- Forex Profit Set-Up #1; Buy USDCHF - D1 Time-Frame

- Forex Profit Set-Up #2; Sell NZDUSD - D1 Time-Frame

- Forex Profit Set-Up #3; Buy USDSGD - D1 Time-Frame

Most retail forex traders may never pay attention to LIBOR or know what it is and some may remember the price fixing scandal many Tier1 banks plead guilty to and paid heavy fines for. Regulators try to improve or replace LIBOR, but until it happens it will play a crucial role in financial market. It is planned to remain in place until it will be phased out in 2021 as announced by the UK’s top regulator, the Financial Conduct Authority. LIBOR stands for the London Interbank Offered Rate and it is the average interest rate estimated by 18 major banks in London if it would borrow funds from other banks the following business day.

LIBOR is the predominant rate, but MIBOR, SIBOR and HIBOR were also introduced and are fixed in their local time zones at 11:00 AM. LIBOR is announced at 11:30 AM by the BBA. Out of the 18 bank responses, the BBA discards the top and bottom four and averages the ten remaining responses to arrive at the day’s LIBOR. One-Year US Treasury Bill Rates as well as LIBOR are used to calculate US Adjustable Rate Mortgages or ARM’s. The current rates were last printed in 2008, the start of the previous global financial crisis which originated in the US housing market with ARM’s carrying plenty of blame.

LIBOR, together with EURIBOR, are the premier global benchmarks for short-term interest rates and over $350 trillion worth of derivative and financial products are linked to LIBOR and the biggest part to the US Dollar denominated version. LIBOR is calculated for the US Dollar, the Euro, the British Pound Sterling, the Japanese Yen and for the Swiss Franc. Maturities are available for One Day, One Week, One Month, Two Months, Three Months, Six Months and Twelve Months. As short-term borrowing costs increase, banks as well as investors will be squeezed for capital.

As key indicators and benchmarks of the interconnected global financial system approach 2008 levels, it is smart to be cautious. The forex market will see an impact from the increase in short-term borrowing costs, especially in US Dollar currency pairs as the US is increasing borrowing at the same time it institutes tax-cuts. Forex traders can profit by taking advantage of trading opportunities which will emerge as a result. Open your PaxForex Trading Account now and prepare your portfolio for profits.

The US Treasury is doing its part in applying pressure on rates with first-quarter net issuance set to exceed $400 billion. The 4-Week Bill sales was increased to $65 billion which compares to just $15 billion in the first-quarter of 2017. The increase in rates has increased investors appetite for money market funds. More demand is expected moving forwards as the US Fed is set to increase interest rates further. US government-only money market funds are high in demand with assets increasing by roughly $200 billion to $2.26 trillion from the previous year’s level of $2.07 trillion. The US Dollar will be pushed and pulled in both directions as this trend plays out further in 2018. This is the reason why forex traders should monitor LIBOR and here are three currency pairs which can boost your profits in the meantime.

Forex Profit Set-Up #1; Buy USDCHF - D1 Time-Frame

This currency pair ended its correction after completing a breakout above its horizontal support area. As LIBOR increases and short-term interest rates get pushed higher at a time of increased US government borrowing, the US Dollar could face further downward pressure. The USDCHF offers traders a counter-trend trade for the short-term as a bullish price channel is expected to keep upward pressure on price action. Forex traders are advised to buy dips down to the ascending support level of the bullish price channel.

The CCI briefly spiked above 100 and into extreme overbought territory, but has quickly reversed and is approaching neutral conditions. Any minor dip will take this technical indicator into buy territory and confirm the buy recommendation. Take advantage of the Daily Forex Technical Analysis published by PaxForex and let our expert analysts highlight the trading day’s most lucrative forex trades.

