After months of being criticized by President Trump for raising interest rates, the US Federal Reserve gave in and delivered on his wish. Central banks are supposed to be independent, but in many cases they bow to pressure from the government. Fed Chief Powell basically ruled out any more interest rate increases for 2019 and at the same time lowered the growth outlook of the US for the year to 2.1%. While risk assets have initially cheered the move, this trend starts to slowly reverse as reality sets in. Global growth is a lot weaker and slowing down fast which will likely to continue throughout the first-half of this year.

After Powell’s announcement, the US Dollar tanked and US 10-Year Treasury Yields were dragged down as well while Gold spiked. Many had priced in a more dovish Fed, but the extend of it took many by surprise. US Dollar bulls returned to the trade today amid bargain hunting and as analysts combed through more details of yesterday evening’s Fed announcement. Powell mentioned the economic contraction in the Eurozone as well as China and stated that as global growth slows, the US economy will be impacted as well. Inflation also remains tame which gave the US Fed another excuse to hold all interest rate hikes for 2019.

Some analysts now draw comparisons to Japan which is now entering its third decade of quantitative easing. A deflation-trap may pose the biggest risk to the US Fed and has plagued the Bank of Japan for many years. There is a growing risk that the next interest rate adjustment out of the US may be to the downside as the economy is slowly headed into a recession. This is likely to also bring quantitative easing back in play with a fresh round of stimulus. This has further brought MMT or Modern Monetary Theory into play, designed to socialize market with big government spending. The backbone of MMT states that a country doesn’t have to worry about debt as it can always print more money in order to service interest payments.

The Us Dollar has experienced a very volatile 24 hours as forex traders are scaling back their initial reaction to sell. Will traders focus their attention on a weaker global economic outlook or on central banks accelerating QE programs? Open your PaxForex Trading Account today and allow our expert analysts to help you build a profitable forex portfolio!

While Norway decided to raise interest rates today, central banks in the UK, Switzerland, Indonesia, Taiwan and the Philippines all remained on hold with no change in their loose monetary policy. The Russian central bank is also expected to remain on hold tomorrow, but analysts are looking for a change in tone which could pave an interest rate increase as inflationary pressures are receding. It appears as if most central banks are in no position to increase interest rates and that the risk remain for cuts. This could potentially set-up an inflation trap unless the global economy slips into a recession before the end of 2020. The US Fed pauses interest rate increases, but here are three forex trades in order to increase your profits!

Forex Profit Set-Up #1; Buy USDNOK - D1 Time-Frame

While the US Fed remains on hold for the rest of 2019, the Norwegian central bank is expected to increase interest rates further. This will provide an overall bearish set-up for the USDNOK, but price action is expected to make a short-term recovery after recovering from a brief dip into its horizontal support area. The hammer formation in its latest daily candlestick further adds to bullish pressure in this currency pair. A recovery into its next horizontal resistance level is anticipated to take shape and forex traders are recommended to buy dips in the USDNOK down into the upper band of its horizontal support area.

The CCI slid into extreme oversold conditions and into an ascending support level which is favored to force a breakout above the -100 mark. Bullish momentum is expected to increase, but remain below the 0 level. Deposit into your PaxForex Trading Account now and find out why more and more successful forex traders call PaxForex their home!

Forex Profit Set-Up #2; Buy USDSGD - D1 Time-Frame

Following a third decline into its horizontal support area, buyers in the USDSGD have stepped in and prevented a further contraction in this currency pair. The bullish momentum boost has caused price action to eclipse the upper band of its horizontal support area from where more upside is favored. The USDSGD is now expected to extend its price action reversal until it will reach its secondary descending resistance level which is located below its next horizontal resistance level. Forex traders are advised to buy any dips in price action from current levels.

The CCI saw its descend halted and reversed by an ascending support level and this technical indicator is now expected to push out of extreme oversold territory. This will likely trigger a push to the upside in price action. Follow the PaxForex Daily Forex Technical Analysis and copy the recommended trades and profits from our expert analysts into your own trading account!

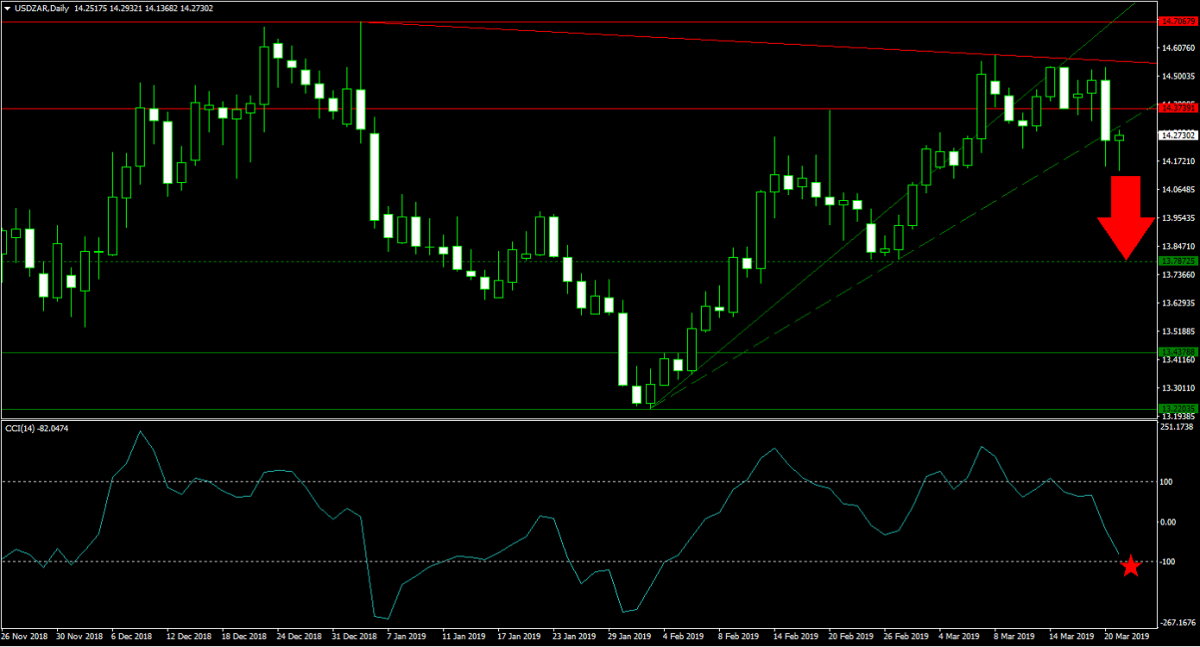

Forex Profit Set-Up #3; Sell USDZAR - D1 Time-Frame

Economic woes for the South African economy have provided a bullish boost to the USDZAR, but yesterday’s decision by the US Fed to pause interest rate have deflated this momentum push. The result was a breakdown below its horizontal resistance area, which was preceded by a descend below its steep, primary ascending support level. Bearish momentum further pressures the USDZAR below its secondary ascending support level from where a drop down into its next horizontal support level is anticipated. Selling potential rallies into its primary descending resistance level, located inside of its horizontal resistance area, is the favored trading recommendation.

The CCI is leading the contraction as this momentum indicator moved out of extreme overbought conditions which accelerated the decline below the 0 level. The resulting bearish momentum change is expected to further add downside pressure. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market while yielding over 500 pips in monthly profits!