Forex trading is inherently risky because it is a zero sum game. Every dollar you gain through trading represents a loss on someone else balance sheet. Traders earn and lose in the financial markets every day. One of the primary differences between successful and not-so-successful traders is their understanding and consistent application of a simple risk management strategy and knowing when to cut your losses and let your profits run.

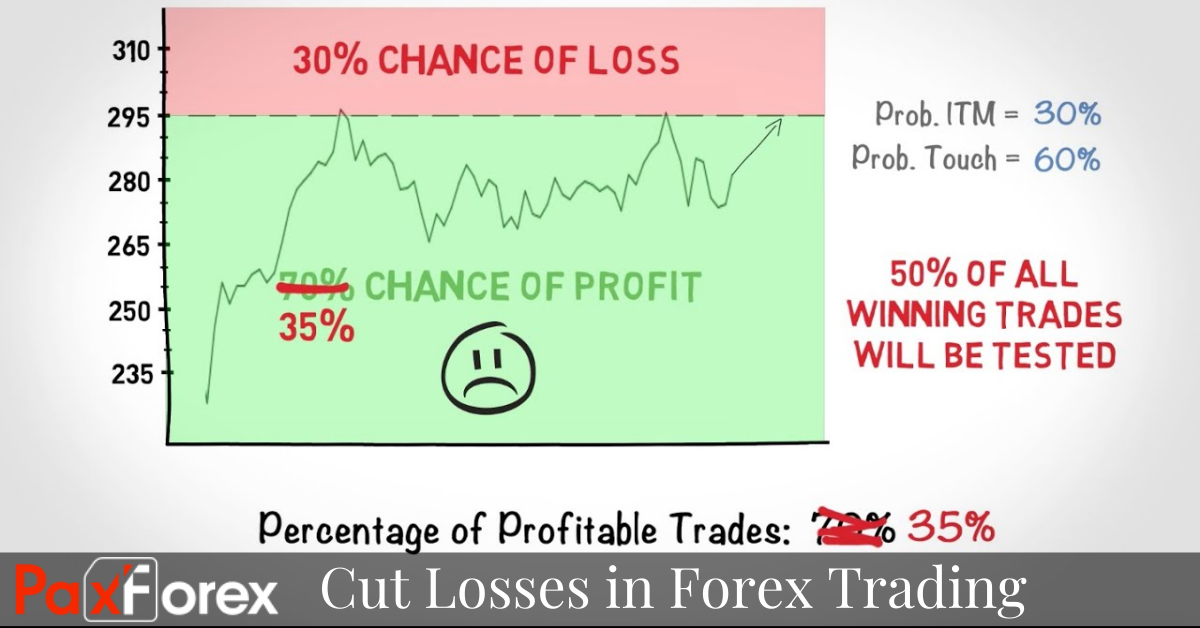

When it comes to actually generating a return from any kind of leveraged trading, the primary factor you need to bear in mind is that it is all just a glorified numbers game. Markets move up and down. One position loses, another gains. Currencies get stronger and then they get weaker. No matter what you do you will often be on the wrong side of these fluctuations, and sometimes you might even get the call right. Where the profit potential comes in is in the balancing act between ensuring that you earn more on your profitable positions than you lose on those that don’t work out quite so well.

Holding on to losing trades and selling winners too early result in a skewed risk reward ratio and unprofitable trading results. But the problem goes much deeper. Historically, in order to survive our ancestors had to treat threats and opportunities differently. Losses are threats and we try everything to avoid a sure loss, even if it means gambling and possibly losing much more. In contrast, profits and gains were taken much faster and receiving a sure profit is preferable than gambling to gain a lager reward. This behavior still exists today and is deeply ingrained in our DNA.

Money management deals with traders following a set of rules designed to protect the trading account from losses. Without a proper money management system, succeeding in trading is almost impossible. Such a system takes into account losses as well. If one is trading with the idea that losses can never occur, then the battle is lost before the start. The idea is to find a way to navigate through good and bad trades in such a way that over time the trading account is growing. The main point is/should be for the account to grow over time.

Studies have shown that we don’t accept naturally to make losses, and we avoid the pain that can be caused by it. However, having an open mind to cut losses is a skill that can be learned over time through trading experience. When it comes to trading forex successfully, letting profits run and cutting losses quickly needs to be something of a mantra. Live by it and stick to it throughout your day-to-day trading. By having the nerve to make the right call, against your instincts and natural judgment, you can have a dramatic impact on your bottom line and ultimately on your future as a forex trader.