Minutes from the last FOMC meeting which was held on May 2nd showed that the US Fed saw no reason to rush into increasing interest rates. A growing number of market participants questions if the US Fed will increase interest rates much further in 2018. While the Trump administration have criticized the Fed for not normalizing monetary policy, it appears that even the Trump approved new Fed Chairman Jerome Powell who took over on February 5th 2018 is unable to accelerate the return to normal. Many call the current US monetary environment the ‘new normal’.

The decade long low interest rate environment, introduced by previous Fed Chairman Ben Bernanke as a result of the 2008 financial crisis, has been the breeding ground for the next few financial problems which are soon to mature into great disruptions. As a result of low borrowing costs. Emerging market economies have flocked to US denominated debt in order to face low interest payments. Over the next 18 months, $249 billion worth of emerging market debt needs to be either refinanced at higher interest rates or repaid to investors.

Emerging market economies will struggle with this debt load and in some cases may even be unable to repay or refinance. The economic burden could throw some economies into a recession which will add to the slew of negative global economic developments and eventually could result in a global recession. Each decade the global financial market faces a huge crisis. In the 80’s it was the Latin American debt crisis, in the 90’s it was the Asian financial crisis and in the 00’s we had the Argentine debt default, the US housing crisis and the Eurozone debt crisis.

How will emerging markets handle the rising debt wall? Will emerging market currencies get crushed if the debt wall comes crumbling down? As deadlines approach, the forex market will react to developments and forex traders can experience a sharp increase in profits if they are positioned accordingly. Open your PaxForex Trading Account today and get access to the exciting and profitable world of 24/5 forex trading.

Any increase in interest rates by the US Fed will increase borrowing and financing costs for emerging markets. One of the biggest risk is the outflow of foreign investors which would further increase the looming debt collapse. China has the largest amount if US Dollar debt to mature which may be one reason the US Fed is holding their interest rates steady. China is also the biggest buyer of US Treasuries which further gives credit to this line of thought. Turkey, Hungary and Poland top the list of emerging markets with the largest exposure to foreign debt according to their GDP. At the end of 2017, total emerging market foreign debt stood at $8.3 trillion with over 75% of it in US Dollars. Forex traders need to monitor the US Fed and emerging market debt carefully and here are three forex trades which should be in every forex portfolio right now.

