Roughly two weeks into 2019 and volatility is already rising across financial markets which impacts the forex market as well. Everything is connected in one way or another and successful forex traders understand that one needs to keep an eye out on developments in other sectors, such as equities, commodities and bonds, in order to get a complete picture. Understanding how they are connected can also offer great trading signals for currencies and improve overall profitability while it will decrease negative surprises.

Let’s take a look at equity markets, especially in the US, which are certain to contribute to moves in the US Dollar. While equity markets rebounded over the past two weeks as they usually do, volatility as measured by the so called “fear index” or VIX contracted to a six week low. As the equity rally appears to fizzle out, the VIX could explode at any moment which often results in heavy selling. This in turn impacts the US Dollar and forex traders need to be wary of the VIX erupting like a volcano as it could increase selling pressure on all USD currency pairs. Intraday volatility has also surged to the highest levels since December 2008 and the ripple effects are felt across financial markets.

Then there is the commodity market which especially impacts commodity currencies such as the Australian Dollar, the New Zealand Dollar, the Canadian Dollar and to a lesser degree the Swiss Franc. Oil prices have seen a sharp increase in price swings while Gold has marched higher. Forex traders should watch out for Copper prices as it is a solid indicator for global growth. Hard commodities, those which can be mined or extracted, have a bigger impact on the forex market than soft commodities, those which are planted, grown and harvested.

Central banks are expected to be a lot more active in meddling with markets and interest rates in 2019. One recent example is China which did not officially lower interest rates, but opted to guide the interbank borrowing costs to the downside. This equalled a one-day injection of cash into the Yuan market. Open your PaxForex Trading Account today and build a profitable forex account with the help of our expert analysts.

Keep in mind the bond market as well. It has been a bit too quiet which unnerves many market participants as a bigger move could be exploding through the world’s largest bond market. In addition, many expect a US yield curve inversion in the US after the short-end of the curve inverted last year. A 2-Year/10-Year inversion in US Treasuries is likely to push the US Dollar to the downside. After the ECB ended its QE last year, the Eurozone bond market is ripe for jitters as portfolio managers will start to adjust positions. This will be felt in the Euro and impact forex markets. Volatility in 2019 is expected to increase sharply and the FX market will be impacted by it, here are three trades to ride the volatility to profitability!

