In 2017 Bitcoin rallied many its cryptocurrency peers into one of the biggest rallies in financial history. At some point, Bitcoin was up over 2,000% on an intra-day base level. Many refer to the cryptocurrency mania as a retail phenomenon as the majority of professional investors shy away from the highly volatile digital asset class. Some well-known titans of industry even went as far as to label it a scam. This has not deterred retail traders from ploughing into cryptocurrencies, chasing huge returns and in many cases not learning from past mistakes.

The party ended this January, but not before the market capitalization of cryptocurrencies exceeded $800 billion. The next few months saw a deflating of the bubble with similarities to the dot-com crash. A recent study showed that many new cryptocurrencies die four months after their token sale. During the dot-com bubble, many new technology companies surged in price but had little to no value. Investors flocked to them based on the promise of high returns in an asset class they didn’t understand.

Most retail traders who chase returns in digital assets don’t understand the class, what it is or what it can do. They simply follow headlines, often on Twitter, and simply buy into it hoping 2017 will be repeated. More and more countries make trading in cryptocurrencies illegal, are shutting down exchanges and regulators are trying to understand how to classify and regulate Bitcoin and Company. Trading volumes have dropped and market-cap shrank by roughly two-thirds. The deflation of the bubble may bot be over yet and prices could plunge a lot more from current levels.

What’s Next for Bitcoin and Company? Despite the negative news surrounding digital assets, they are moving more into the mainstream. Potentially the best development out of Bitcoin was the blockchain technology which powers cryptocurrencies. It is the only thing all parties can agree on, but what will happen once the dust settles? Will there be a renewed influx of capital chasing returns or will the current trend remain in place? Open your PaxForex Trading Account now and fund it with Bitcoin or Ethereum!

Potentially the biggest risk to return-chasers is the alarming rate at which digital wallets are being hacked and money stolen. While a lot of stolen cryptocurrencies have been recovered and some exchanges offered to reimburse wallet holders for losses, it remains a drag on a new industry which in many countries fights for survival. So, what’s next for Bitcoin and Company? The future is uncertain. There are many rivals and alt-coins are gaining attention and capital. Cryptocurrencies will play a bigger role and are likely here to stay. Smart traders will know when and how to diversify and here are three forex trades which should be in the portfolio of every cryptocurrency enthusiast.

