In 2007, 83% of GDP in G-20 nations was controlled by mainstream parties which favored a liberal democratic form of governing. Populist parties, who vow to fight for the common man and are against the establishment, controlled only 4%. Then the global financial crisis hit in 2008 and the weaknesses and inefficiencies of the establishment became visible to the masses. As the Great Recession resulted in millions of job losses while the wealth gap widened, citizens of the G-20 decided it is time for a change.

A decade later the situation looks a lot different and G-20 countries who are governed by either a populist government or a non-democratic one are faring much better economically than the liberal democracies of the past. While some of that may be attributed to the recovery which has spanned the period of the rise of populism, it is important to understand why populism is on the rise and how they force change in the uncontrolled spending of the past. This will have a direct impact on their economies and currencies.

In 2017, liberal democracies only controlled 32% of GDP in the G-20 while populists share surged to 41%. Adding to the downfall of the old establishment is the increase in GDP controlled by non-democratic members of the G-20. China, Russia, Saudi Arabia and Turkey now control 24% of GDP. Some may argue that this is a clear sign that liberal democracies are bad for the economy, by extension the labor market and ultimately for its citizens. The next decade will be crucial if the populist move will survive as it will show how it will fare under an economic crisis.

How will currencies of populists governments perform? Can the new policies eventually lead to an appreciation in value and spur wealth creation? As populists implement their agenda, it will create short-term volatility as markets react and adjust to the policies which will be in place for the next few years. Access the forex market today by opening your PaxForex Trading Account and be ready to profit from countless trading opportunities brought to you by our expert analysts.

Hungary and Poland have been governed by populists governments who are not afraid to take back control from the EU and fight for the rights of their citizens. Italy has now joined the ranks as the first Eurozone member with a populists government after Austria swore in its first right-wing government post World War II. Greece has been on the far left of the equation and market watchers have now set their attention on Cyprus, Lithuania, Portugal and Spain. The biggest surprise may be France which appears less EU friendly than the previous election suggested. Will populist governments rally their respective currencies? Here are three forex trades to add to your portfolio now.

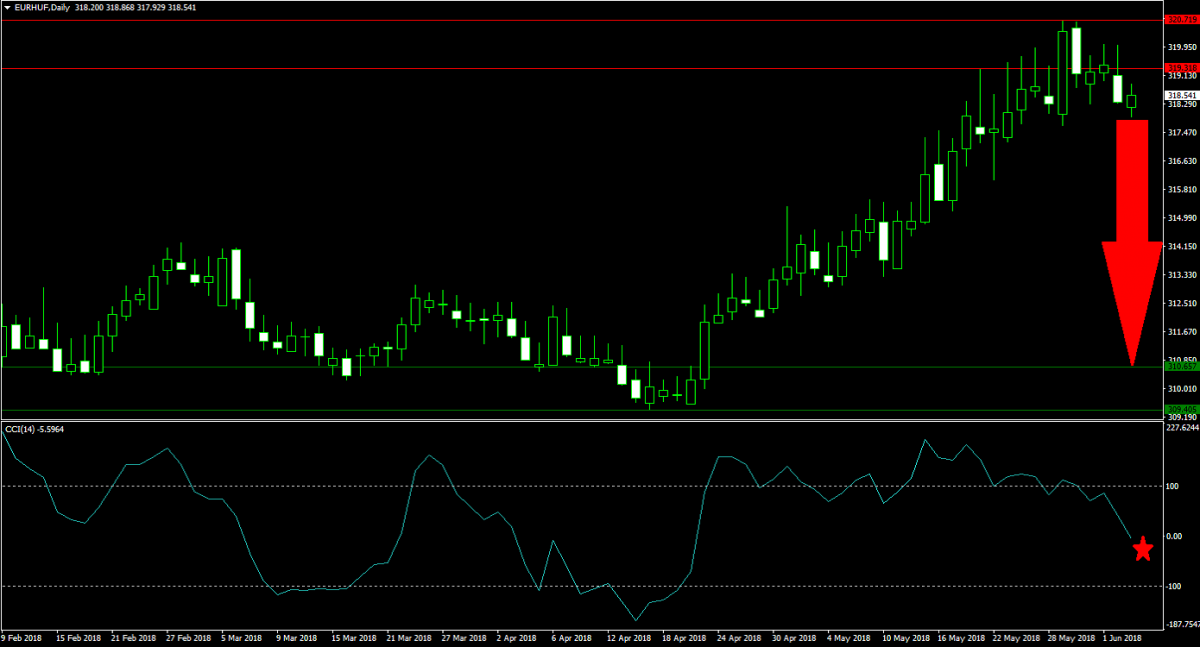

Forex Profit Set-Up #1; Sell EURHUF - D1 Time-Frame

Following a sharp advance in this currency pair, a sentiment change from bullish to bearish occurred as a result of the failed breakout above its horizontal resistance area. After the EURHUF has pushed below the lower band, little support remains in the way for a bigger corrective phase. Profit taking will fuel the descend which can stretch down to its horizontal support area. Forex traders should spread their sell orders from current levels up to the lower band of its horizontal resistance area.