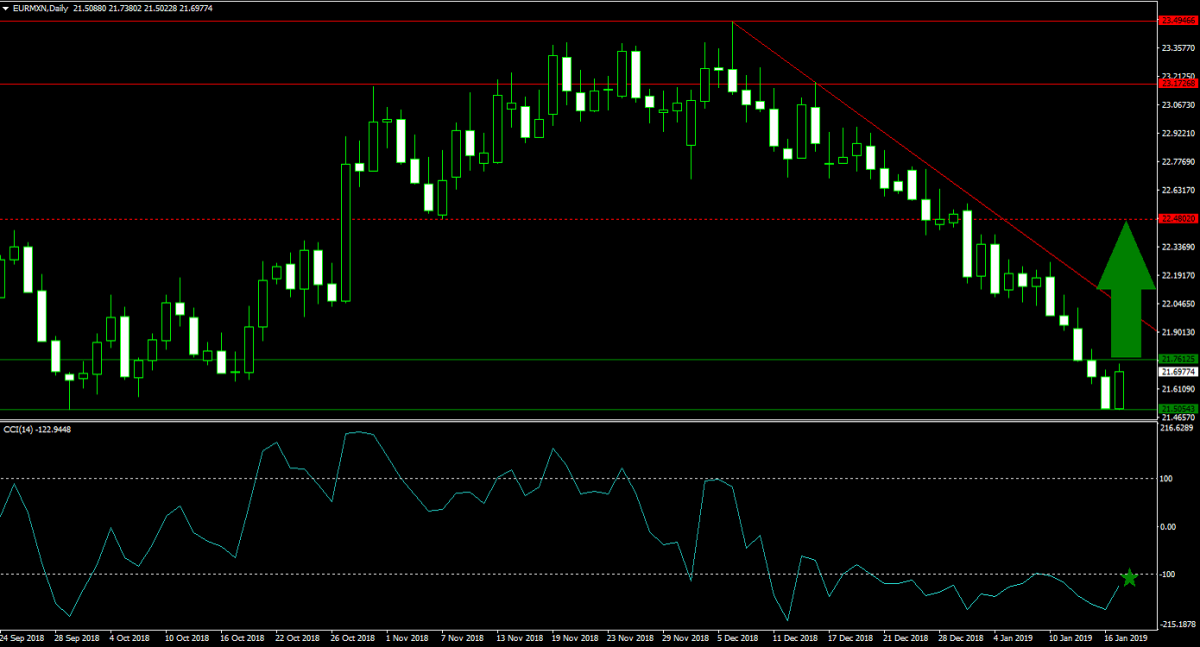

Forex Profit Set-Up #1; Buy EURMXN - D1 Time-Frame

The Eurozone economy is slowing down which pressured the Euro to the downside, but this move has been overdone in the EURMXN. Price action has now settled into its horizontal support area and bearish sentiment is being depressed. A breakout above the upper band is expected to carry enough bullish momentum for a second breakout above its primary descending resistance level. This would clear that path for the EURMXN to challenge its next horizontal resistance level and forex traders are advised to spread their buy orders inside the horizontal support area.

The CCI has been trading in extreme overbought territory, but a shallow positive divergence has formed which represents a strong bullish trading signal. A move above -100 is likely to trigger a massive short-covering rally. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market yielding 500 pips per month and more.

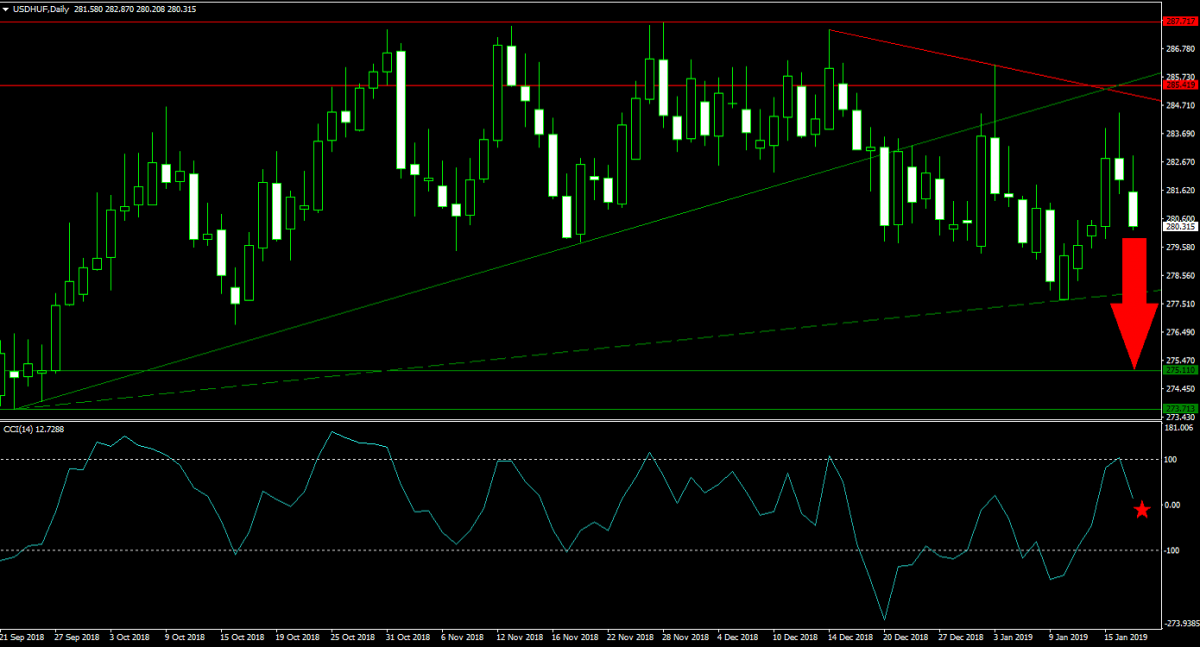

Forex Profit Set-Up #2; Sell USDHUF - D1 Time-Frame

As the ECB has exited it QE program which drove capital to high yield economies like Hungary, central banks in those countries may have to increase interest rates sooner than expected. The USDHUF is currently in the middle of its corrective phase, following a failed breakout above its horizontal resistance area. A breakdown below its secondary ascending support level is expected to take the USDHUF to the upper band of its next horizontal support area. Selling rallies from current levels is favored.