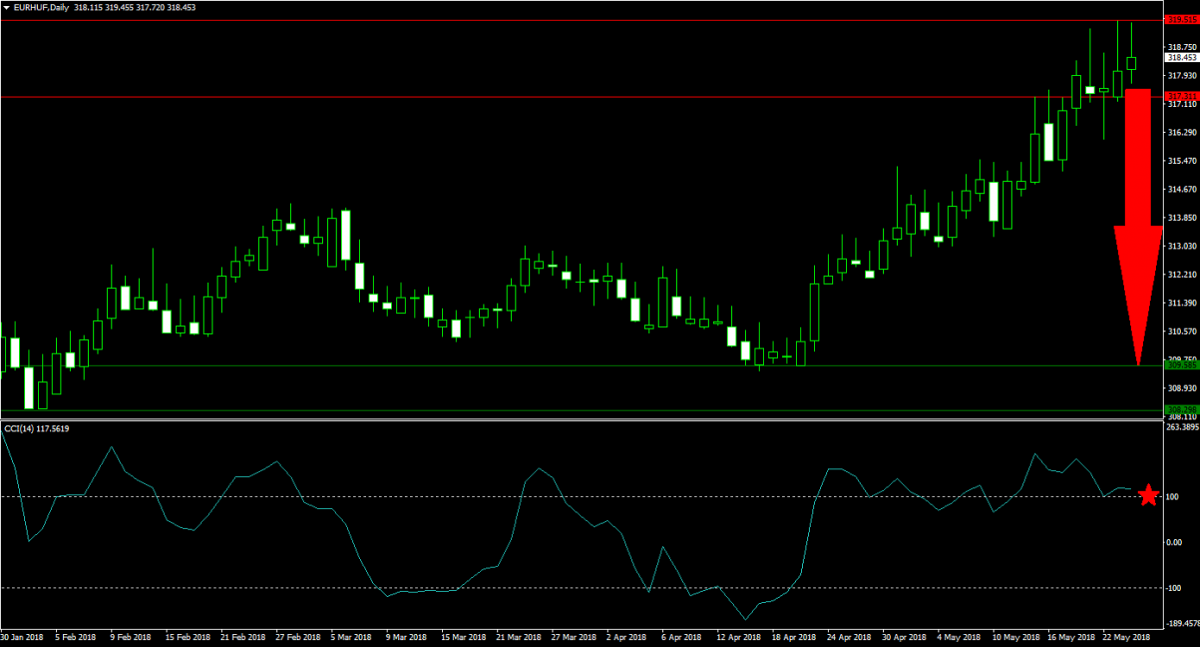

Forex Profit Set-Up #1; Sell EURHUF - D1 Time-Frame

A sharp advance in the EURHUF has left this currency pair vulnerable to profit taking. Price action is currently in the process to validate its new horizontal resistance area and the last four D1 candlesticks formed a bearish pattern. As sentiment for the EURHUF is turning bearish, a breakdown below the lower band of its resistance area is likely to trigger a sell-off. Forex traders are advised to spread their sell orders inside its horizontal resistance area.

The CCI is trading in extreme overbought conditions, but is off its highs. This indicator has entered a shallow sideways trend just above the 100 mark and a push below could trigger the expected sell-off. Subscribe to the PaxForex Daily Fundamental Analysis and receive the most profitable fundamental trading set-ups every day directly from our expert analysts.

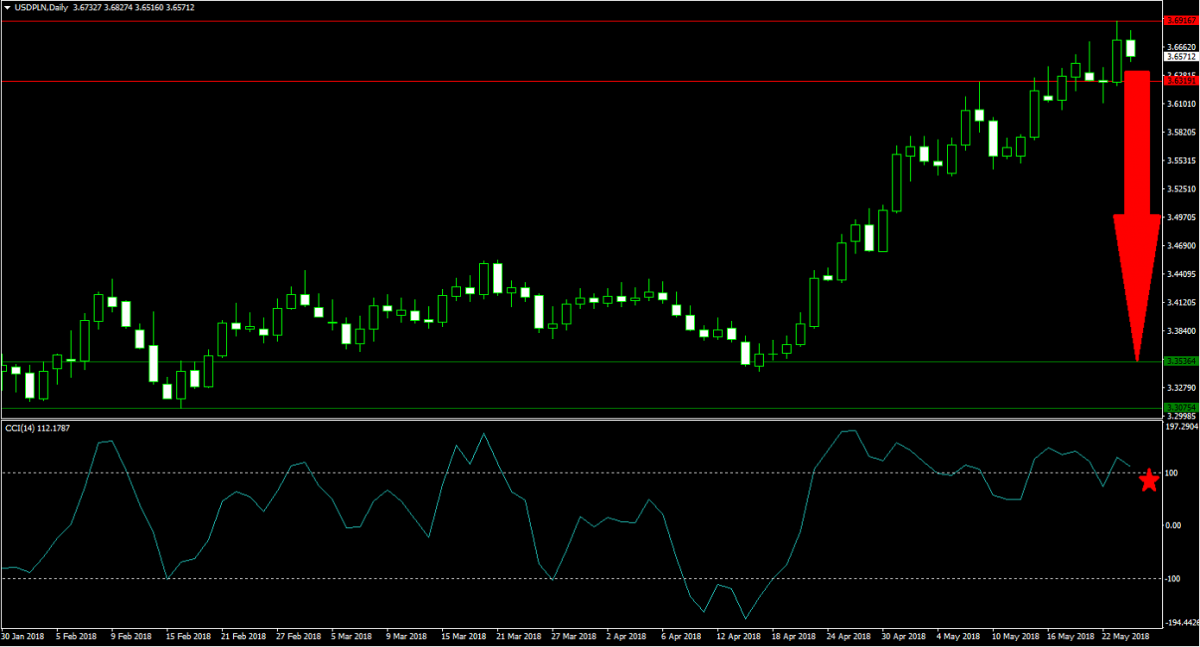

Forex Profit Set-Up #2; Sell USDPLN - D1 Time-Frame

Following the strong rally from the upper band of its horizontal support area into its strong horizontal resistance area, the USDPLN has exhausted its upside potential. This currency pair is losing bullish momentum and a breakdown from current levels should be anticipated. Forex traders are recommended to stagger sell orders between the lower band and the upper band of its horizontal resistance area in order to profit from the expected contraction in the USDPLN.

