With Oil's stature as a high-demand global commodity comes the possibility that major fluctuations in price can have a significant economic impact. The price of crude Oil depends on many factors that influence it individually or have a reciprocal effect. These factors vary in relevance and their importance can quickly change. The Oil price was, for decades, largely dictated by demand from the US and supply from the OPEC group of Oil producers, but the rapid rise of US shale Oil output and incredible economic growth in China mean that the global Oil price now has many more driving factors.

Changes in gasoline and diesel prices mirror changes in crude Oil prices. Those changes are determined in the global crude Oil market by the worldwide demand for and supply of crude Oil. With the worldwide economic recovery underway, demand is on the rise again but unrest in the Middle East and North Africa has put supplies at risk. This combination of rising demand and reduced supply helped to push prices higher over the last few years. However, the recent downturn in prices was the result of the growth in Oil supplies, largely from the U.S., outpacing the growth in global demand.

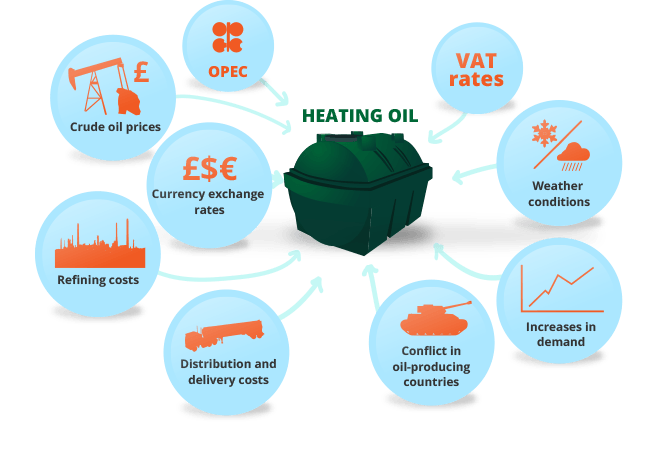

Oil prices are controlled by traders who bid on Oil futures contracts in the commodities market. That is why Oil prices change daily. It all depends on how trading went that day. Other entities can only affect the traders' bidding decisions. These influencers include the U.S. government and the Organization of Petroleum Exporting Countries. They don't control the prices because traders actually set them in the markets. If the big Arabian Oil states agree to reduce the supply, the price of crude Oil will rise – as will the income of Oil-exporting countries. Political crises and wars, natural disasters and the release of strategically invested Oil reserves all influence the supply of crude Oil and therefore its market price.

Producers and consumers of Oil are the first group of market participants who trade on the Oil exchanges. Investors who are not interested in the actual Oil itself make up the second group of market players. Oil is traded via futures contracts. The market participants agree to a price for buying crude Oil, which they will only receive and pay for at a later point in time. If this is just a few days, they buy at what is called the “spot price.” However, most Oil trades take the form of long-term contracts. These are especially interesting for the second group of Oil market players, the investors. Many private and institutional investors see Oil as an attractive tangible asset for securing themselves against inflation and minimizing the risks of financial investments.

The main driver of Oil prices started to change in the early part of the last decade. Oil prices started becoming less about supply and demand of Oil itself and became more of a proxy for the world economy through the stock market. Oil as a commodity became Oil as an investment. The reasoning behind this phenomenon is that if the economy will pick up, then there will be more demand for Oil, which should make it a more valuable commodity. What happens, though, is that short-term investors start chasing gains, which can inflate prices past anything grounded in reality.

To receive new articles instantly Subscribe to updates.