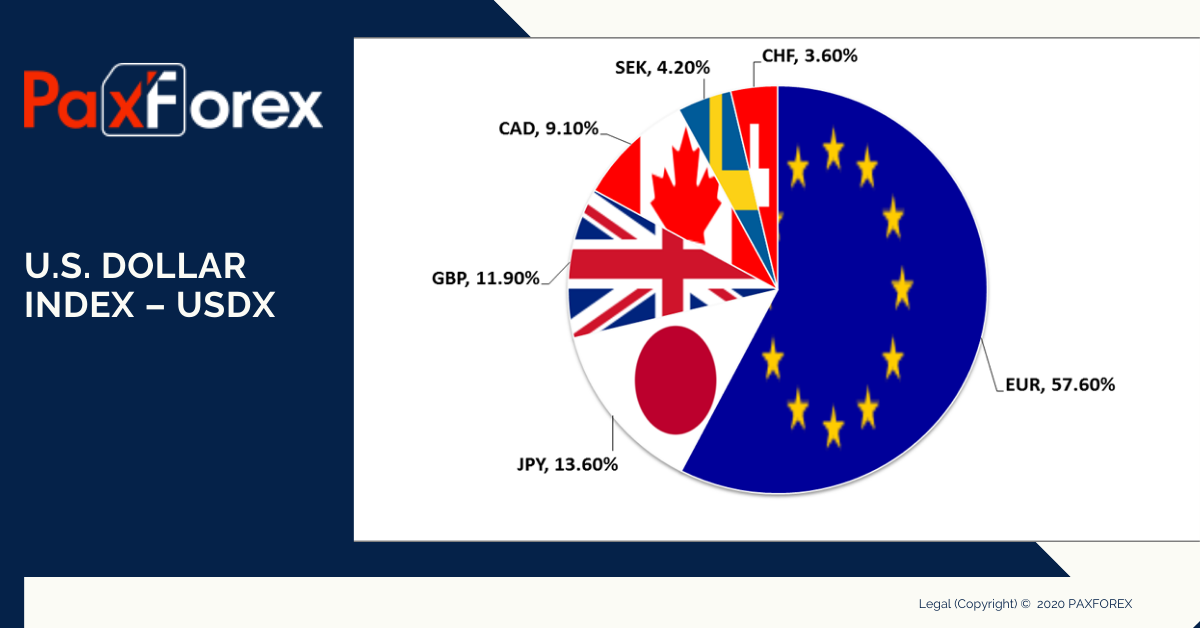

U.S. Dollar Index (USDX) was introduced in March 1973, when the Bretton Woods system ceased to exist.The index shows the ratio of U.S. dollar against a basket of six major world currencies - Euro (EUR),Yen (JPY), British Pound (GBP), Canadian Dollar (CAD), Swedish Krona (SEK) and Swiss Franc (CHF). As part of this basket each currency has its own weight:

EUR - 57,6%

JPY - 13,6%GBP - 11,9%CAD - 9,1%SEK - 4,2%CHF - 3,6%The composition of the basket since the year of 1973 changed only once - in 1999, when the euro was introduced.At the time of appearance the index had a value of 100 points. Its historic lows were reached in March 2008 - 70.7 points, while the maximum value was recorded in February 1985 - 148.1 points. The index traded at the time of the global currency markets - 24 hours a day, 5 days a week. The index is presented in the form of various traded instruments: a stock market investment funds (exchange traded funds, or ETF), mutual funds and stock options.The index is calculated as a weighted geometric mean of the above mentioned currencies according to the following formula: USDXt = 50,14348112 x (EURt) -0,576 x (JPYt) 0,136 x (GBPt) -0,119 x (CADt) 0,091 x (SEKt) 0,042 x (CHFt) 0,036.In the formula, the power of coefficients corresponding to the weights of currencies in the basket. Calculation of the index coincides with the data used in calculating the Fed trade-weighted dollar index of currencies of countries which form the main foreign trade turnover of U.S. Most of the international trade in the U.S. accounts for the euro area (57.6%), followed by Japan - 13.6% United Kingdom - 11.9% Canada - 9.1%, Sweden - and Switzerland 4.2% - 3.6 %.How to use the dollar index USDX on the Forex Market?

It is important to understand whether you like it or not, U.S. dollar dictates trends of major world currencies, so the USDX index is an excellent starting point for determining the strength or weakness of U.S. dollar currency pairs.As a rule, the change of the trend of this index leads to changes in the trends of the currency pairs in which the USD is presented. For example, during an USDX uptrend the pairs with direct quote will also increase (eg, USD/CHF, USD/CAD), and currency pairs with contrary quotation will be slow down (eg, EUR/USD, GBP/USD).Using a set of technical analysis tools, such as candles, support / resistance levels, moving averages, you can get an idea about the strength of the U.S. dollar in terms of long-term trends, the possible long and short-term reversals, as well as changes in the attitudes of market participants.