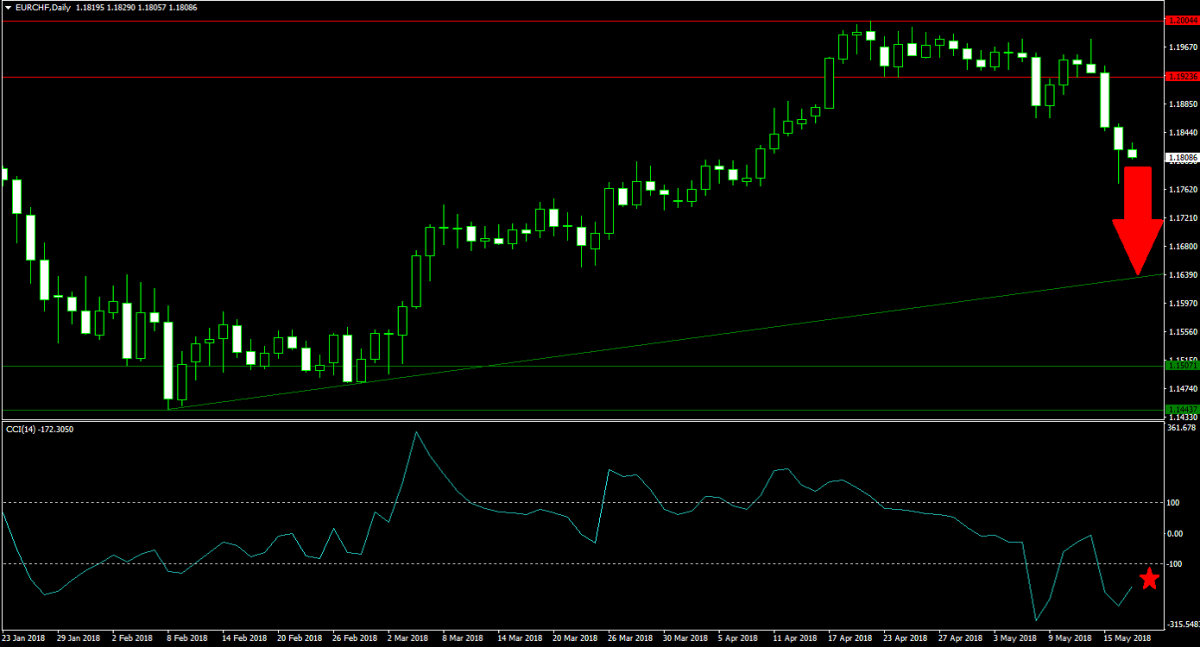

Forex Profit Set-Up #2; Sell EURCHF - D1 Time-Frame

The EURCHF failed to breakout above the 1.2000 level which used to be one of the heaviest defended price levels in the forex market until the Swiss National Bank de-pegged its currency in 2015. The failed breakout led to a successful breakdown below its horizontal resistance area which increased bearish sentiment. The EURCHF is now on course to contract into its ascending support level and forex traders are recommended to sell the rallies.

The CCI, a momentum indicator, is currently trading in extreme oversold conditions below -100 but is above its previous low.. Given the rise in bearish pressures, this indicator has more room to the downside. Subscribe to the PaxForex Daily Forex Technical Analysis section and receive the best technical trading set-ups every day.

Forex Profit Set-Up #3; Buy EURJPY - D1 Time-Frame

A double bottom has formed in the EURJPY and a sentiment swing from bearish to bullish accompanied this formation. This currency pair is now trading just above its horizontal support level and is gathering enough momentum for a breakout above its descending resistance level which will clear the path to its next horizontal resistance area. Forex traders are advised sell the dips as the EURJPY has limited downside risk from current levels.

The CCI already pushed above extreme oversold conditions and is now approaching the 0 mark. A move above it will further increase bullish pressures. Make sure to follow the PaxForex Fundamental Analysis section in order to receive the most profitable fundamental trading set-ups each trading day. Earn over 500 pips with the help of our expert analysts!

To receive new articles instantly Subscribe to updates.