The US Dollar has enjoyed a very strong 2018 despite a series of headwinds and surprised many forex traders. Everything appeared to work just fine for US Dollar bulls, until it doesn’t anymore. As 2018 is slowly winding down, those headwinds are blowing harder and the ultimate price may be paid by the US Dollar. The interest rate increases by the FOMC of the US Fed have added to the bullish sentiment, but are also inserting bearish pressures into the US Dollar environment. The FOMC is set to increase rates three to four times in 2019 and this has created a double edged sword.

Forex traders should pay closer attention to US Yield Curve Inversion which occurs when shorter-dated yields trade higher than longer-dates ones. The $15.4 trillion US Treasury market has so far avoided an inverted yield curve between the 2-Year and 10-Year Treasuries, which is the equivalent of the EURUSD currency pair in forex trading, but the spread did narrow to as thin as 18 basis points. This may change as soon as next year and BMO Interest Rate Strategist Ian Lyngen noted that “It’s too early to call the FOMC blinking on the hiking cycle and as a result our expectation for the curve to flatten to inversion remains in place.”

Another big bullish contributor to the US Dollar was the rise in the price of oil. Since the US shale oil boom, the US became a top exporter of oil which shifted the dynamics of the global oil market. As oil retreated, the US Dollar remained elevated due to the US Dollar carry trade. TD Securities Head of American FX Strategy stated that “The past few months the USD has benefited from a US-based carry trade, which rested on low volatility and relative out-performance. The collapse in oil matters in this case since the US is now one of the notable global marginal oil producers. It is a growth shock to one of the US’s key growth industries.”

The US economic outlook is therefore changing with the price of crude oil as several key industries now depend on black gold’s performance. How will the US Dollar handle a further collapse in oil prices from current levels? Is it time to book profits and position portfolios for US Dollar weakness or will more interest rate increases keep bulls on board? Open your PaxForex Trading Account today and build a profitable long-term forex portfolio.

Adding another layer of US Dollar uncertainty is the likely funding shortfall despite the fact that the US Dollar is the most oversupplied currency on the planet. It has been a one-sided affair and end-of-the-year balance sheet adjustments around the globe will spike demand for the US currency. Cross-currency basis swaps surged in September and the trend is expected to accelerate. Bank of America Head of US Interest Rate Strategy pointed out that “As Libor rates continue to widen, we think that would see similar funding pressures through cross-currency basis swaps.” The looming US Yield Curve Inversion, oil and the US Dollar are on the radar screen and here are three forex trades for your trading screen.

Forex Profit Set-Up #1; Sell USDNOK - D1 Time-Frame

While Norway is also heavily dependent on the price of oil, it is overall less exposed to the other risks the US is currently dealing with. The USDNOK enjoyed a strong rally which took this currency pair into its horizontal resistance area from where bullish sentiment is fading. A double breakdown from current levels is anticipated to take price action below its secondary ascending support level and down into its next horizontal support level. Forex traders are advised to place their sell orders inside of its horizontal resistance area.

The CCI formed a negative divergence inside extreme overbought conditions which led to a breakdown below it. More downside is favored from current levels which will indicate more downside in the USDNOK. Download your PaxForex MT4 Trading Platform now and take the first step into a profitable direction. Join our growing community of profitable forex traders!

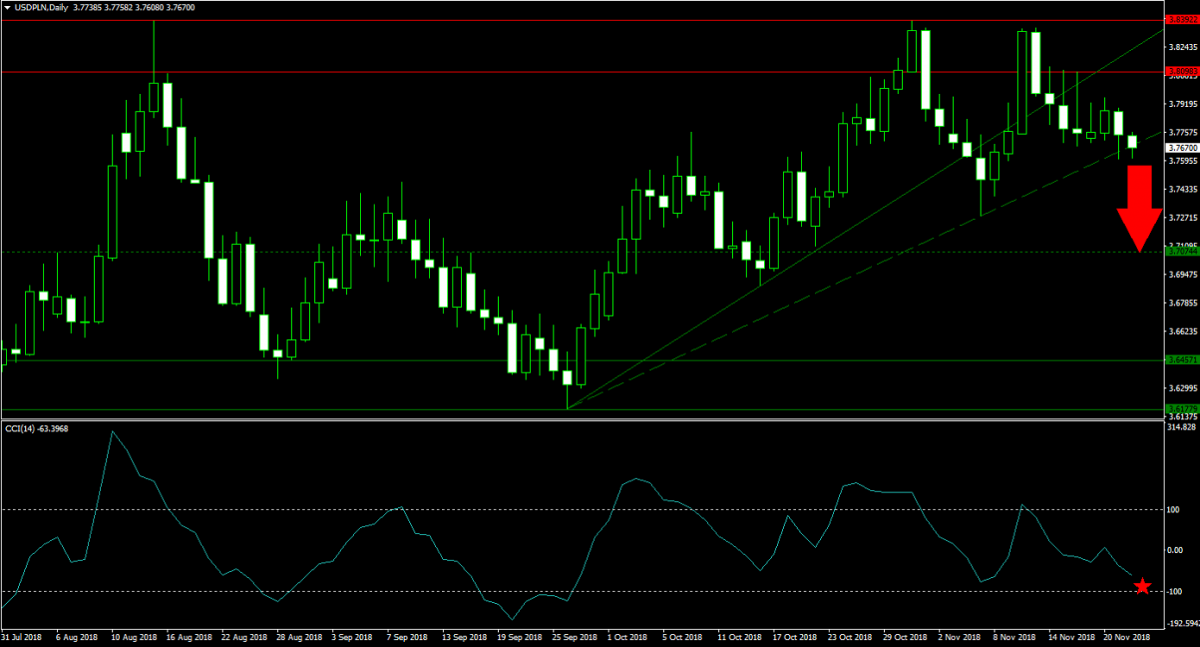

Forex Profit Set-Up #2; Sell USDPLN - D1 Time-Frame

The USDPLN offers forex traders a more advanced bearish trade in the US Dollar. Price action already completed a breakdown below its horizontal resistance level as well as below its primary ascending support level. Bearish sentiment took this currency pair down into its secondary ascending support level from where another breakdown is anticipated to take the USDPLN into its next horizontal support level. Forex traders are recommended to sell the rallies in this currency pair.

The CCI, following a brief spike into extreme overbought territory, is in correction mode and completed a bearish momentum crossover with a move below the 0 mark. Subscribe to the PaxForex Daily Forex Technical Analysis and create a profitable forex account by using the trading recommendations posted by our expert analysts. Copy, paste and profit!

Forex Profit Set-Up #3; Buy USDZAR - D1 Time-Frame

Forex traders who prefer to remain bullish can find one great hedge to the above short recommendations in the USDZAR. Price action is currently trading at its secondary ascending support level which is located above its horizontal support area. As bearish pressures are weakening, this currency pair is ready for a short-covering rally. This is expected to take the USDZAR above its primary as well as secondary descending resistance levels and into its primary ascending support level which is located just above its next horizontal resistance level. Buying the dips in this currency pair is favored.

The CCI is trading in extreme oversold conditions, but a shallow positive divergence has formed. This is predicted to push this momentum indicator above the -100 level which may trigger a short-covering rally. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market and yield over 500 pips pre month in profits!

To receive new articles instantly Subscribe to updates.