The CCI has steadily contracted from extreme overbought territory and moved below the 0 mark which confirms a sentiment change. More downside should be expected from this technical indicator. Make a deposit into your PaxForex Trading Account today and enter the EURHUF to your portfolio before it will accelerate to the downside.

Forex Profit Set-Up #2; Sell USDPLN - D1 Time-Frame

Price action already completed a breakdown below its horizontal resistance area which resulted in a sharp increase in bearish momentum. The USDPLN enjoyed a solid advance, partially driven by a strong US Dollar which rallied for the past seven trading weeks. Forex traders should be prepared for a trend reversal in the USDPLN and therefore sell the rallies, a reversal in the US Dollar is set to lead the next move. This currency pair carries attractive downside with limited upside potential.

The CCI has quickly reversed from extreme overbought conditions and is now trading below the 0 level. This bearish crossover confirms that a trend reversal in the USDPLN is imminent. Follow the PaxForex Daily Forex Technical Analysis section in order to receive the most profitable technical trading set-ups delivered directly into your inbox.

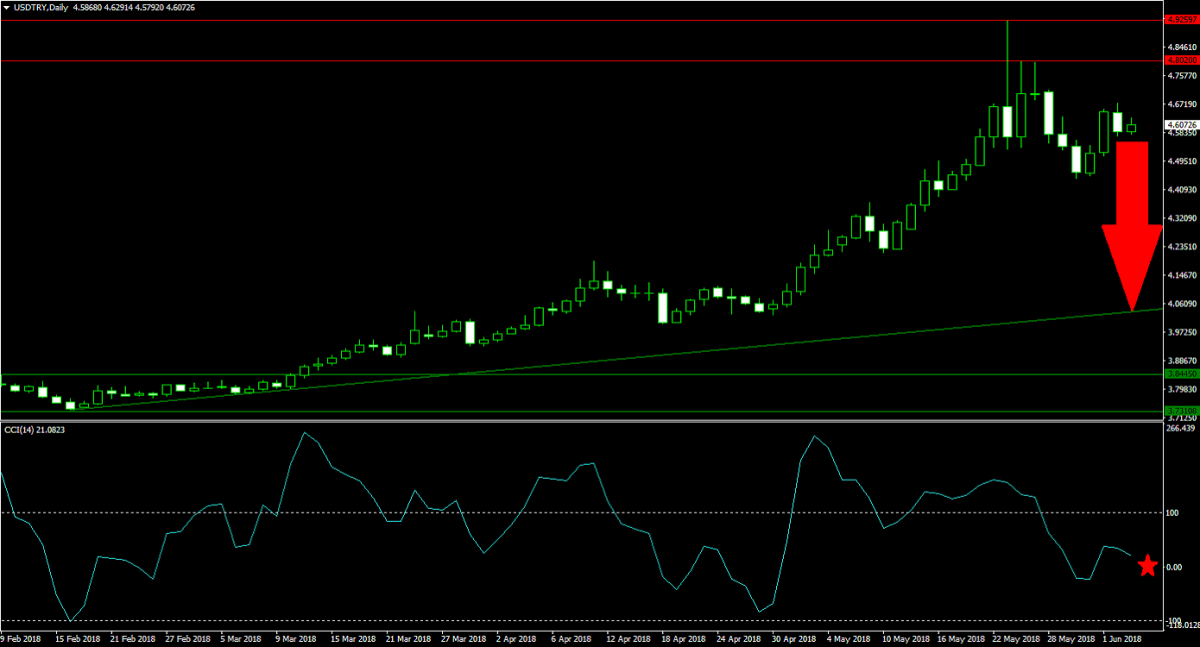

Forex Profit Set-Up #3; Sell USDTRY - D1 Time-Frame

After a sharp contraction in the Turkish Lira which send the currency to record lows, a volatility spike accompanied the formation of a new horizontal resistance area. The USDTRY then completed a breakdown and forex traders should be positioned for an extension of the price action reversal. A move into its ascending support level, which originated at the intra-day low of its next horizontal support area, is expected and forex traders are advised to sell the rallies in this currency pair.

The CCI, a momentum indicator, has formed a negative divergence which is a strong bearish trading signal. A push below the 0 level is likely to trigger a new round of profit taking in the USDTRY. Subscribe to the PaxForex Daily Fundamental Analysis and get each trading day’s most relevant fundamental trading set-up from our expert analysts. Earn over 500 pips per month and never miss out on profitable trading opportunities.

To receive new articles instantly Subscribe to updates.