As widely expected, the US Federal Reserve lowered its key interest rate by 25 basis points to a Lower Bound Rate of 2.00% and an Upper Bound Rate of 2.25%. The Interest Rate on Excess Reserves remained unchanged at 2.10%. Financial markets in the US saw a volatile move to the downside, closing off of their lows, as Fed Chief Powell struggled to signal a clear path ahead. He also struck a more hawkish tone than many anticipated in the wake of a global economic slowdown which resulted in disappointment across the board and criticism by US President Trump.

Powell stated that “We’re thinking of it as essentially in the nature of a mid-cycle adjustment to policy. It’s not the beginning of a long series of rate cuts. I didn’t say it’s just one.” Some argued that the US central bank gave into pressures by the Trump to lower interest rates and while the White House certainly wanted more, there was dissent at the Fed for this 25 basis points interest rate cut. Esther George, the Kansas City Fed President, and Eric Rosengren, the Boston Fed President voted against the cut which was the first time under Powell that two members voted against him.

During the press conference, Powell argued that the cut was a defensive one in order to shield the US economy from the global slowdown as well as low inflation and trade disputed. He tried to convince markets that this was more of an insurance policy to keep the US economy on the right track, that the US economy remains healthy with a favorable outlook. He then caused volatility to spike after he initially mentioned the mid-term adjustment and then opened the door for more interest rate cuts. The conflicting message was not well received by global financial markets.

The US Fed delivered its interest rate cut, what’s next? Last December Powell struck a hawkish tone only to walk it back later. Yesterday he was flip-flopping between two directions. Is now the right time to look at short opportunities in the US Dollar? Subscribe to the PaxForex Daily Fundamental Analysis today and allow our expert analysts to guide you through the forex market, yielding over 500 pips in profits per month.

The US Fed also ended its balance sheet reduction program, which pleased Trump who was overall disappointed. He tweeted “As usual, Powell let us down.” Cornerstone Macro Partner Roberto Perli added “We’re looking for another 25 basis points, probably later than September, but before the new year.” Aberdeen Standard Investments Senior Global Economist James McCann added “This was always a challenging balancing act for Powell.” Financial markets showed the US central bank once again that no matter what it does, it can’t win. The US Fed cuts rates, what’s next? US Dollar resilience could catch up with reality sooner rather than later and result in a bigger sell-off as economic prospects worsen, here are three forex trades to boost profit prospects for your portfolio.

Forex Profit Set-Up #1; Sell USDCAD - D1 Time-Frame

The Canadian Dollar started 2019 with a strong rally which was followed through by a short-term price action reversal. After the US Fed cut interest rates, the US Dollar has moved into an uncertain future. The USDCAD extended its move into its horizontal resistance level where bullish momentum is fading and the secondary descending resistance level is adding bearish pressures. This currency pair is now anticipated to reverse to the downside and complete a breakdown below its primary ascending support level until it can challenge the lower band of its horizontal support area. Forex traders are advised to sell any rallies in the USDCAD from current levels.

The CCI is trading in extreme overbought conditions where a negative divergence formed. This represents a strong bearish trading signal expected to lead the expected price action reversal. Open your PaxForex Trading Account today and find out why more and more forex traders prefer to grow their balance at PaxForex!

