As developments around the trade war between the US and China are getting most of the media attention, a currency war is brewing underneath which could exacerbate the situation further. US President Trump insists that China and the EU are manipulating their respective currencies in order to maintain a trade advantage over the US. Reuters published an interview yesterday where Trump stated 'I think China’s manipulating their currency, absolutely. And I think the Euro is being manipulated also.' The US Dollar entered its fourth day of selling after reaching 2018 highs.

While Trump has made the accusations without providing explanation or proof, it is not the first time that his point of view conflicts with the official assessment of a US government agency. The US Treasury Department releases a semi-annual report on forex policy and in its latest report which was published in April, it didn’t list any country as a currency manipulator. The last time the US government applied that label to a country was in 1994. Despite the official position, Trump disagrees and has accused China and the EU of currency manipulation in various speeches and interviews.

Some believe that his stance, which is driving the US Dollar to the downside, is intended to do just that. Previous US administrations have publicly favored a strong US Dollar policy, but under Trump the lines have become blurry. Adding to downside pressure on the US currency from the White House is Trump’s extreme dislike over interest rate increases under US Fed Chief Powell who was hand picked by Trump to replace Yellen. The interest rate increases come at the same time the US is expected to borrow more while the economy is set to slow down.

Is the current price action reversal in US Dollar currency pairs due to profit taking after a solid move or will it extend further? Momentum is shifting from bullish to bearish, but many currency pairs are approaching key levels which can determine continuation or reversal. Open your PaxForex Trading Account today and learn how more and more successful forex traders earn more pips per trade.

Trump complained to Republican donors last Friday about the Fed and wished his central bank would assist him in negotiations in the same manner he views other central banks are assisting their countries. Last Friday, Trump told donors that 'We’re negotiating very powerfully and strongly with other nations. We’re going to win. But during this period of time I should be given some help by the Fed. The other countries are accommodated.' The next clue for where the US Dollar may be headed this summer will come from this week’s Jackson Hole symposium. For now, the US Dollar is punished by Trump and here are three forex trades to add to your portfolio.

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

After reaching a 2018 low, the EURUSD reversed course and completed a breakout above its horizontal support area as well as above its primary descending resistance level. This resulted in a rise in bullish sentiment, but price action in this currency pair is now challenged by its secondary descending resistance level. A push above it will clear the path to its next minor horizontal resistance level. Forex traders are advised to spread their buy orders inside both descending resistance levels.

The CCI has spiked higher from extreme oversold conditions and momentum sufficed to push it above the 0 level which resulted in a momentum change from bearish to bullish. More upside is expected as the EURUSD is favored to advance. Partner with PaxForex and increase your earnings from the forex market through CPA or revenue share which are the most attractive in the industry.

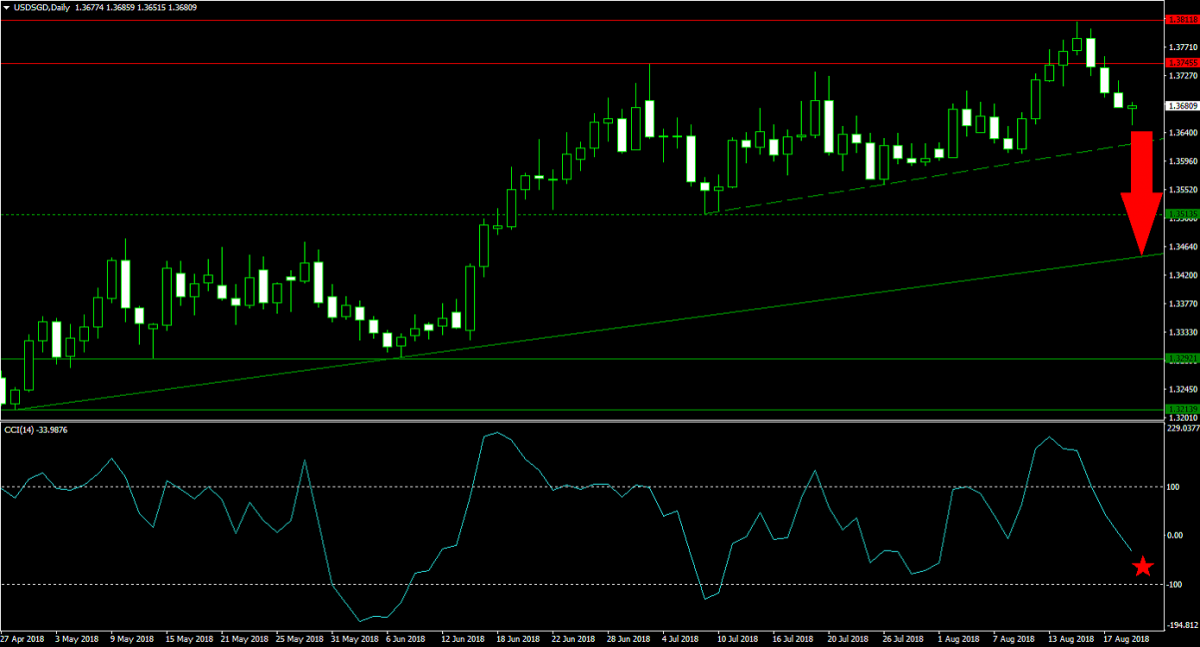

Forex Profit Set-Up #2; Sell USDSGD - D1 Time-Frame

Following a successful breakdown from its horizontal resistance area, the USDSGD is now on its way down to its next horizontal support level. Its primary ascending support level is also located just beneath it which enforces support. The next minor test for this currency pair comes in the form of its secondary ascending support level which is unlikely to prevent further selling due to the rise in bearish momentum. Forex traders are recommended to buy the rallies in the USDSGD up to the lower band of its horizontal resistance area.

The CCI has collapsed from extreme overbought territory and plunged through the 0 barrier which erased bullish momentum in this currency pair. A move into extreme oversold conditions is expected to follow. Subscribe to the PaxForex Daily Forex Technical Analysis and receive all technical trading set-ups delivered directly into your inbox. Never miss another profitable opportunity in the forex market again.

Forex Profit Set-Up #3; Buy Silver - D1 Time-Frame

Since commodities are primarily priced in US Dollars, they enjoy an inverse relationship. As the US Dollar is weakening, many commodities will rise in value. The extreme bearish trend in Silver over the past two months has been broken when its primary descending resistance level merged with its horizontal support area and price action pushed above it. A breakout is now pending which is expected to take Silver above its next horizontal resistance level and into its secondary descending resistance level. Long positions just below the upper level of the horizontal support area are preferred.

The CCI dropped deep into extreme oversold conditions, but started to advance from its lows. This momentum indicator is now on its way to eclipse the -100 level and move further towards the 0 mark. Follow the PaxForex Daily Fundamental Analysis and let our expert analysts guide you through the profitable world of forex trading. Earn over 500 pips per month simply by following our fundamental trading set-ups.

To receive new articles instantly Subscribe to updates.