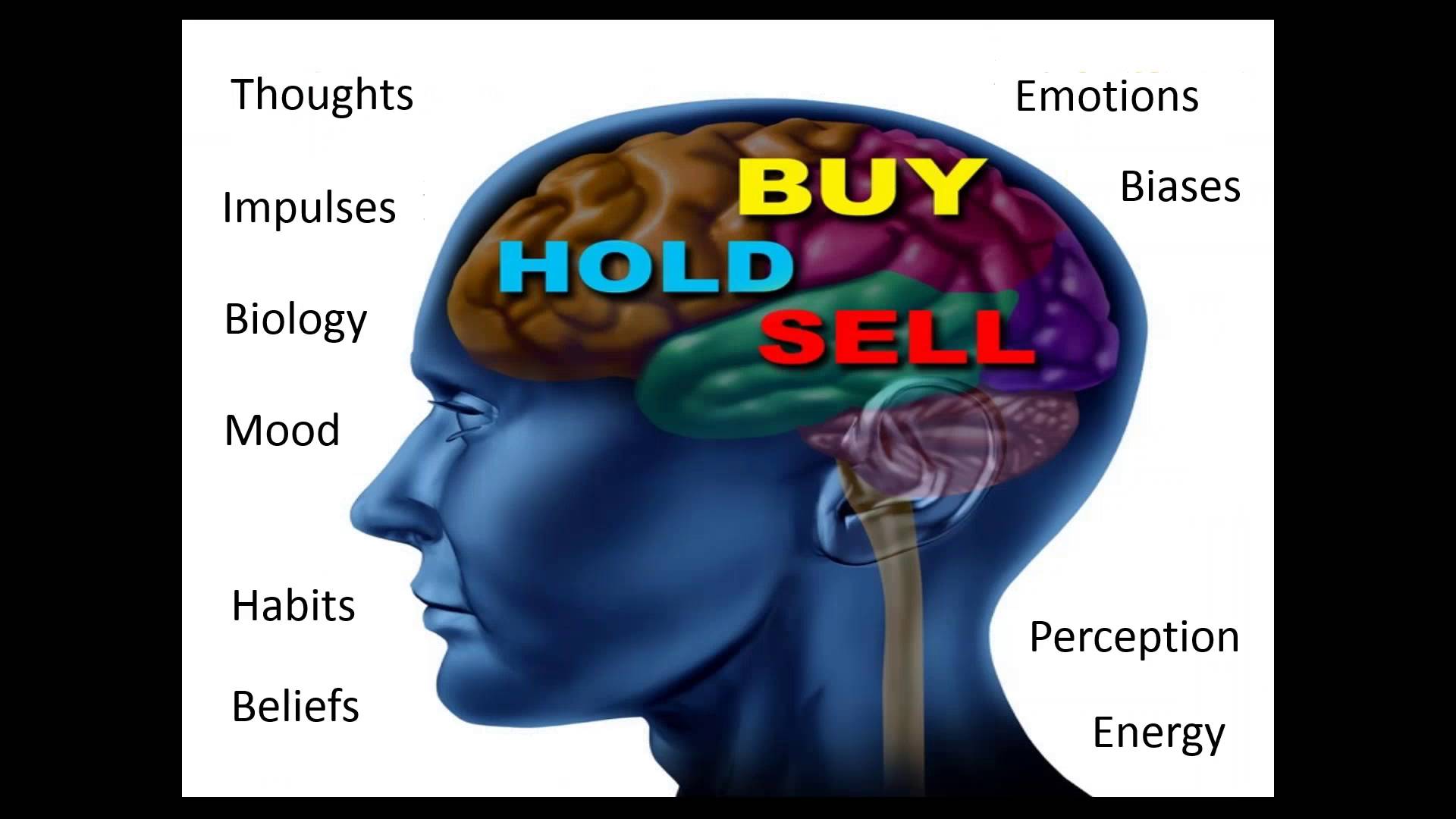

Successful trading is difficult and building the correct attitudes and beliefs is the way to develop the habits and skills necessary for profitable trading. Without a profitable and successful trading mindset, you will be swimming upstream against your emotions/fears, thoughts, and unconscious habits which undermine your success. As with any form of speculative activity, the importance of psychology in forex trading simply cannot be overestimated. Humans are emotional beings, and they have well-defined psychological traits that often accumulate into a number of unique personality types.

Your mindset makes the biggest percentage of your possibilities of either losing or winning in the currency trading game. It all depends on the attitude and the way you set your mind to it. The mindset actually becomes the foundation on which you lay your strategies before you begin trading in the forex market. People like taking shortcuts in almost everything in life but when it comes to trading, there are no shortcuts. It all depends on how you position your mind on the kind of trading you want to get into.

The first thing you need to do to develop the proper forex trading mindset is to have realistic expectations about trading. Successful people seem to have a completely different mindset around losses and failure because they think about it differently. In trading, this would translate to not letting every trade (win or lose) determine your sense of value because this will make you totally dependent upon the results in the beginning which is a precarious time. Instead, focus on what you need to do with the information being presented in the loss or mistake you made.

No trader ever became successful without taking risks, without going against their emotions, their sense of comfort, their desire to do it the easy way, or not put in the work. You have to get comfortable with losing as it will be part of the game. Be willing to fail and make mistakes. If you hide behind the comfort zone, you will never go to places you’ve never been before in your trading. You can learn from your failures as much as your successes, so just consider it part of the process of learning to trade and achieving your objective.

You can’t control what the markets will do, but you can control what you can do. Do you understand now, this is where your focus needs to be. Yes, you need an edge in the market, but once you have defined that edge, that is where the hard part begins. The emotions of hope, greed, and fear will enter your trading life. And if you haven’t done the work on yourself, there will be consequences that will show up in your trading. If you do the work, you will learn and grow and improve, and your trading results will reflect that. Successful trading requires constant improvement.

To receive new articles instantly Subscribe to updates.