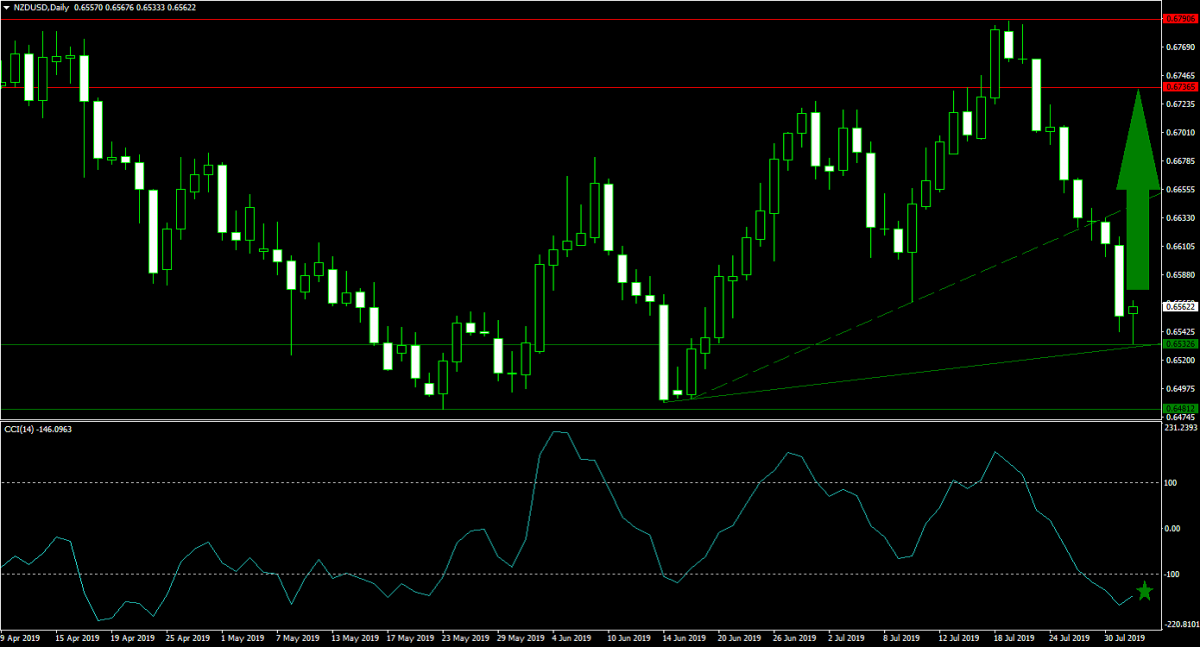

Forex Profit Set-Up #2; Buy NZDUSD - D1 Time-Frame

After the NZDUSD competed a breakdown below its horizontal resistance area, price action started to accelerate to the downside which took it below its secondary ascending support level. After reaching the upper band of its horizontal support area, enforced by its primary ascending support level, this currency pair started to recover. The rise in bullish momentum is now favored to recover to the upside and retrace its most recent sell-off. Buying any dips in the NZDUSD down to the lower band of its horizontal support area remains the favored trading approach.

The CCI is trading in extreme oversold territory, but remained well off of its previous low and started to recover. A push above -100 is expected to initiate the next wave of buy orders. Download your PaxForex MT4 Trading Platform now and join our fast growing community of profitable forex traders!

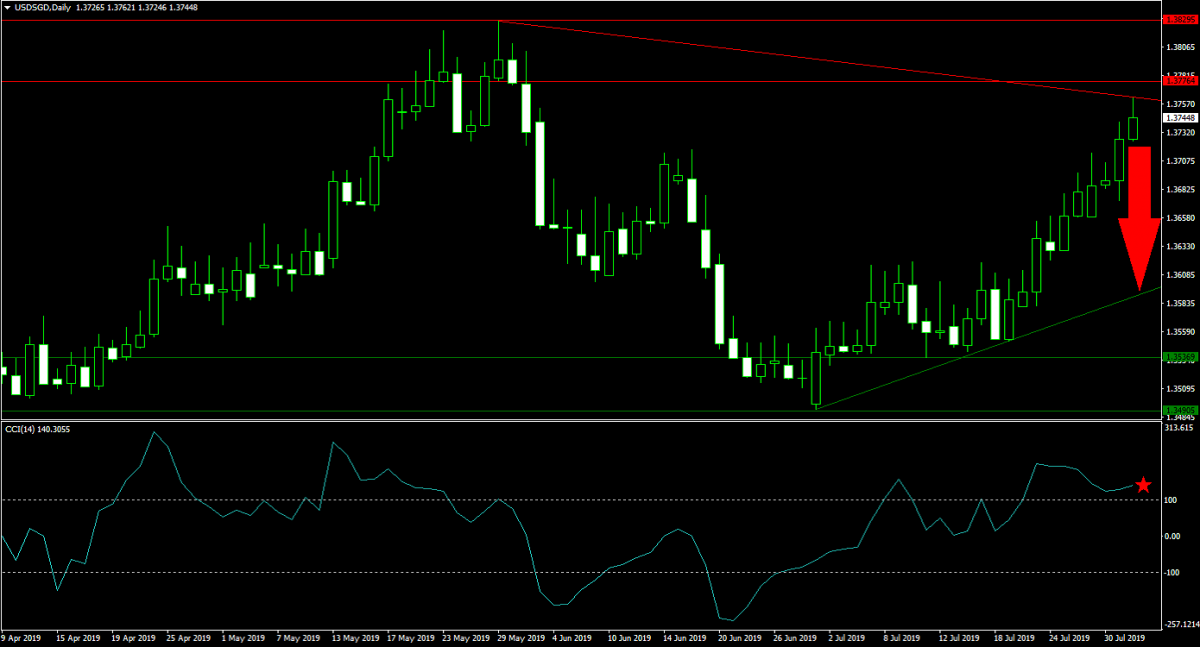

Forex Profit Set-Up #3; Sell USDSGD - D1 Time-Frame

The strong rally in the USDSGD started to fizzle out as bullish momentum is being depleted by its primary descending resistance level, just below its horizontal resistance area. The strong advance is vulnerable to a reversal and as US Dollar uncertainty mounts, price action is anticipated to accelerate to the downside until it can challenge its primary ascending support level. Forex traders are recommended to sell any rallies in the USDSGD into the upper band of its horizontal resistance area.

The CCI is trading in extreme overbought conditions and a drop below the 100 mark is likely to invite more sell orders into this currency pair. Follow the PaxForex Daily Forex Technical Analysis and simply cope the recommended trades of our expert analysts into your own trading account!

To receive new articles instantly Subscribe to updates.