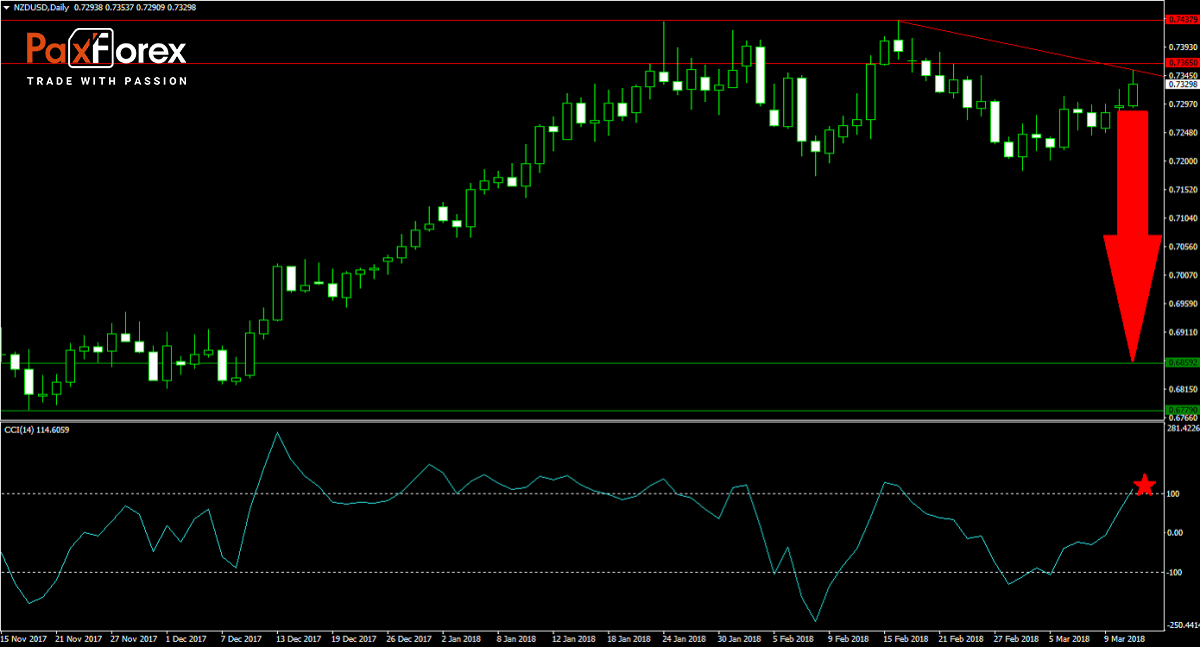

Forex Profit Set-Up #2; Sell NZDUSD - D1 Time-Frame

The US Dollar will attract long bids as the FOMC is set to increase interest rates at their next meeting. Together with the short-term oversold nature of the US currency, this will generate buying opportunities in the Greenback. The NZDUSD is under selling pressure from its descending resistance level which emerged after price action broke down below its horizontal resistance area. Forex traders are recommended to spread their sell orders between 0.7330 and 0.7365.

The CCI is currently trading above the 100 level and is therefore in extreme overbought conditions. A breakdown below is expected to attract more sell orders which will further apply downward pressure on the NZDUSD. Download your PaxForex MT4 Trading Platform today and enter this trade to your trading account before it will accelerate to the downside.

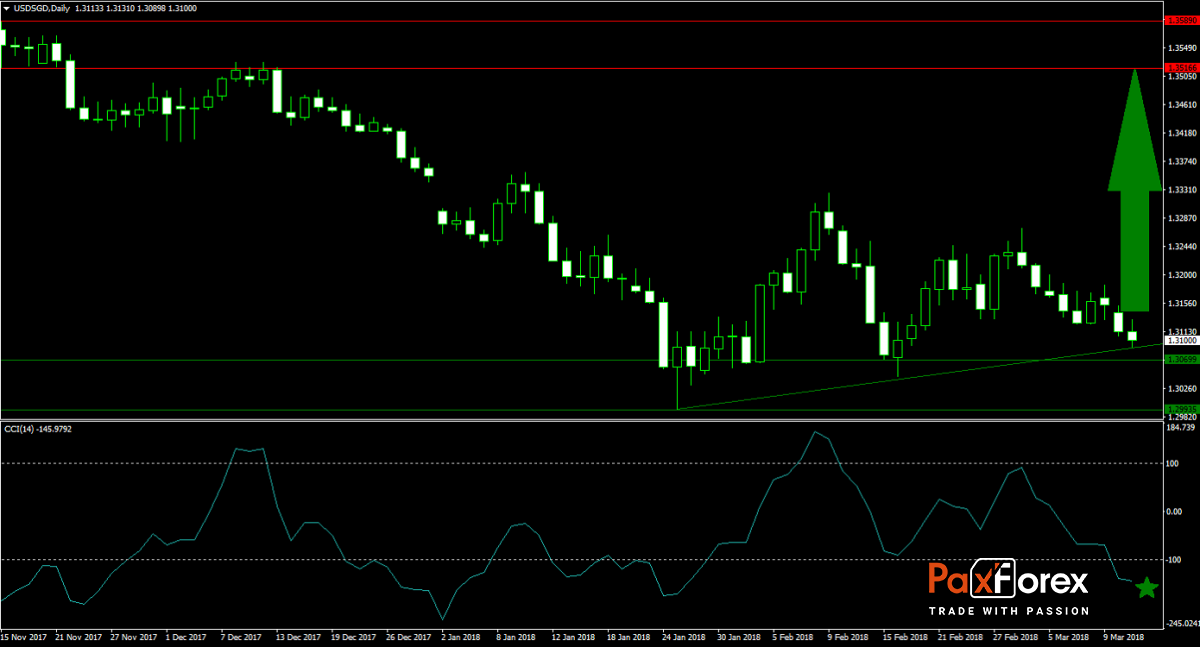

Forex Profit Set-Up #3; Buy USDSGD - D1 Time-Frame

An ascending support level is predicted to initiate a profit taking rally in the USDSGD. Following the initial breakout above its horizontal support area, price action recorded a higher low which resulted in the formation of its ascending support level. This currency pair is now trading near support once again and forex traders should take advantage of buy orders above and below the 1.3100 mark. This trade carries plenty of upside potential with limited downside risk from current levels.

The CCI, a momentum indicator, is trading deep in extreme oversold conditions below -100. A push above -100 will result in more upside pressure in the USDSGD. Learn how to add over 500 pips every month to your forex trading account with the help of our PaxForex expert analysts. Follow the Daily Fundamental Analysis where the trading day’s most important fundamental trades are outlined and profit from our knowledge.