The foreign exchange market is a global decentralized market where currencies are traded. This includes all aspects of buying, selling and exchanging currencies at current or determined prices. An important consideration when opening a retail forex trading account involves choosing among the different types of forex brokers available to handle your forex transactions. This represents an important decision, because the type of forex broker chosen can affect both the quality of service you receive, as well as your transaction fees and dealing spreads.

There are many types of forex brokers who offer online trading services. Some offer legitimate services while others are illegal and deceptive. Some are regulated by official regulation bodies while others can do pretty much whatever they want. Most traders don’t take the time to understand the difference between them in order to choose the best forex brokers, and can therefore be fooled into making unwise choices regarding their trades and investments.

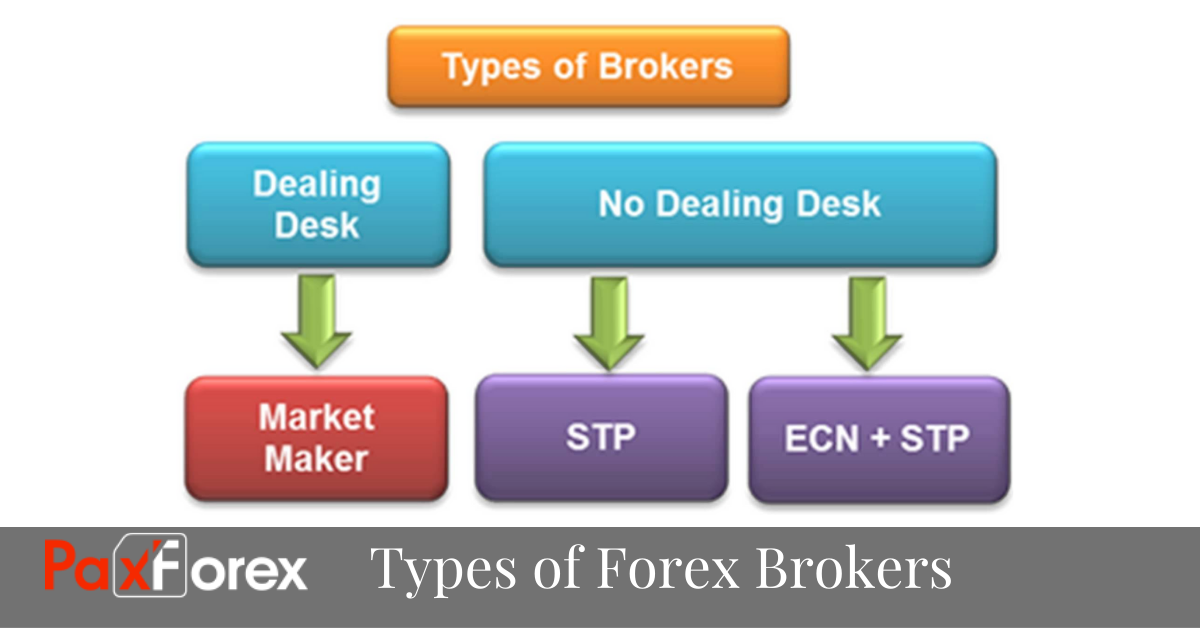

There are two main types of brokers: Dealing Desks (DD) and No Dealing Desks (NDD). Dealing Desk brokers are also called Market Makers, while No Dealing Desks can be further subdivided into Straight Through Processing (STP) and Electronic Communication Network (ECN). Each of these three different types of forex brokers have a different way of handling transactions and executing orders.

A dealing desk broker is a market maker. Market makers typically offer fixed spreads and may elect to quote above or below actual market prices at any time. Market makers are always the counter-party of the trader, who doesn't trade directly with the liquidity providers. Market makers get paid through the spreads, and they usually also take the opposite trades of their clients prior to covering themselves (or not) with regards to the liquidity providers.

With a genuine No Dealing Desk broker, there is no re-quoting of prices, which means that you can trade during economic announcements without any restrictions. The spreads offered are lower, but they are not fixed, so they can increase significantly when volatility is increasing during major economic announcements. ECN and STP brokers aren’t an opposite part of the transaction. They provide orders to banks, funds, other intermediaries, retail clients. They pass their clients’ orders to the inter-bank market for execution and allow their clients to be a counter party to a transaction.