While many traders are attracted to the forex market’s 24-hour trading and fast moves, others choose the forex market for its long trends and responsiveness to key support and resistance areas. Position trading is the longest term trading and can have trades that last for several months to several years. This kind of forex trading is reserved for the ultra-patient traders, and requires a good understanding of the fundamentals.

Falling somewhere on the spectrum between swing trading and long-term investment is the discipline of position trading. Position trading is a strategy where traders and investors aspire to capitalize on strong pricing trends through entering and remaining present in a market for an extensive term. A position trade is a commitment of both time and money, with the intention of realizing a sizable gain from the sustained growth of an open position’s value.

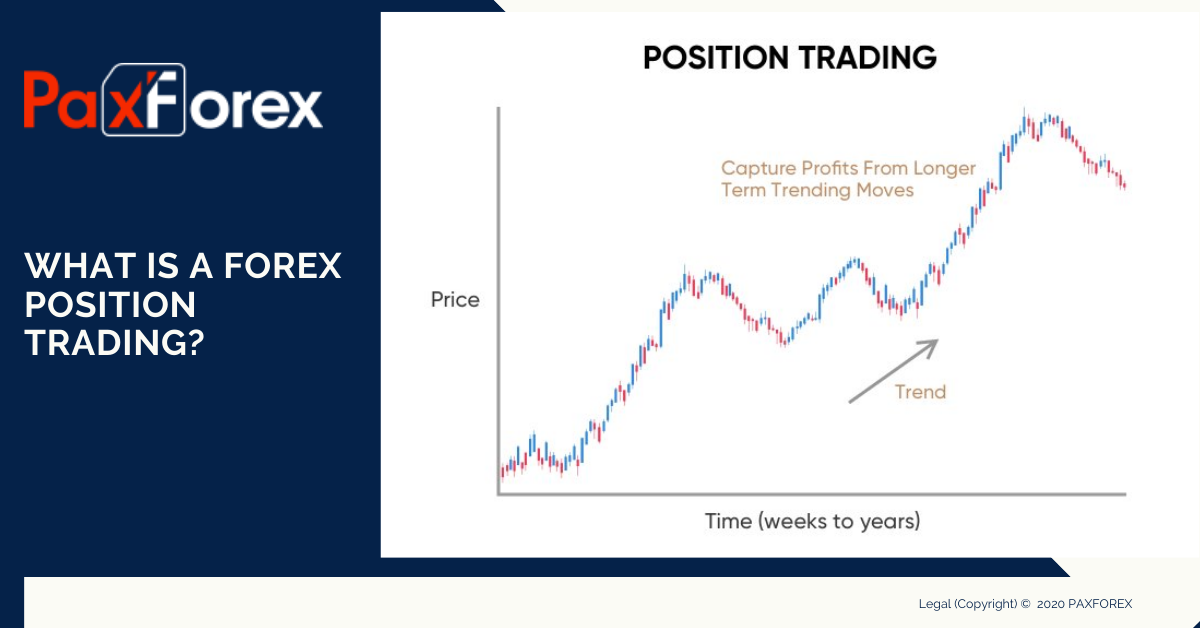

Position trading is taking a position in an asset, expecting to participate in a major trend. Position traders aren’t concerned with minor price fluctuations or pullbacks. Instead they want to capture the bulk of the trend, which can last for months or years. The main appeal of this approach is that it doesn’t require much time. Once the initial research is done, and the position trader has decided how they want to trade the asset they’ve selected, they enter a trade and there’s little left to do. The position is monitored on occasion, but since minor price fluctuations aren’t a concern, the position requires little maintenance or oversight.

The advantages of position trading appeal to a wide array of individuals. People who do not have the time necessary to trade on an intraday basis find position trading a great way of engaging the financial markets. While the logic behind the implementation of a position trading strategy is alluring to some, there are several unique disadvantages. As stated earlier, taking a position for a considerable period of time is a commitment. Getting “cold feet” and making an unplanned, early exit from the trade may serve to compromise the integrity of the entire strategy.

Position trading is the opposite of day trading, where traders make trades each day and spend hours trading. Swing trading is less time-intensive than day trading since trades last a couple days to several weeks; this still requires time to monitor and find new positions each week. Position traders make between zero and three trades a year in assets they own. Swing traders will likely make 25 to a few hundred trades a year, and day traders make hundreds to thousands of trades a year.