Many people believe that the markets are random but many others also argue that although prices may appear to be random, they do in fact follow a pattern in the form of trends. One of the most basic ways in which traders can determine such trends is through the use of fractals. Fractals essentially break down larger trends into extremely simple and predictable reversal patterns. When many people think of fractals in the mathematical sense, they think of chaos theory and abstract mathematics.

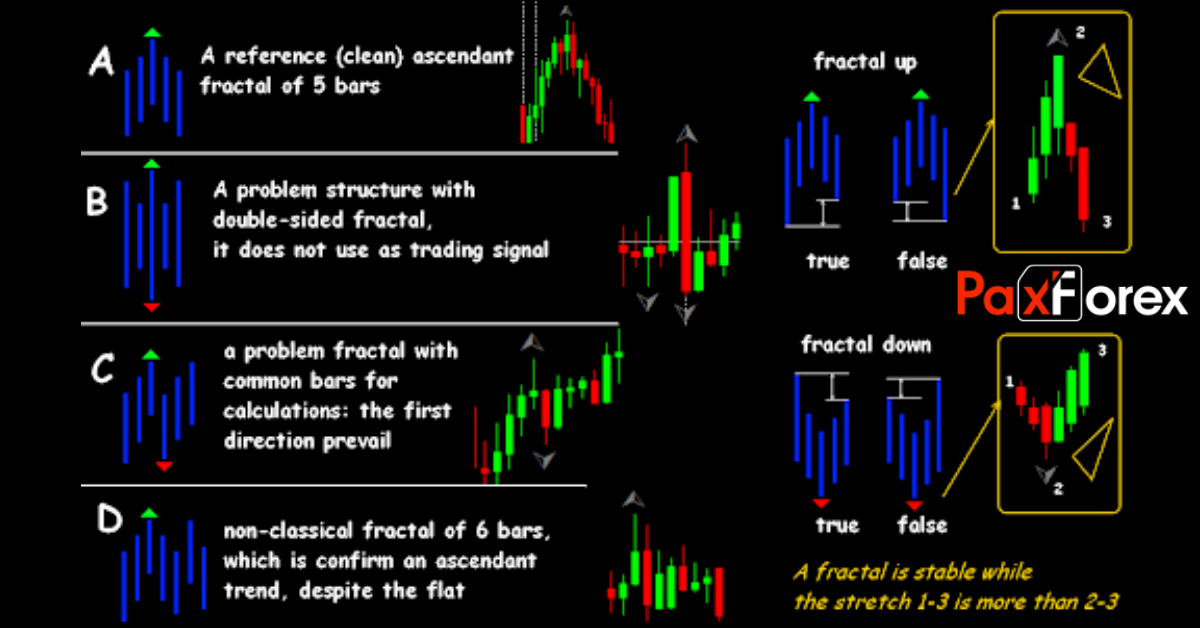

While these concepts do apply to the market most traders refer to fractals in a more literal sense. That is, as recurring patterns that can predict reversals among larger more chaotic price movements. These basic fractals are composed of five or more bars. The rules for identifying fractals are bearish turning point occurs when there is a pattern with the highest high in the middle and two lower highs on each side, a bullish turning point occurs when there is a pattern with the lowest low in the middle and two higher lows on each side.

Fractal trading is only one of the evaluation methods which is effective during the periods of a stable trend, while in a wide flat can be unprofitable. It is necessary to understand that the fractals trade strategies were initially developed for the stock market which was less volatile and more predicted. Trading with fractals is extensively used by the large market players and it is the best indicator of the fractals’ reliability. The combinations of fractals have such characteristics as self-similarity, scaling and memory of the entry conditions and therefore, they can be used successfully for making price forecasts.

Fractals are indicators on candlestick charts that identify reversal points in the market. Traders often use fractals to get an idea about the direction in which the price will develop. A fractal will form when a particular price pattern happens on a chart. The pattern itself comprises five candles and the pattern indicates where the price has struggled to go higher, in which case an up fractal appears or lower, in which case a down fractal appears.

Like many trading indicators, fractals are best used in conjunction with other indicators or forms of analysis. Perhaps the most common confirmation indicator used with fractals is the "Alligator indicator" a tool that is created by using moving averages that factor in the use of fractal geometry. Fractals make excellent decision support tools for any trading method. However, fractals in conjunction with the trend instruments represent the powerful tool of a technical analysis and can be the basis of constructing the steadily profitable system.