The CCI briefly pierced into extreme overbought conditions, but quickly reversed direction and is now approaching the 0 mark. A move below it is expected to attract a new wave of sell orders. Download your PaxForex MT4 Trading Platform now and add the recommended trades of our expert analysts to your account; grow your balance consistently trade-by-trade.

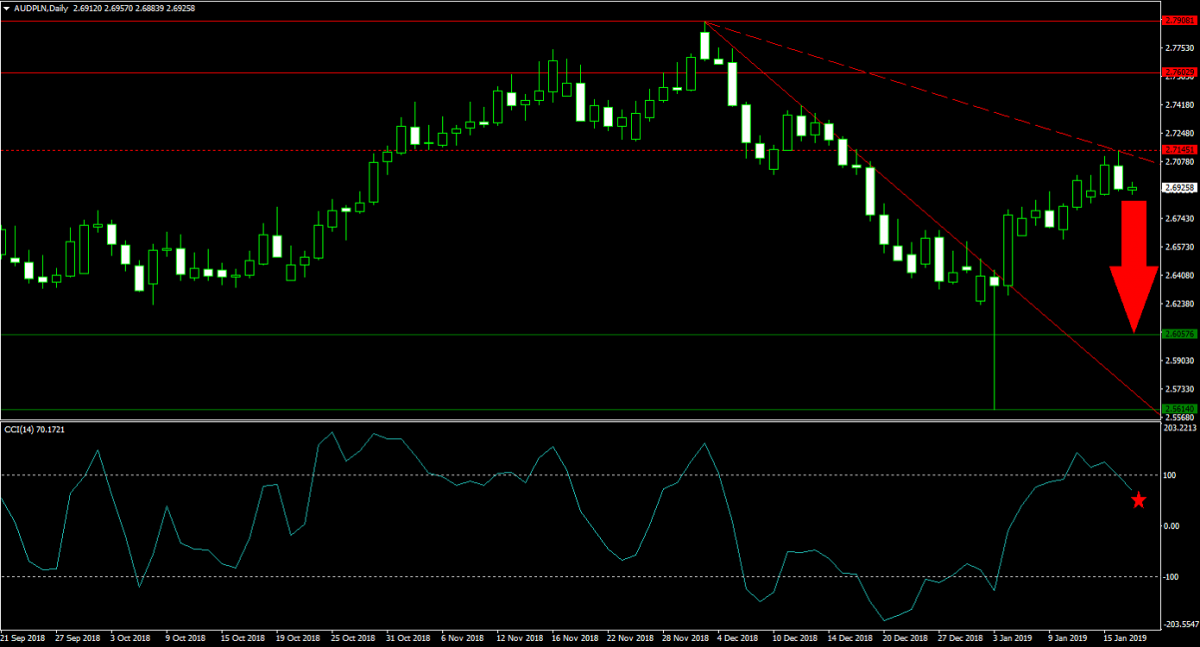

Forex Profit Set-Up #3; Sell AUDPLN - D1 Time-Frame

Poland has enjoyed the same benefit as Hungary from the ECB QE program, and is now once again in the same boat in regards to central bank policy. At the same time the Australian Dollar continues to struggle with the impacts of the US-China trade war. Price action in the AUDPLN accelerated following the flash crash two weeks ago, but an extension of the uptrend was rejected by it horizontal resistance level. The secondary descending resistance level is further applying downside pressure on the AUPPLN which is anticipated to reverse back down into the upper band of its horizontal support area. Forex traders are recommended to sell rallies into its secondary descending resistance level.

The CCI has already completed a breakdown from extreme overbought territory which increased bearish momentum. A further contraction below the 0 level is expected to lead price action to the downside. Subscribe to the PaxForex Daily Forex Technical Analysis and increase your monthly profits simply by adding the recommended trades of our expert analysts into your own trading account.

To receive new articles instantly Subscribe to updates.