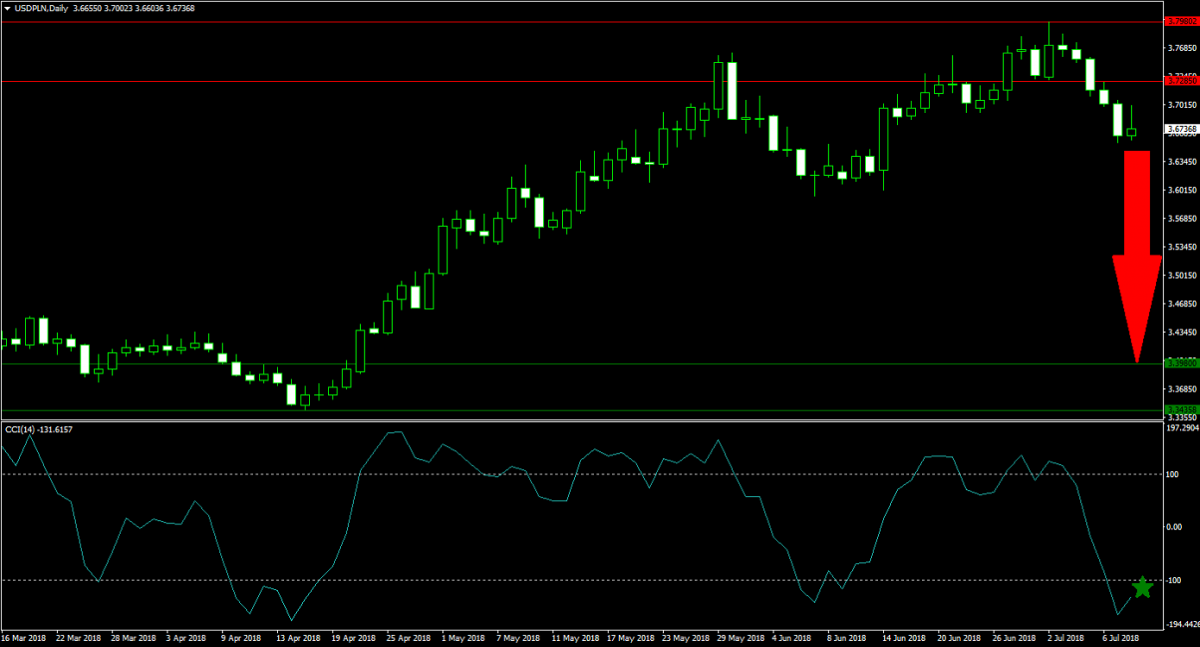

Forex Profit Set-Up #1; Sell USDPLN - D1 Time-Frame

The Polish Zloty became a synonym for rebellion against the EU, together with the Hungarian Forint, and therefore an excellent trade for all cryptocurrency supporters. Poland may become the first EU member country which will have its voting rights revoked, but the Zloty is positioned well to extend its recent gains against the Euro. The EURPLN completed a breakout below its horizontal resistance area and forex traders are advised to sell the rallies in this currency pair in order to capitalize from the expected profit taking inspired sell-off.

The CCI plunged into extreme oversold conditions, but a dead-cat bounce higher should not be ruled out which would take this indicator into neutral territory and coincide with a solid short entry trading opportunity. Download your PaxForex MT4 Trading Account today, fund it with Bitcoin or Ethereum and diversify your digital assets with real currencies in the forex market.

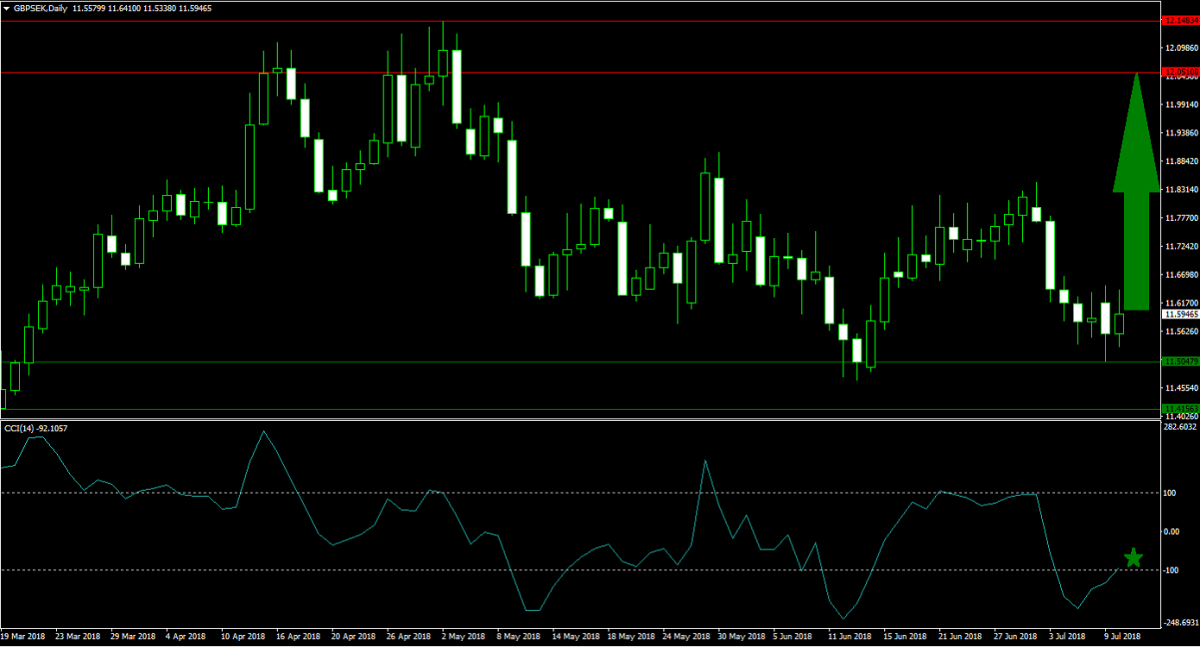

Forex Profit Set-Up #2; Buy GBPSEK - D1 Time-Frame

Another fitting anti-establishment trade for cryptocurrency traders is the GBPSEK. Brexit is a slap in the face of the establishment and even Sweden, the home of social welfare, is on the verge of shifting towards a populist, anti-immigrant party when voters hit the polls in less than nine weeks. The GBPSEK is trading it the upper band of a strong horizontal support area from where price action can accelerate to the upside, forex traders should place their buy orders just above and below the upper band.