The CCI us trading in extreme overbought territory and a negative divergence has formed which is a strong bearish trading signal. This could lead to a breakdown in this technical indicator. Use your Bitcoin and Ethereum to make a deposit into your PaxForex Trading Account in order to diversify your assets and add an additional revenue stream to your monthly income.

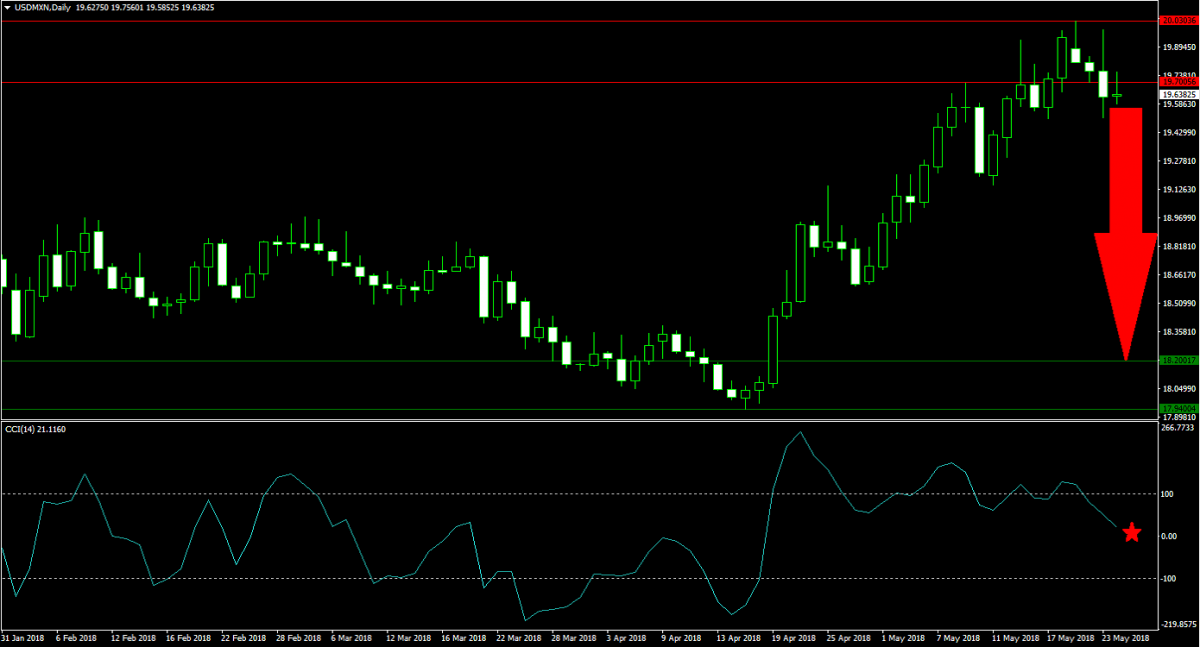

Forex Profit Set-Up #3; Sell USDMXN - D1 Time-Frame

The USDMXN has already completed a breakdown below its horizontal resistance area which resulted in a sentiment change from bullish to bearish. With only one minor support level in the way, price action is clear to extend its move to the downside until it will reach the upper band of its next horizontal support area. Forex traders should sell the rallies in the USDMXN in order to capture the attractive downside potential in this currency pair.

The CCI has also completed a breakdown from extreme overbought levels and a negative divergence continues to increase bearish pressures in this momentum indicator. A push below the 0 level is expected to accelerate the sell-off. Subscribe to the PaxForex Daily Forex Technical Analysis in order to get the latest technical trading set-ups which will boost your monthly earnings.

To receive new articles instantly Subscribe to updates.