The CCI has already pushed above the 100 level and therefore out of extreme oversold territory. This resulted in a momentum shift to bullish and is set to attract new buy orders. Never miss a profitable trading opportunity and follow the PaxForex Daily Forex Technical Analysis section. This will allow you to get the technical trading set-ups delivered directly to your inbox as soon as they are published.

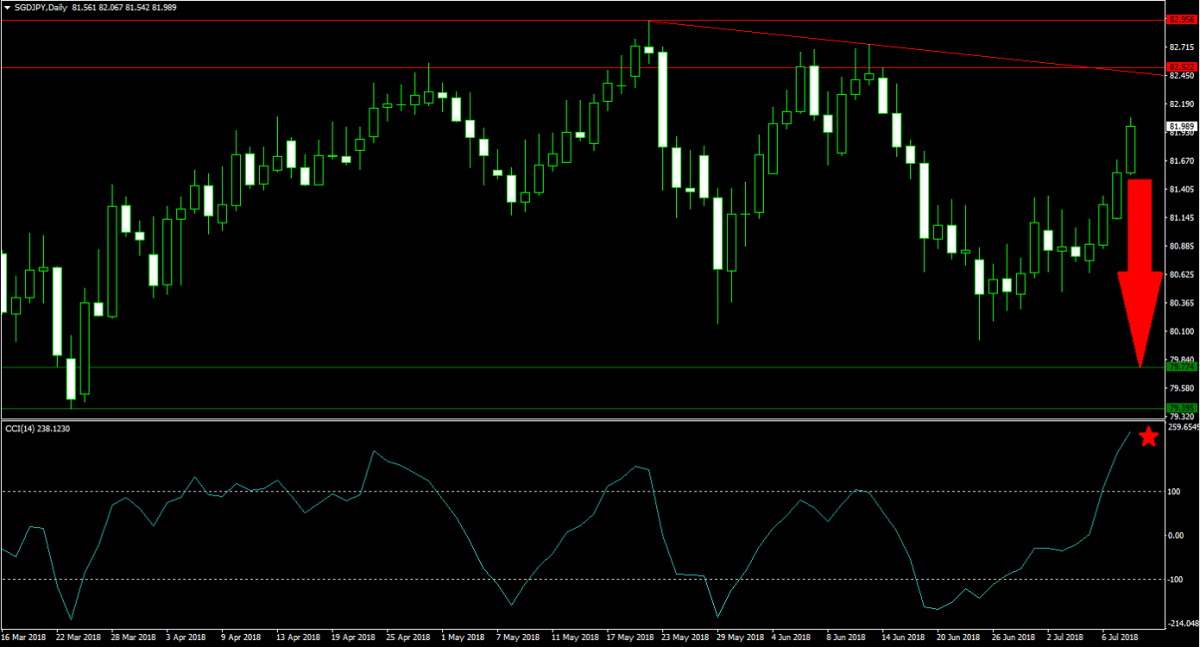

Forex Profit Set-Up #3; Sell SGDJPY - D1 Time-Frame

A lot of activity surrounding cryptocurrencies is located in Asia, so it makes perfect sense to take a look at the SGDJPY. A spike to the upside over the past four trading days made this currency pair vulnerable for a pull-back. A descending resistance level and the lower band of its horizontal resistance area further limits the upside potential in this currency pair. Forex traders are recommended to spread their sell orders from current levels and into its descending resistance level.

The CCI has advanced deep into extreme overbought conditions and is expected to collapse from current levels. A move below the 100 mark by this momentum indicator will further increase bearish pressures. Allow our expert analysts to guide your digital assets thorough the forex market and subscribe to the PaxForex Daily Fundamental Analysis where you will receive fundamental trade set-ups which will yield you over 500 pips per month.

To receive new articles instantly Subscribe to updates.